Private Credit's Pre-Turmoil Weakness: A Credit Weekly Perspective

Table of Contents

Liquidity Concerns in the Private Credit Market

The current crisis has starkly revealed a critical vulnerability within the private credit market: liquidity. Many private credit funds, attractive for their potential high yields, lack the robust liquidity mechanisms necessary to meet investor redemptions during times of market stress. This illiquidity risk, often overlooked during periods of calm, has become a major concern.

-

Limited Redemption Options: Many private credit funds have long lock-up periods, restricting investor access to their capital. This structure, while beneficial during periods of stable growth, becomes a significant constraint when investors face unexpected liquidity needs or broader market pressure.

-

Thin Secondary Market: Unlike publicly traded securities, private debt instruments typically lack a liquid secondary market. This makes it incredibly difficult to sell investments quickly to meet redemption requests, further exacerbating illiquidity.

-

Increased Redemption Pressure: As investors confronted their own liquidity constraints, redemption pressure on private credit funds intensified, creating a vicious cycle. Funds struggled to meet these demands, leading to further market distress and impacting valuations.

-

Correlation Concerns: The previously assumed low correlation between private credit and public markets has proven inaccurate in the recent volatility. Market downturns in public equities have negatively impacted private credit valuations, further impacting investor sentiment and liquidity.

Valuation Challenges and Mark-to-Market Issues

Accurate valuation of private credit investments has always presented challenges, but the recent market turmoil has amplified these difficulties, particularly regarding mark-to-market accounting.

-

Opaque Valuation Processes: The lack of readily available market pricing data for many private credit assets makes determining fair value inherently subjective and difficult to ascertain, especially during periods of market stress.

-

Mark-to-Market Volatility: Mark-to-market accounting, while providing transparency in theory, exposes private credit portfolios to significant fluctuations based on market sentiment rather than underlying asset fundamentals. This has led to substantial downward valuation adjustments.

-

Distressed Debt Impact: The rise in distressed debt situations and defaults has made accurate valuation even more challenging. Forecasting future cash flows for distressed assets requires significant expertise and often entails considerable uncertainty.

-

Fair Value Uncertainty: The absence of consistent and reliable valuation methodologies across different private credit funds makes comparison and benchmarking difficult, adding to the overall uncertainty in the market.

Credit Risk Underestimation and Due Diligence Shortcomings

The pursuit of high yields in the pre-turmoil era may have led to some underestimation of credit risk and shortcomings in due diligence processes.

-

Sectoral Overexposure: Some argue that excessive lending in specific sectors or to borrowers with weak fundamentals contributed to the current challenges. A lack of diversification increased the vulnerability of some portfolios.

-

Insufficient Due Diligence: Insufficient due diligence and loan underwriting practices may have allowed weaker assets to enter some portfolios, increasing the overall risk profile. A more rigorous approach to credit risk assessment is now crucial.

-

Yield Maximization Over Risk Management: The relentless pursuit of higher returns might have overshadowed prudent risk management practices. A more balanced approach, prioritizing risk mitigation alongside yield, is essential.

-

Interest Rate Sensitivity: The sharp rise in interest rates has exposed the vulnerability of highly leveraged borrowers with weak cash flows, leading to increased defaults and further market instability.

Impact on Investor Strategies and Future Outlook

The recent market events have significantly impacted investor strategies and the future outlook for private credit.

-

Portfolio Diversification: Investors are actively reevaluating their private credit allocations, reducing exposure and diversifying portfolios to mitigate risk.

-

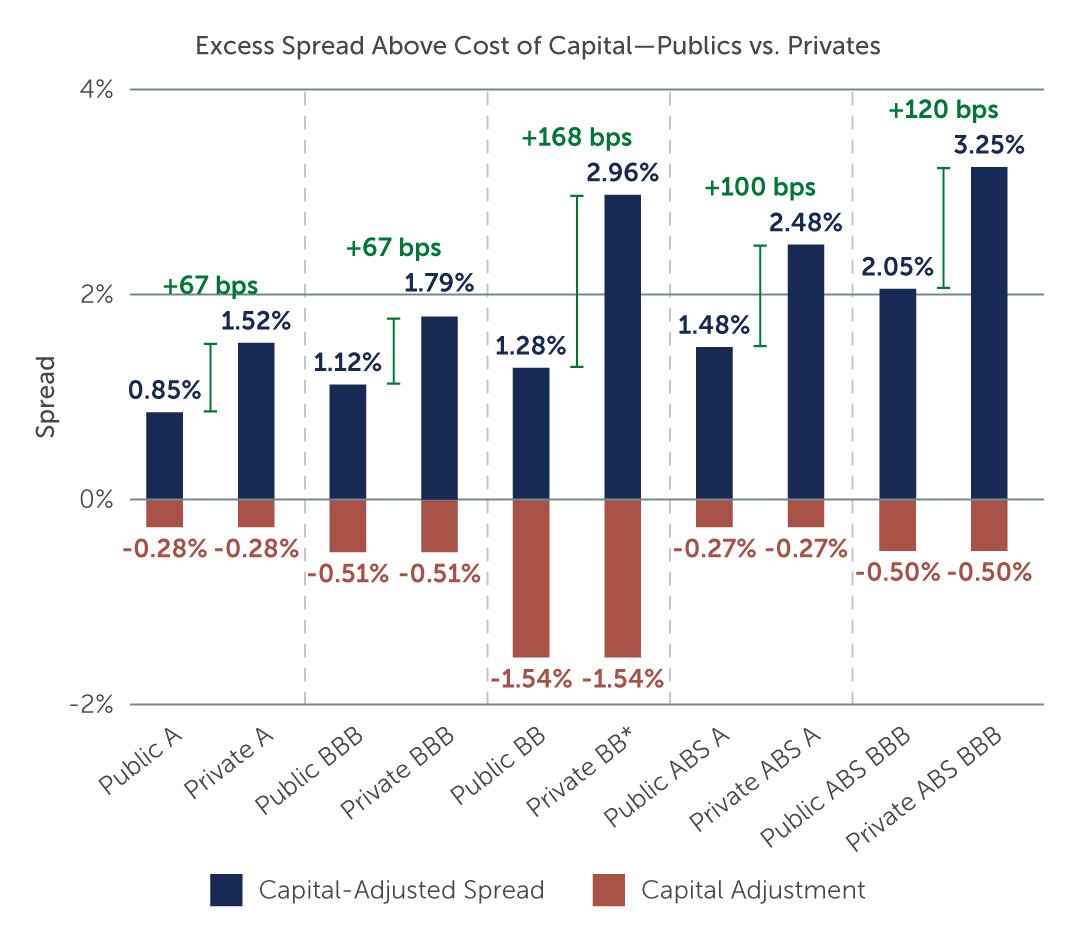

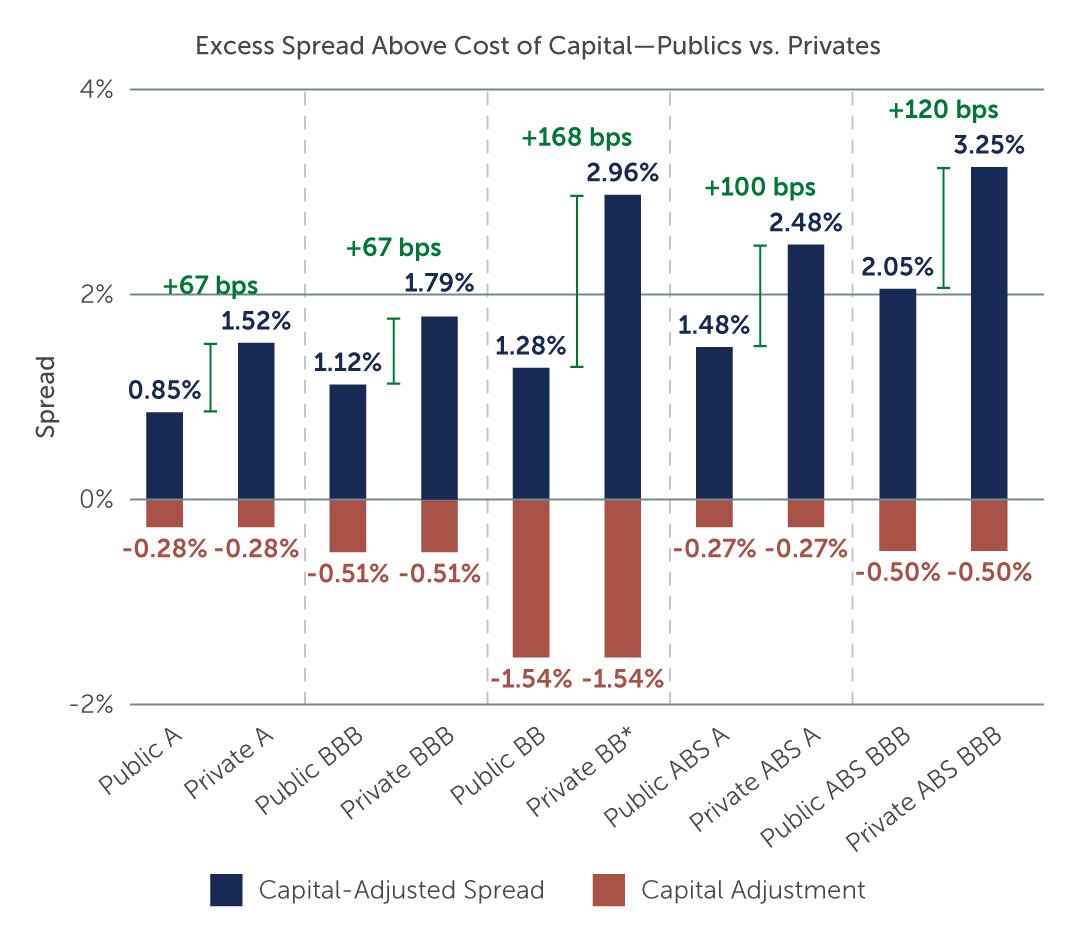

Reduced Risk Appetite: Risk appetite has considerably decreased, leading to stricter lending standards and a higher cost of capital for borrowers.

-

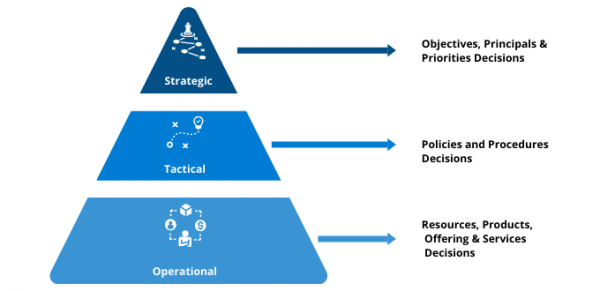

Future of Private Credit: The future of private credit depends heavily on addressing liquidity issues, improving transparency through better data reporting and valuation standards, and enhancing risk management practices.

-

Regulatory Scrutiny: Regulatory changes are likely to increase oversight and strengthen investor protections in the private credit market.

Conclusion:

The pre-turmoil weaknesses within the private credit market, exposed by recent market turmoil, emphasize the critical importance of thorough due diligence, robust liquidity management, and accurate valuation practices. Understanding these vulnerabilities is paramount for investors navigating this evolving landscape of private debt and alternative lending. Investors should carefully assess the liquidity profile, credit risk, and valuation methodology of any private credit investment. By focusing on transparent and well-managed funds, investors can potentially mitigate risks and participate successfully in the private credit market. Continued monitoring of the market and ongoing analysis will be provided in our next Credit Weekly report.

Featured Posts

-

Exploring Self Expression Through Style Insights From Ariana Grandes Recent Transformation

Apr 27, 2025

Exploring Self Expression Through Style Insights From Ariana Grandes Recent Transformation

Apr 27, 2025 -

Free Film And Tv On Kanopy What To Watch Today

Apr 27, 2025

Free Film And Tv On Kanopy What To Watch Today

Apr 27, 2025 -

Investing In Canada Napoleons Strategic Business Decisions

Apr 27, 2025

Investing In Canada Napoleons Strategic Business Decisions

Apr 27, 2025 -

Pfc Dividend 2025 Fourth Cash Reward Expected March 12th

Apr 27, 2025

Pfc Dividend 2025 Fourth Cash Reward Expected March 12th

Apr 27, 2025 -

Ariana Grandes Bold New Style The Role Of Professional Experts

Apr 27, 2025

Ariana Grandes Bold New Style The Role Of Professional Experts

Apr 27, 2025