Reduced Consumer Spending: A Challenge For Credit Card Issuers

Table of Contents

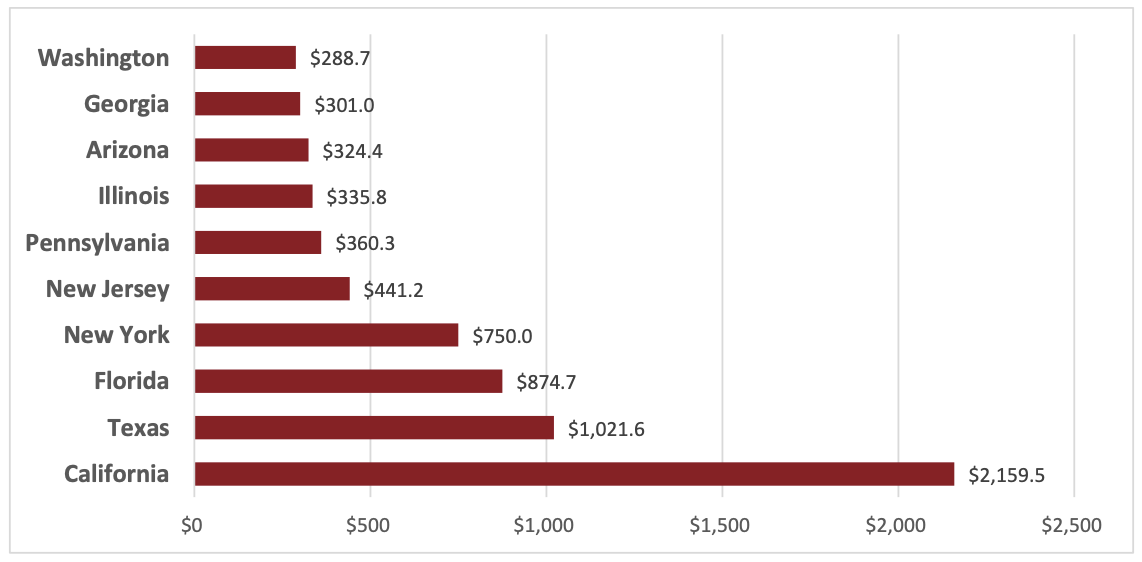

Lower Transaction Volumes and Revenue

Reduced consumer spending directly translates into fewer credit card transactions. This decrease in activity leads to lower interchange fees, the primary revenue source for many credit card issuers. The impact ripples through the entire financial ecosystem. We're seeing a significant contraction in overall credit card usage, affecting both the issuer and the merchant.

-

Decreased spending on discretionary items: Consumers are cutting back on non-essential purchases like travel, entertainment, and dining out, leading to a noticeable drop in transaction volume for credit card companies. This is particularly impactful for issuers who rely heavily on rewards programs tied to these spending categories.

-

Increased focus on essential spending: Consumers are prioritizing essential expenses like groceries, utilities, and rent. This shift leads to lower average transaction values, further reducing overall revenue generated through credit card transactions. The impact is felt across the board, from high-end retailers to everyday grocery stores.

-

Impact on merchant fees: Merchants also feel the pinch as they process fewer transactions. This reduction in merchant fees directly impacts their profitability and could even lead to reduced acceptance of credit cards in some sectors. This creates a feedback loop, potentially further decreasing consumer spending on credit.

-

Potential for increased defaults and charge-offs: As consumers struggle to repay balances due to reduced income, the risk of defaults and charge-offs increases significantly. This necessitates increased provisioning for loan losses, further eroding profitability for credit card companies. This poses a substantial risk management challenge for issuers.

Increased Credit Risk and Delinquency Rates

As consumers tighten their belts, the risk of loan defaults and delinquencies rises significantly. This increases the provisioning for loan losses, impacting profitability and requiring more sophisticated risk assessment models. The current economic uncertainty exacerbates this risk.

-

Higher unemployment rates: Rising unemployment directly contributes to an increase in missed payments and delinquencies as individuals lose their primary source of income. This significantly impacts credit card issuers' bottom line.

-

Reduced disposable income: Decreased disposable income makes it harder for consumers to manage credit card debt, leading to higher delinquency rates and increased financial strain. This necessitates more proactive customer support strategies.

-

Increased scrutiny of credit applications: To mitigate risk, credit card issuers are likely to implement stricter underwriting criteria for new applicants, potentially reducing the number of new accounts and associated revenue. This is a necessary step to manage the increased credit risk.

-

Potential for increased collection costs: The rise in delinquencies could lead to significantly increased costs associated with debt collection efforts, further impacting profitability. Effective and efficient collection strategies are paramount.

Strategies for Credit Card Issuers to Adapt

Credit card companies need to proactively adapt to the changing economic landscape and the impact of reduced consumer spending. This involves implementing strategies to mitigate risk and maintain profitability. A multi-pronged approach is essential.

-

Offering more flexible repayment options: Providing options like extended payment plans, reduced interest rates, or balance transfers can help retain customers and reduce delinquencies. This improves customer loyalty and reduces risk.

-

Developing new products and services: Creating products tailored to the current economic climate, such as secured credit cards or carefully managed buy now, pay later options, can attract new customers and manage risk effectively. This requires a nuanced understanding of consumer needs.

-

Investing in advanced analytics and fraud detection: Advanced data analytics can help identify and mitigate potential risks, improve fraud detection, and optimize lending decisions. This is crucial for managing risk in a challenging market.

-

Implementing stricter underwriting criteria: More rigorous credit scoring and application processes can help reduce the risk of defaults and improve the overall credit quality of the portfolio. This requires a balanced approach to avoid excluding deserving customers.

-

Exploring partnerships: Collaborations with other businesses to offer bundled services and value-added benefits can enhance customer value propositions and increase engagement. This strengthens customer relationships and offers broader appeal.

The Importance of Customer Retention

Retaining existing customers becomes crucial during periods of reduced consumer spending. Loyalty programs and personalized offers can help to increase customer engagement and reduce the cost of acquiring new customers.

-

Targeted marketing campaigns: Focusing on value and affordability in marketing materials can attract and retain customers. This is vital for maintaining customer base and market share.

-

Enhanced customer service: Providing excellent customer service and support, particularly in addressing financial difficulties, helps build loyalty and reduce churn. This is crucial for building long-term relationships.

-

Implementing loyalty programs: Rewarding long-term customer relationships with exclusive benefits and perks enhances customer retention and increases spending. This fosters loyalty and incentivizes continued engagement.

Conclusion

Reduced consumer spending presents a significant challenge for credit card issuers, impacting transaction volumes, revenue, and credit risk. However, by implementing proactive strategies such as offering flexible repayment options, strengthening risk management practices, and focusing on customer retention, credit card companies can navigate this challenging period and mitigate potential losses. Understanding the dynamics of reduced consumer spending and adapting accordingly is crucial for maintaining profitability and long-term sustainability in the credit card industry. To learn more about effective strategies for dealing with the impact of reduced consumer spending, explore our resources on credit risk management and financial planning.

Featured Posts

-

Nevideni Film Tarantinov Razlog Za Odbijanje Travoltovog Filma

Apr 24, 2025

Nevideni Film Tarantinov Razlog Za Odbijanje Travoltovog Filma

Apr 24, 2025 -

Live Stock Market Updates Dows 1000 Point Rally And Market Analysis

Apr 24, 2025

Live Stock Market Updates Dows 1000 Point Rally And Market Analysis

Apr 24, 2025 -

Millions In Losses Fbi Probes Office365 Executive Inbox Breaches

Apr 24, 2025

Millions In Losses Fbi Probes Office365 Executive Inbox Breaches

Apr 24, 2025 -

Shark Infested Beach Swimmer Vanishes Body Discovered

Apr 24, 2025

Shark Infested Beach Swimmer Vanishes Body Discovered

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Game Changer

Apr 24, 2025

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Game Changer

Apr 24, 2025