Spot Market Focus: EU Deliberations On Russian Gas Ban

Table of Contents

Economic Ramifications of a Russian Gas Ban

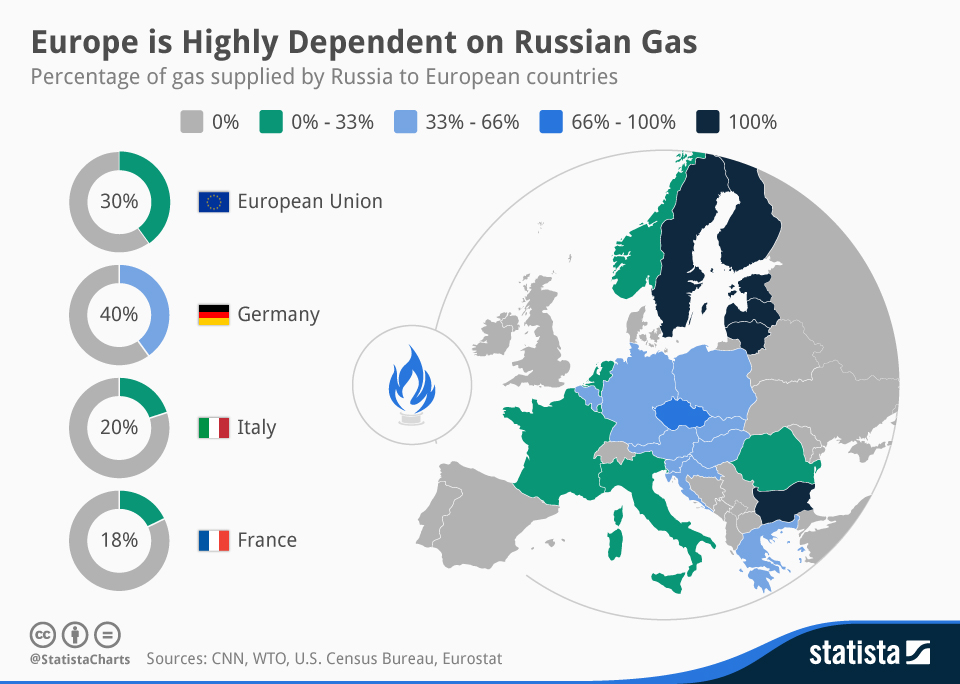

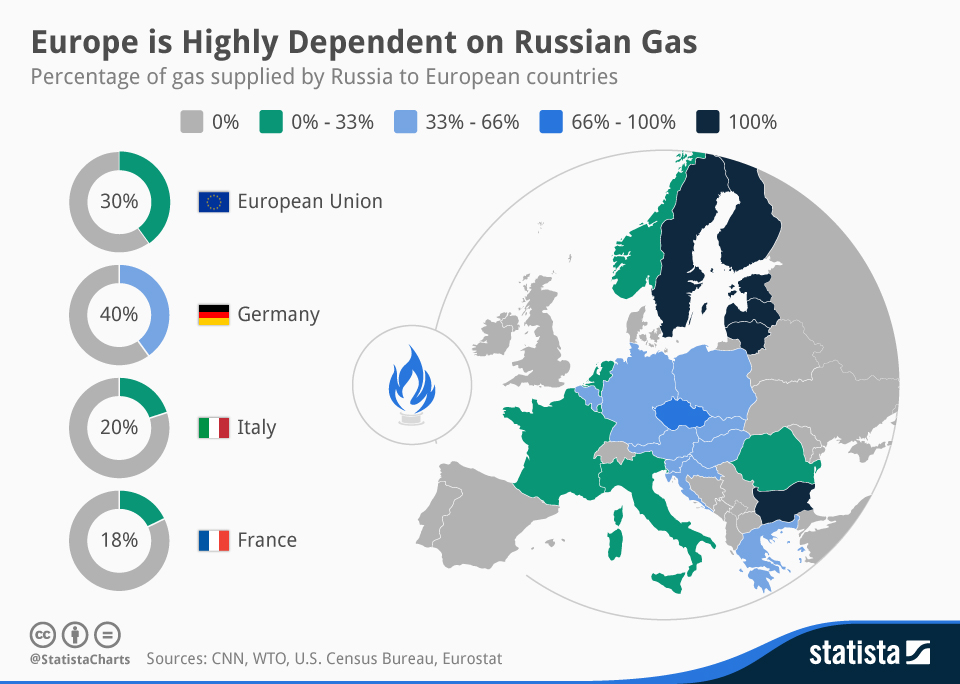

A complete ban on Russian gas imports would send shockwaves through the EU economy. The consequences are multifaceted and far-reaching, impacting consumers, businesses, and national governments alike.

Soaring Energy Prices and Inflation

The most immediate impact would be a dramatic surge in energy prices across the EU. This would translate into:

- Increased consumer energy bills: Households would face significantly higher heating and electricity costs, potentially pushing many into energy poverty.

- Impact on businesses: Industries reliant on natural gas, such as manufacturing and agriculture, would experience increased production costs, leading to price hikes for consumers and potentially impacting competitiveness.

- Inflationary pressures: The increased cost of energy would fuel broader inflation, eroding purchasing power and impacting economic growth across the EU.

Countries heavily reliant on Russian gas, such as several Eastern European nations, would be particularly vulnerable, facing potentially crippling economic challenges. Governments may need to implement significant interventions, such as subsidies or price caps, to mitigate the social and economic fallout from these price shocks. The effectiveness and long-term sustainability of such interventions remain a significant concern.

Spot Market Volatility and Uncertainty

A Russian gas ban would inject extreme uncertainty into the already volatile spot gas market. We can anticipate:

- Price fluctuations: Significant and unpredictable price swings would become the norm, making it difficult for businesses to plan and budget effectively.

- Increased trading activity: Market participants would engage in frantic trading to secure alternative supplies, potentially leading to market manipulation and price bubbles.

- Potential market disruptions: Supply chain bottlenecks and disruptions could occur, exacerbating the price volatility and creating shortages in certain regions.

Energy companies would face immense challenges in developing effective hedging strategies and long-term supply planning in such a turbulent environment. The capacity and efficiency of existing gas storage facilities will play a crucial role in mitigating the intensity of price volatility. However, relying solely on storage is unsustainable in the long term.

EU Strategies for Mitigating the Impact

The EU is actively pursuing several strategies to lessen the blow of a potential Russian gas ban, acknowledging the need for both short-term and long-term solutions.

Diversification of Gas Supplies

A key element of the EU's strategy is reducing its dependence on Russian gas through diversification of supply sources. This involves:

- Increased LNG imports: Boosting the import of Liquefied Natural Gas (LNG) from other global suppliers is a priority. This requires investment in LNG terminals and infrastructure.

- Exploration of alternative pipeline sources: The EU is actively exploring alternative pipeline routes and agreements with countries like Norway and Azerbaijan.

- Investment in renewable energy: A long-term solution involves accelerating the transition to renewable energy sources, such as wind and solar power, to decrease reliance on fossil fuels altogether.

The EU is supporting member states in their efforts to diversify, providing financial assistance and technical expertise where needed. However, challenges remain, including the limited availability of LNG globally, the need for significant infrastructure upgrades, and the complexities of negotiating new supply agreements.

Accelerated Renewable Energy Transition

The urgency of transitioning to renewable energy sources is now paramount. This involves:

- Investment in wind, solar, and other renewable technologies: Significant investments are needed to expand renewable energy capacity rapidly.

- Policy implications for promoting renewables and energy efficiency: Supportive policies, including subsidies, tax incentives, and streamlined permitting processes, are vital.

- Potential difficulties in rapidly scaling up renewable energy capacity: Challenges include securing sufficient land, securing skilled labor, and dealing with potential opposition from local communities.

Accelerating this transition is not only a response to the potential Russian gas ban but a crucial step towards long-term energy security and climate goals.

Geopolitical Implications of a Russian Gas Ban

The decision to ban Russian gas has profound geopolitical implications, impacting EU-Russia relations and the global energy landscape.

EU-Russia Relations

A complete ban would inevitably further strain already tense relations between the EU and Russia. We could expect:

- Economic sanctions: Further economic sanctions against Russia are likely, potentially escalating tensions.

- Diplomatic tensions: Communication and cooperation between the two sides would almost certainly deteriorate.

- Impact on other sectors: The impact might ripple across various sectors, potentially impacting trade and investments beyond the energy sector.

Russia might retaliate with measures that further disrupt energy supplies or target other EU interests. The potential for escalation and broader conflict cannot be ignored.

Impact on Global Energy Markets

The effects of a Russian gas ban would extend far beyond the EU, causing significant disruptions in global energy markets:

- Increased competition for LNG: Global demand for LNG would soar, leading to intense competition among importing countries.

- Price increases in other regions: Countries outside the EU would also experience higher gas prices.

- Market instability: The global gas market could become highly volatile and unpredictable.

Energy security concerns in other parts of the world would intensify, underscoring the need for international cooperation to address the crisis and prevent further instability.

Conclusion

The EU's deliberation on a Russian gas ban highlights the complex interplay of economic, political, and geopolitical factors affecting the energy sector. A ban would undoubtedly cause short-term economic disruption, particularly within the spot market. This necessitates a swift and coordinated response from the EU involving diversification of gas supplies, acceleration of the renewable energy transition, and strategies to manage the ensuing market volatility. Effective planning and mitigation strategies are crucial, both at the national and individual levels.

Call to Action: Stay informed on the developments regarding the Russian gas ban and its impact on the EU spot market. Regularly consult reliable news sources and expert analyses to understand the evolving situation and its potential consequences for your business or household. Understanding the intricacies of this spot market crisis is crucial for effective planning and mitigation strategies.

Featured Posts

-

A Look Into The Lives Of Chalet Girls In Europes Exclusive Ski Resorts

Apr 24, 2025

A Look Into The Lives Of Chalet Girls In Europes Exclusive Ski Resorts

Apr 24, 2025 -

John Travolta Analyzing His Surprisingly Low Rotten Tomatoes Score

Apr 24, 2025

John Travolta Analyzing His Surprisingly Low Rotten Tomatoes Score

Apr 24, 2025 -

Chinese Equities Soar Hong Kong Market Responds To Trade Optimism

Apr 24, 2025

Chinese Equities Soar Hong Kong Market Responds To Trade Optimism

Apr 24, 2025 -

Why Is The Canadian Dollar Falling Against Major Currencies

Apr 24, 2025

Why Is The Canadian Dollar Falling Against Major Currencies

Apr 24, 2025 -

White House Cocaine Incident Secret Service Investigation Concludes

Apr 24, 2025

White House Cocaine Incident Secret Service Investigation Concludes

Apr 24, 2025