Chinese Equities Soar: Hong Kong Market Responds To Trade Optimism

Table of Contents

Easing Trade Tensions Fuel Market Growth

Recent positive developments in US-China trade negotiations have significantly boosted investor confidence, fueling the growth in Chinese equities. The easing of trade tensions is a primary driver of this market surge. Decreased uncertainty translates directly into increased investment. Specific agreements and announcements have played a crucial role in this positive shift.

- Decreased tariffs on specific goods: The reduction or removal of tariffs on certain goods has eased the burden on Chinese businesses and stimulated economic activity. This has directly benefited many sectors, leading to improved profitability and stronger stock performance.

- Increased commitment to trade dialogue: A renewed commitment to constructive dialogue between the US and China has calmed market anxieties. The perception of a more stable and predictable trade relationship is crucial for long-term investment decisions.

- Improved forecasts for bilateral trade: More optimistic forecasts for bilateral trade between the two economic giants have significantly improved investor sentiment. Analysts predict increased trade volume, further bolstering the positive market outlook.

- Positive impact on Chinese manufacturing and exports: Easing trade tensions have positively impacted Chinese manufacturing and export sectors. This has led to stronger earnings reports and subsequently, higher valuations for related Chinese equities.

Strong Performance of Key Chinese Sectors

The surge in Chinese equities isn't uniform; specific sectors are experiencing particularly strong gains. This reflects both the overall economic recovery and the structural changes within the Chinese economy.

- Growth in technology companies driven by innovation and increased domestic demand: Chinese technology companies are experiencing remarkable growth fueled by innovation and increasing domestic demand. Investments in 5G, artificial intelligence, and other cutting-edge technologies are driving this sector's performance.

- Resilience of consumer staples amidst economic uncertainty: Despite economic uncertainty, the consumer staples sector has demonstrated remarkable resilience. This indicates strong underlying consumer demand and a stable foundation for growth.

- Positive outlook for the financial sector due to government reforms: Government reforms within the financial sector are creating a more favorable environment for investment and growth. This positive outlook is driving the performance of Chinese financial equities.

- Potential for growth in the real estate sector despite recent regulatory changes: While facing regulatory changes, the real estate sector still presents potential for growth, particularly in specific segments and regions. This sector remains a significant component of the Chinese economy.

Increased Foreign Investment in Hong Kong

The positive sentiment surrounding Chinese equities is attracting significant foreign investment into the Hong Kong stock market. Hong Kong, as a major financial hub, is benefiting from these capital inflows.

- Rising attractiveness of Hong Kong as an investment destination: Hong Kong's robust legal framework and efficient financial markets make it an attractive destination for foreign investors seeking exposure to the Chinese economy.

- Increased participation of international institutional investors: Major institutional investors are increasing their allocations to Chinese equities through Hong Kong, further boosting market liquidity.

- Improved market liquidity due to higher trading volumes: Increased trading volumes contribute to improved market liquidity, making it easier for investors to buy and sell Chinese equities.

- Potential for further capital inflows in the near future: Given the positive outlook, analysts anticipate further capital inflows into Hong Kong's stock market, sustaining the upward trend in Chinese equities.

Risks and Considerations for Investors

While the outlook for Chinese equities is positive, investors should acknowledge potential risks and uncertainties. A balanced investment strategy is crucial for mitigating these risks.

- Potential for renewed trade tensions: The possibility of renewed trade tensions between the US and China remains a significant risk factor. Investors should monitor developments closely.

- Geopolitical risks impacting the region: Geopolitical risks within the region could negatively impact market sentiment and investment flows. Careful consideration of these factors is essential.

- Regulatory changes within the Chinese market: Regulatory changes within China could affect specific sectors and companies. Investors need to stay informed about these changes.

- Importance of diversification within a portfolio: Diversification remains crucial for mitigating risk. Investors should not over-concentrate their portfolios in Chinese equities.

Conclusion

The surge in Chinese equities, driven by easing trade tensions and strong performance across key sectors, is creating exciting investment opportunities. The Hong Kong stock market is a key beneficiary of this positive momentum. However, investors should approach the market with caution, considering potential risks and diversifying their portfolios accordingly. Invest wisely in Chinese equities, capitalizing on the current surge while carefully managing risk. Learn more about the opportunities in the Hong Kong stock market and Chinese equities by consulting with a qualified financial advisor.

Featured Posts

-

Analysis Chinese Stocks In Hong Kong Benefit From Reduced Trade Friction

Apr 24, 2025

Analysis Chinese Stocks In Hong Kong Benefit From Reduced Trade Friction

Apr 24, 2025 -

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025 -

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025 -

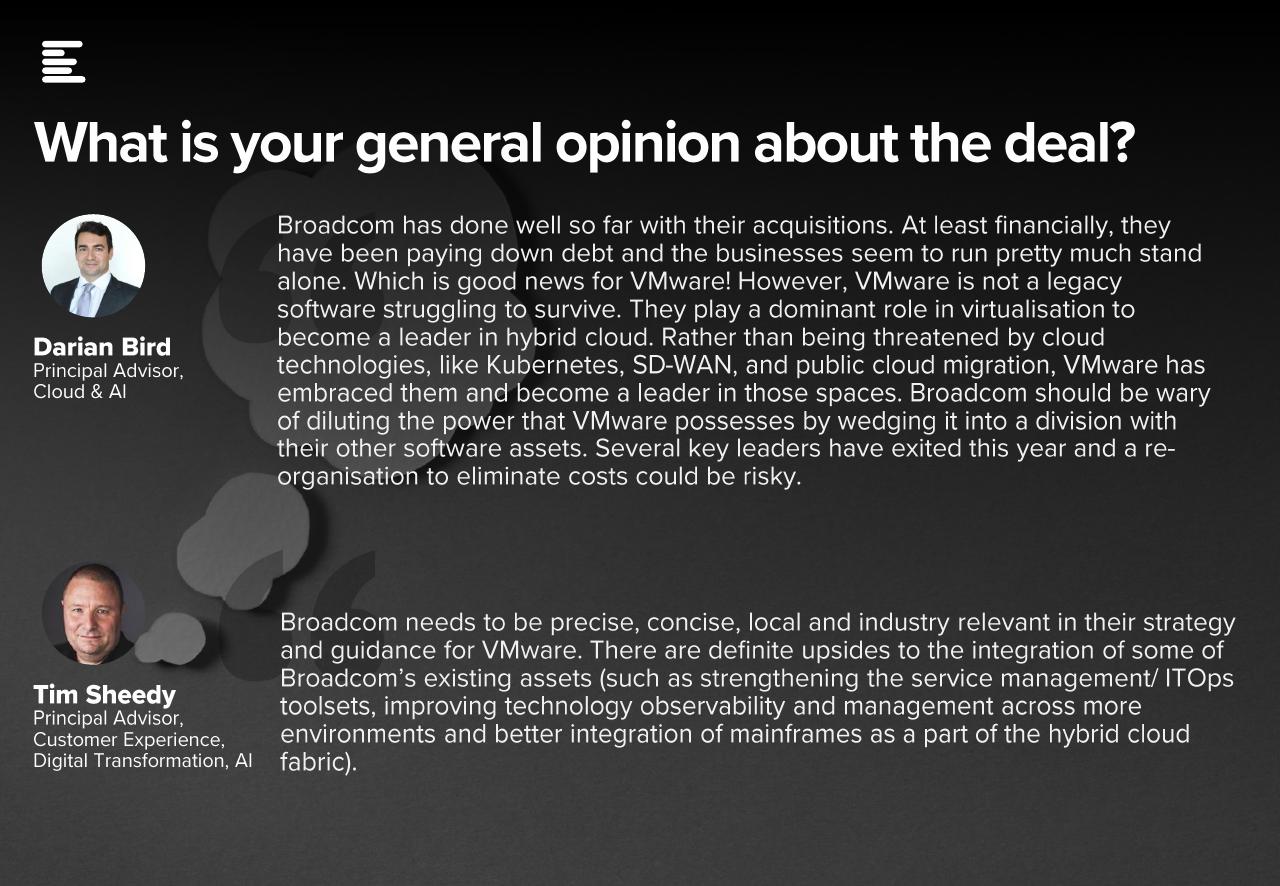

At And T Exposes Extreme Cost Increase In Broadcoms V Mware Proposal

Apr 24, 2025

At And T Exposes Extreme Cost Increase In Broadcoms V Mware Proposal

Apr 24, 2025 -

5 Dos And Don Ts For Landing A Job In The Private Credit Boom

Apr 24, 2025

5 Dos And Don Ts For Landing A Job In The Private Credit Boom

Apr 24, 2025