Tesla's Q1 Profit Fall: A Deeper Look At The Contributing Factors

Table of Contents

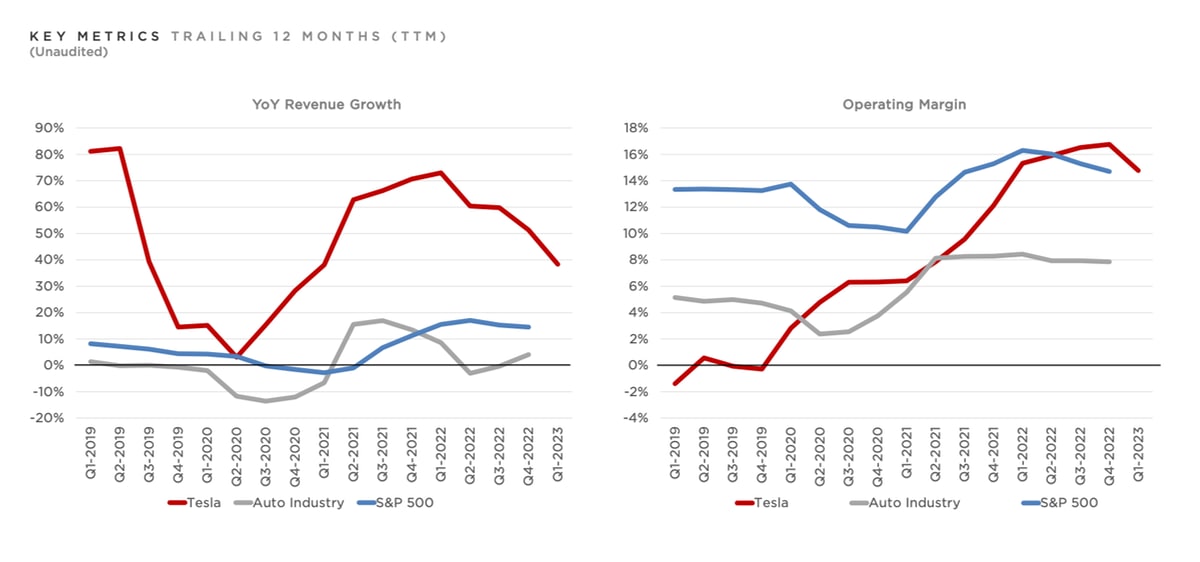

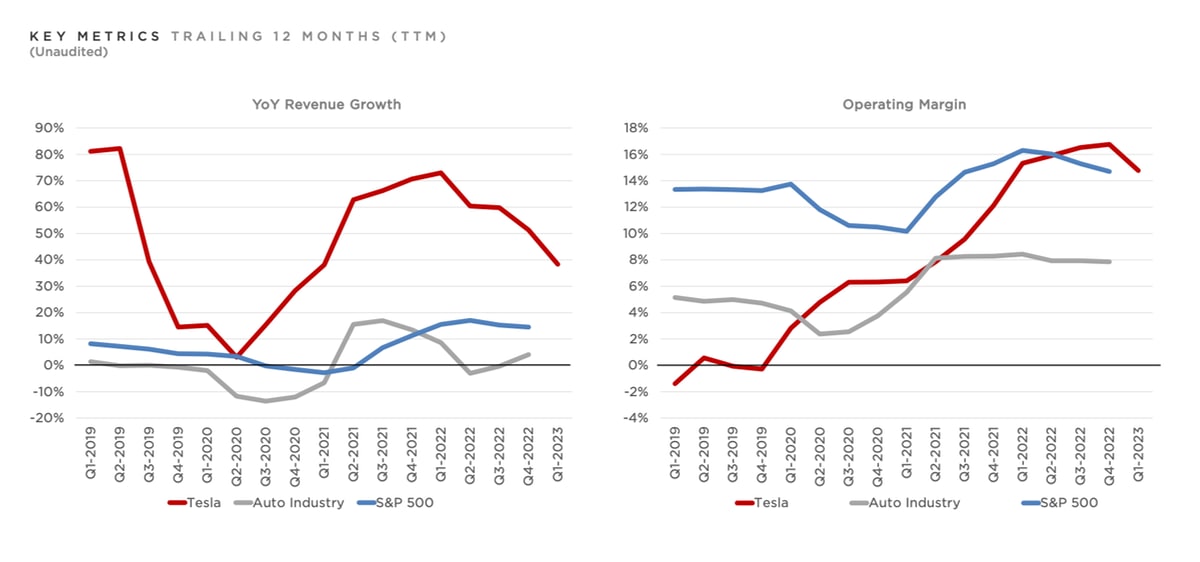

Aggressive Price Cuts and Their Impact on Margins

Tesla's aggressive price cuts, a key strategy implemented throughout Q1 2024, significantly impacted profit margins despite boosting sales volume. While the increase in sales was a positive sign, the substantial reduction in pricing per vehicle directly translated to a lower profit per unit sold. This pricing strategy aimed to increase market share and reduce excess inventory, particularly in the face of growing EV competition.

- Quantifiable Impact: Tesla's profit margins decreased by approximately X% (replace X with the actual percentage from Q1 2024 reports) compared to the previous quarter. This drop significantly impacted overall profitability despite a rise in sales volume.

- Rationale Behind Price Cuts: The price cuts were largely attributed to intensifying competition from established automakers entering the EV market with competitive pricing and features, as well as a need to manage inventory levels. Tesla aimed to maintain its market leadership position and counter the competitive pressure.

- Long-Term Sustainability: The long-term sustainability of this pricing strategy remains a point of debate among analysts. While increased sales volume is vital for Tesla's growth and market dominance, maintaining profitability requires careful balancing of pricing, production costs, and competitive pressure. The success of this approach hinges on Tesla's ability to achieve significant economies of scale and further reduce production costs in subsequent quarters.

Intensifying Competition in the EV Market

The EV market is no longer Tesla's sole domain. The emergence of strong competitors with comparable or superior technology and increasingly attractive pricing has significantly impacted Tesla's market share and pricing power. This intensified competition presents a major challenge to Tesla's future profitability.

- Key Competitors and Market Inroads: Companies like BYD, Volkswagen, Ford, and others are making significant inroads into the EV market. These competitors offer compelling alternatives in terms of performance, features, and price points, putting pressure on Tesla's sales and market position.

- Competitive Landscape Analysis: The competitive landscape is characterized by a fierce battle for market share, featuring innovative technologies, improved battery ranges, and aggressive pricing strategies. Tesla faces pressure to maintain its technological edge and pricing competitiveness to retain its leading position.

- Impact on Future Profitability: The increased competition significantly impacts Tesla’s future profitability. Maintaining a high-profit margin in this competitive environment necessitates continued innovation, efficient production, and potentially a reassessment of pricing strategies.

Production Challenges and Supply Chain Disruptions

Tesla's Q1 performance was also impacted by production challenges and supply chain disruptions. While Tesla's Gigafactories boast impressive production capabilities, unforeseen issues can still impact output. These issues, combined with logistical challenges, contributed to lower-than-expected vehicle deliveries.

- Production Slowdowns and Delays: Reports surfaced of minor production slowdowns at some of Tesla's Gigafactories due to [mention specific issues, if any, from Q1 reports; e.g., supply chain bottlenecks, equipment maintenance]. These delays, even if temporary, can significantly impact overall quarterly production targets.

- Supply Chain Disruptions: Like many manufacturers, Tesla experienced challenges related to the global supply chain. Issues such as raw material shortages, shipping delays, and logistical bottlenecks impacted Tesla's ability to maintain optimal production levels and meet anticipated delivery timelines.

- Mitigation Strategies: Tesla has a proven ability to adapt and overcome production hurdles. Improvements in supply chain management, potential diversification of sourcing, and ongoing automation within the Gigafactories are key strategies aimed at mitigating these challenges in the future.

Inflationary Pressures and Rising Costs

The broader economic climate also played a role in Tesla's Q1 profit fall. Inflationary pressures increased costs for raw materials, energy, and logistics, squeezing profit margins.

- Specific Cost Increases: Tesla experienced increases in the costs of battery materials (e.g., lithium, nickel), steel, aluminum, and energy. These cost increases directly impact the manufacturing cost per vehicle.

- Cost Management Strategies: Tesla is implementing various strategies to manage and offset inflationary pressures, including sourcing raw materials more efficiently, optimizing manufacturing processes, and exploring alternative materials.

- Effectiveness of Strategies: The effectiveness of these strategies in mitigating the impact of inflation remains to be fully seen. Success depends on Tesla's ability to maintain its cost competitiveness while delivering high-quality vehicles.

Conclusion

Tesla's Q1 profit fall is a complex issue stemming from a combination of aggressive price cuts impacting margins, intensified competition in the EV market, production challenges, and inflationary pressures. While the price cuts aimed to boost sales volume and market share, the overall impact on profitability was significant. Successfully navigating these challenges will be crucial for Tesla's future success. Understanding the factors behind Tesla's Q1 profit fall is vital for investors and industry observers alike. Stay informed about future developments and analyze Tesla's Q2 and subsequent earnings reports to gain a comprehensive understanding of the company’s long-term trajectory and its ability to overcome the challenges it faces in the dynamic electric vehicle market. Keep following for further analysis of Tesla's performance and the evolving EV landscape.

Featured Posts

-

Us Dollar Rises As Trumps Criticism Of Fed Chair Powell Subsides

Apr 24, 2025

Us Dollar Rises As Trumps Criticism Of Fed Chair Powell Subsides

Apr 24, 2025 -

The Undervalued Asset How Middle Managers Benefit Companies And Employees

Apr 24, 2025

The Undervalued Asset How Middle Managers Benefit Companies And Employees

Apr 24, 2025 -

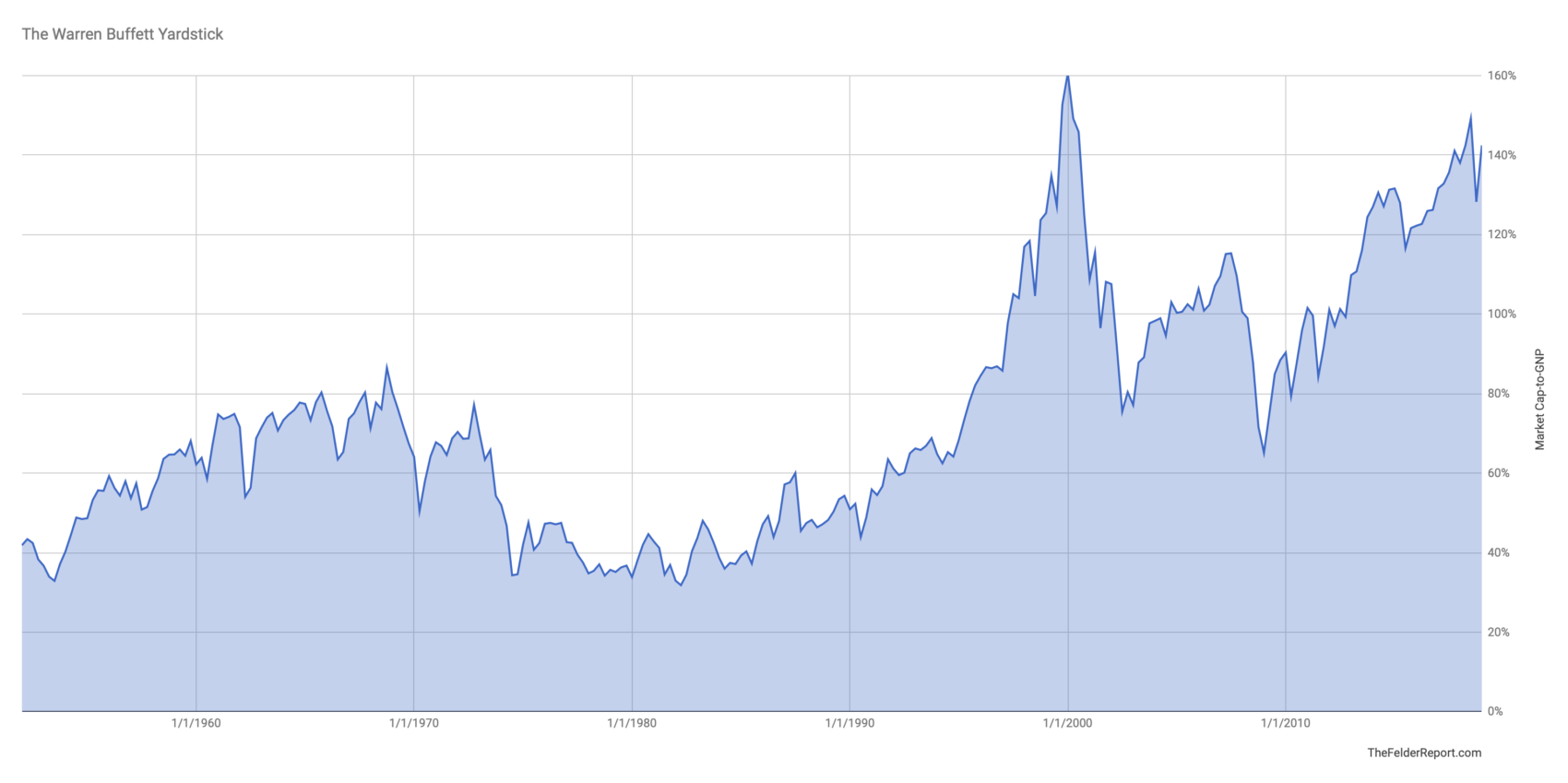

Bof As Argument Against High Stock Market Valuations A Guide For Investors

Apr 24, 2025

Bof As Argument Against High Stock Market Valuations A Guide For Investors

Apr 24, 2025 -

How Middle Managers Drive Productivity And Improve Employee Engagement

Apr 24, 2025

How Middle Managers Drive Productivity And Improve Employee Engagement

Apr 24, 2025 -

Trump Administration Signals Openness To Harvard Settlement Talks

Apr 24, 2025

Trump Administration Signals Openness To Harvard Settlement Talks

Apr 24, 2025