Stock Market Valuation Concerns? BofA Offers Reassurance To Investors

Table of Contents

BofA's Key Arguments for a Positive Market Outlook

Bank of America's positive market outlook rests on several key pillars. Their analysts believe that despite economic headwinds, several factors support continued growth and present compelling investment opportunities.

-

Strong Corporate Earnings Despite Economic Headwinds: BofA Global Research highlights that many companies have demonstrated resilience, exceeding earnings expectations even amidst inflationary pressures. This suggests underlying strength in the economy and the ability of businesses to adapt to challenging conditions. For instance, the report cites strong performance in sectors like technology and consumer staples, driven by innovation and consistent demand.

-

Resilience of the Consumer Sector: Despite rising interest rates and inflation, consumer spending remains relatively robust. BofA attributes this to factors like a strong labor market and pent-up demand from the pandemic. This continued consumer strength is a significant underpinning of their positive market outlook. Further analysis within the BofA report suggests that certain consumer segments are more resilient than others, providing further granularity for investment decisions.

-

Positive Long-Term Growth Projections: BofA's analysts project sustained, albeit moderated, economic growth in the coming years. Their projections take into account factors such as technological advancements, demographic shifts, and ongoing global investment. This long-term growth potential supports their view that current market valuations are not necessarily overinflated. The report includes detailed modeling which accounts for various economic scenarios, supporting the projections' robustness.

-

Strategic Investment Opportunities Identified by BofA Analysts: The report doesn't just offer a generalized positive outlook; it also identifies specific sectors and companies that BofA believes offer attractive investment opportunities. These opportunities are carefully analyzed, considering factors like growth potential, valuation metrics, and risk profiles. This targeted approach allows investors to make informed decisions based on specific recommendations rather than relying solely on general market sentiment.

Addressing Specific Valuation Concerns Raised by Investors

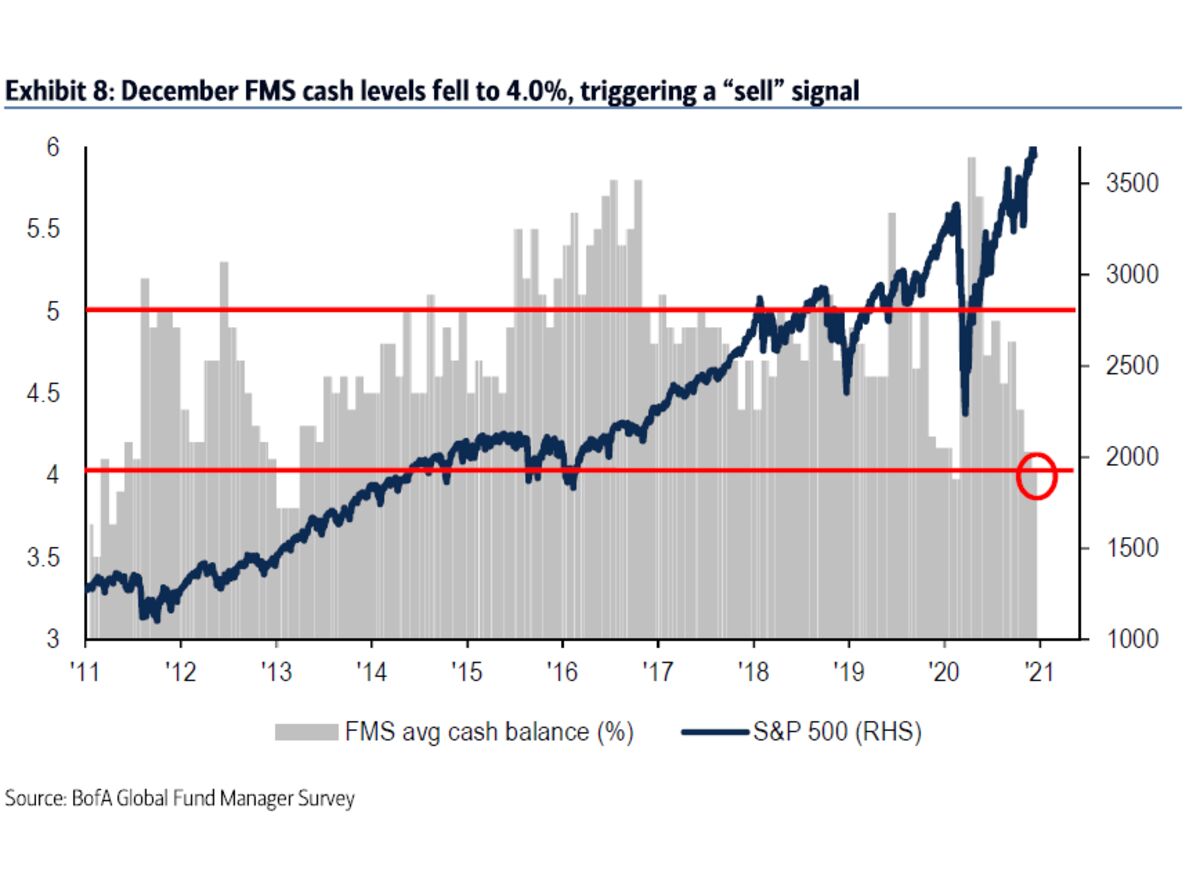

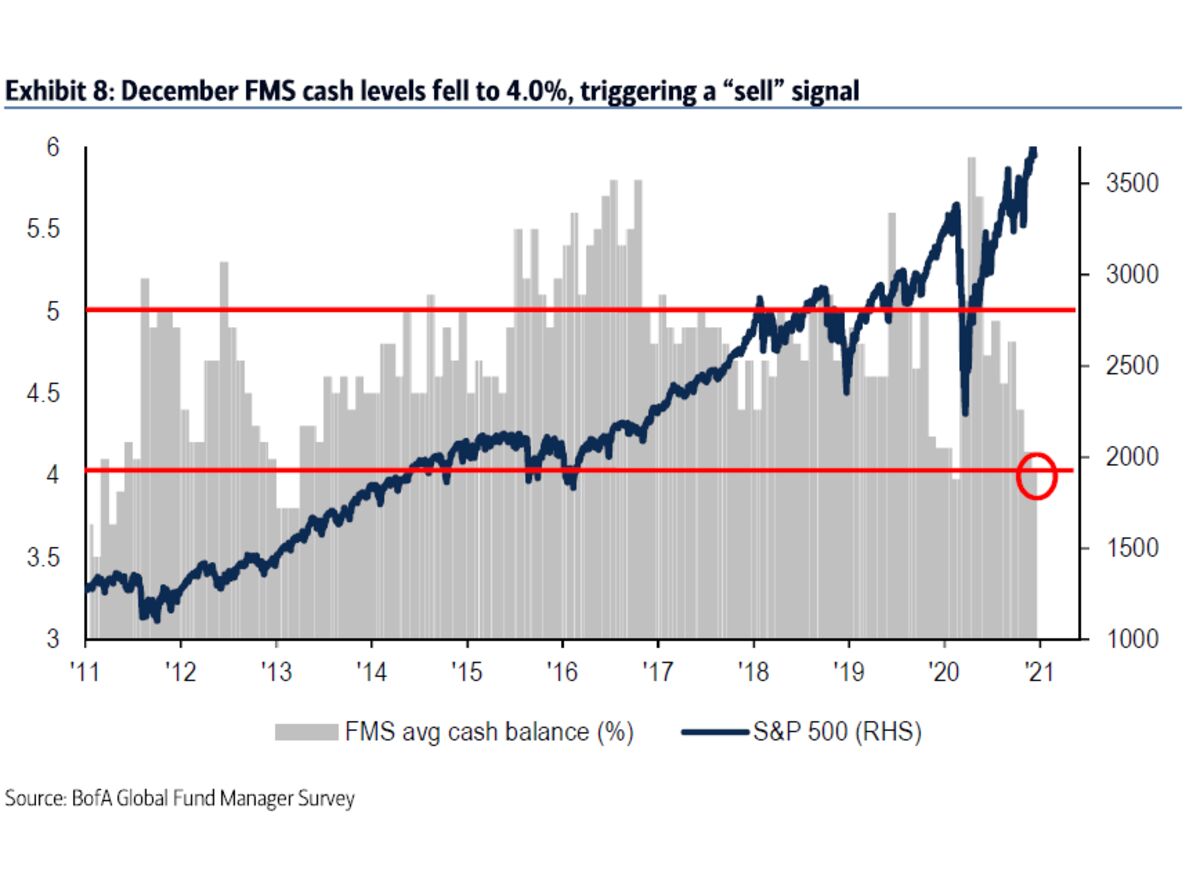

While BofA presents a positive outlook, they acknowledge legitimate investor concerns surrounding current stock market valuation. Two major concerns are often raised: high Price-to-Earnings (P/E) ratios and the impact of interest rate hikes.

-

BofA's Counterarguments to High P/E Ratios: Many investors point to high P/E ratios as an indicator of overvaluation. BofA counters this by emphasizing the importance of considering future earnings growth. Their analysis suggests that many companies are expected to experience significant earnings growth in the coming years, which, when factored into the equation, makes current valuations more reasonable. The report also considers industry-specific P/E ratios and adjusts for differing growth profiles to produce a more nuanced view.

-

Analysis of the Impact of Interest Rate Hikes on Stock Valuations: Rising interest rates impact stock valuations primarily by increasing the discount rate used to value future earnings. BofA's analysis incorporates this impact, but concludes that the effect is likely to be offset by strong corporate earnings and continued economic growth. However, the report also acknowledges the potential for increased market volatility and cautions investors to prepare for potential short-term fluctuations.

-

Discussion of Potential Downside Risks and BofA's Assessment of Their Probability: BofA's analysis is not without caveats. They acknowledge potential downside risks, such as a sharper-than-expected economic slowdown or unforeseen geopolitical events. However, their assessment suggests that the probability of these risks materializing is relatively low, based on their current economic models and market intelligence. This risk assessment is transparently presented in the report, allowing investors to gauge the associated uncertainties.

BofA's Recommended Investment Strategies

Based on their analysis, BofA recommends a cautiously optimistic investment strategy. They suggest focusing on companies with strong fundamentals and long-term growth potential.

-

Specific Sectors or Asset Classes BofA Suggests Focusing On: The report identifies sectors like technology, healthcare, and select consumer staples as potentially offering strong returns. They also suggest diversification across different asset classes to mitigate risk. Specific company recommendations are provided within the full report, carefully selected based on BofA's proprietary research.

-

Investment Strategies to Mitigate Potential Risks (e.g., Diversification): BofA emphasizes the importance of portfolio diversification to reduce exposure to specific sectors or market segments. They advise investors to spread their investments across various asset classes, geographies, and industries to minimize the impact of potential market downturns. The report includes illustrative examples of well-diversified portfolios tailored to different risk tolerances.

-

Tips for Long-Term vs. Short-Term Investment Horizons: BofA advocates a long-term investment approach for most investors, emphasizing the importance of weathering short-term market fluctuations. However, they also provide guidance for investors with shorter-term horizons, recommending strategies to manage risk and protect capital during periods of market uncertainty. Different risk tolerance profiles and time horizons are carefully addressed in the report.

Conclusion: Navigating Stock Market Valuation Concerns with BofA's Guidance

In conclusion, while acknowledging the inherent uncertainties within the stock market, BofA's report presents a cautiously optimistic outlook. Their analysis suggests that strong corporate earnings, resilient consumer spending, and positive long-term growth projections could offset concerns about high P/E ratios and interest rate hikes. However, understanding stock market valuations requires careful consideration of potential downside risks and a well-diversified investment strategy. It's crucial to conduct thorough research and, ideally, seek professional financial advice before making any investment decisions. To effectively manage stock market valuation risks and improve your stock market analysis, learn more about BofA's comprehensive market analysis and consider their investment recommendations to create a strategy that aligns with your individual financial goals. By carefully assessing stock market valuations and understanding the current market outlook, you can navigate the current market landscape with greater confidence and potentially achieve superior investment results.

Featured Posts

-

Office365 Executive Inbox Hacks Result In Multi Million Dollar Losses Fbi Reports

Apr 22, 2025

Office365 Executive Inbox Hacks Result In Multi Million Dollar Losses Fbi Reports

Apr 22, 2025 -

Analyzing The Economic Fallout Of Trumps Policies

Apr 22, 2025

Analyzing The Economic Fallout Of Trumps Policies

Apr 22, 2025 -

Evaluating Pope Francis Pontificate The Conclaves Verdict

Apr 22, 2025

Evaluating Pope Francis Pontificate The Conclaves Verdict

Apr 22, 2025 -

Court Battle Reignited Doj Vs Google Over Search Engine Monopoly

Apr 22, 2025

Court Battle Reignited Doj Vs Google Over Search Engine Monopoly

Apr 22, 2025 -

Bank Of Canadas Rate Pause Expert Analysis From Fp Video

Apr 22, 2025

Bank Of Canadas Rate Pause Expert Analysis From Fp Video

Apr 22, 2025