Stock Market Valuation Concerns: BofA's Reassuring Analysis For Investors

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA's assessment of market valuation employs a multifaceted approach, incorporating various economic indicators and financial metrics. Their analysis counters the narrative of pervasive overvaluation with several key arguments:

-

Strong Corporate Earnings and Revenue Growth: BofA highlights robust corporate earnings and revenue growth across numerous sectors as a primary counterpoint to overvaluation concerns. This positive trend suggests that current valuations, while seemingly high in historical context, are supported by underlying fundamental strength. The analysis likely incorporates data on earnings per share (EPS) growth and revenue growth rates across various sectors.

-

Impact of Low Interest Rates and Accommodative Monetary Policy: The report likely emphasizes the continued influence of low interest rates and the accommodative stance of central banks on market valuations. Low borrowing costs encourage investment and expansion, supporting higher valuations even in the face of historical comparisons. The impact of quantitative easing and other monetary policy tools on asset prices is also likely considered.

-

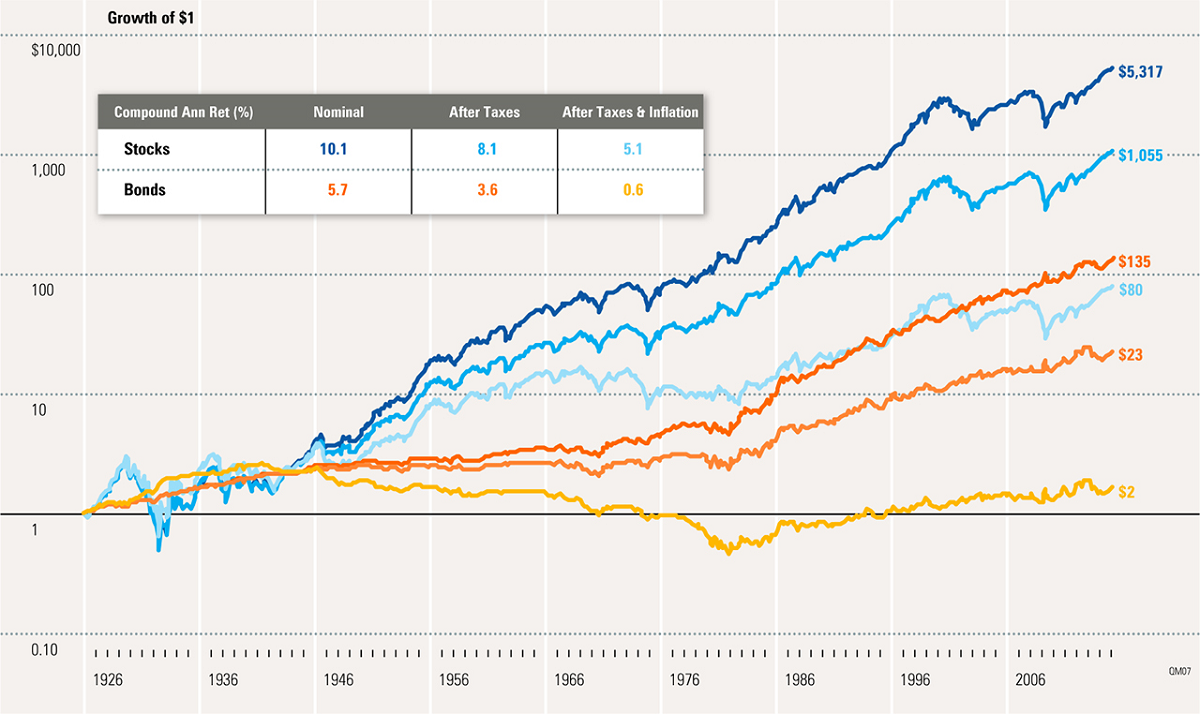

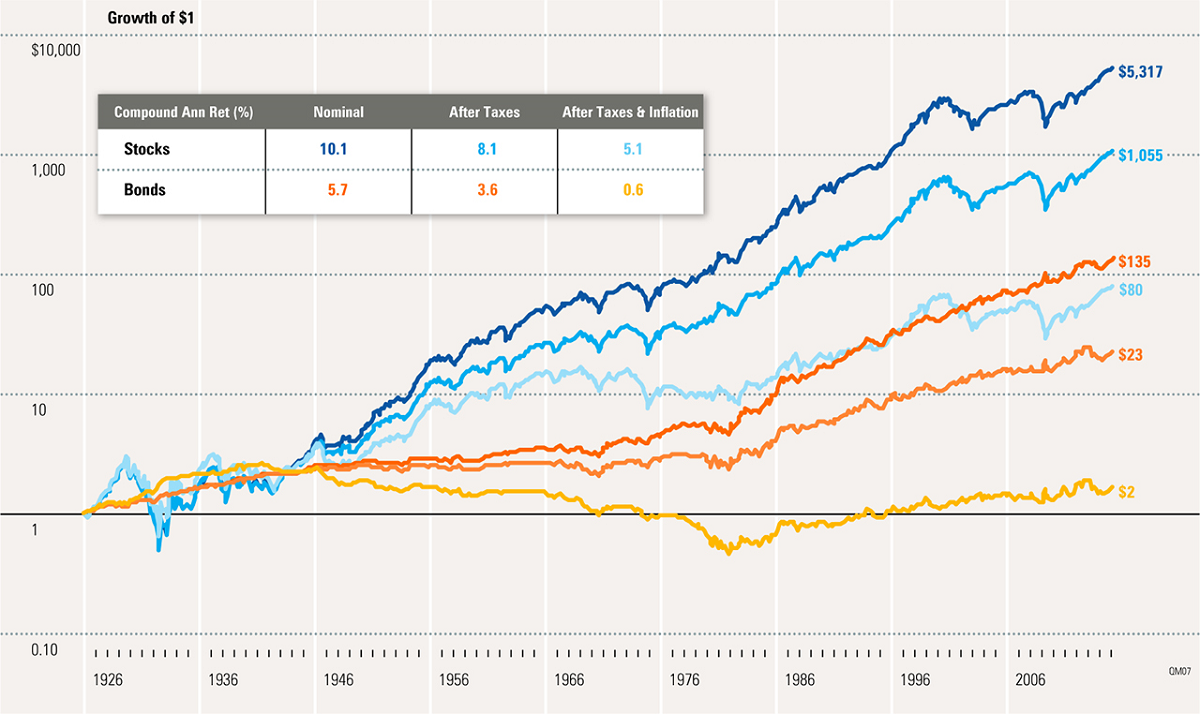

Valuation Metrics and Interpretation: BofA likely employs multiple valuation metrics, such as Price-to-Earnings (P/E) ratios, including the cyclically adjusted price-to-earnings ratio (Shiller PE), to assess market valuation. Their interpretation likely considers these metrics within a broader economic context, acknowledging that historical averages might not fully capture current market dynamics. They may also look at other metrics such as Price-to-Sales ratios and Price-to-Book ratios.

-

Technological Innovation and Earnings Potential: A key component of BofA's analysis likely involves the consideration of technological innovation and its transformative impact on corporate earnings potential. The emergence of disruptive technologies and their potential to drive future growth could justify higher valuations compared to historical norms. This aspect of the analysis focuses on the long-term growth trajectory of companies, influenced by technological advancements.

Addressing Specific Sectors and Risks

BofA’s analysis doesn't present a uniform view across all market sectors. The report likely acknowledges that valuation concerns vary significantly depending on the sector.

-

Sector-Specific Analysis: BofA probably provides a detailed analysis of valuations within specific sectors, such as technology, healthcare, and financials, highlighting potential overvaluations or undervaluations in each. This granular approach allows for a more nuanced understanding of the market's overall health.

-

Identifying Potential Overvalued Sectors: The analysis may identify specific sectors as potentially overvalued, offering a rationale based on their particular growth prospects, competitive landscapes, and current valuations relative to historical trends and peers.

-

Addressing Macroeconomic Risks: BofA’s analysis likely acknowledges potential risks, such as inflation, geopolitical uncertainty, and regulatory changes. The report likely assesses how these factors could impact valuations and suggests strategies for mitigation.

- Risk Mitigation Strategies: This could include diversification, hedging strategies, or focusing on companies with strong balance sheets and resilient business models.

- Impact of Regulatory Changes: This section might detail how potential regulatory changes in specific sectors could influence investment decisions.

BofA's Investment Recommendations

Based on their comprehensive valuation analysis, BofA likely offers specific investment recommendations to navigate the current market.

-

Investment Strategies: These recommendations might include sector rotation, strategic diversification across asset classes, or focusing on value stocks versus growth stocks, depending on their overall market outlook.

-

Specific Stock Picks (with disclaimers): While specific stock picks are often avoided due to legal considerations, the report may provide examples or categories of stocks aligning with their recommendations, accompanied by appropriate disclaimers.

- Rationale Behind Recommendations: The report should clearly articulate the rationale behind their suggested investment strategies and stock picks (if any), connecting these recommendations to their valuation analysis and risk assessment.

- Long-Term Market Outlook: BofA likely offers a long-term outlook for the market, considering their valuation analysis and macroeconomic projections.

Conclusion: Navigating Stock Market Valuation Concerns with BofA's Insights

BofA's analysis provides a valuable counterpoint to prevalent anxieties surrounding stock market valuation. Their arguments highlighting strong corporate earnings, the impact of low interest rates, and the role of technological innovation offer a more nuanced perspective. While acknowledging sector-specific risks, their analysis suggests that a blanket assessment of market overvaluation may be overly simplistic. Remember to conduct your own thorough due diligence before making any investment decisions. Staying informed and carefully considering perspectives like BofA’s can significantly aid in navigating the complexities of the stock market and making sound investment choices related to stock market valuation. To delve deeper into BofA's analysis and their full report (if publicly available), [insert link to BofA report here].

Featured Posts

-

Gambling On California Wildfires A Troubling Trend

Apr 24, 2025

Gambling On California Wildfires A Troubling Trend

Apr 24, 2025 -

Private Credit Boom 5 Key Dos And Don Ts To Secure Your Next Role

Apr 24, 2025

Private Credit Boom 5 Key Dos And Don Ts To Secure Your Next Role

Apr 24, 2025 -

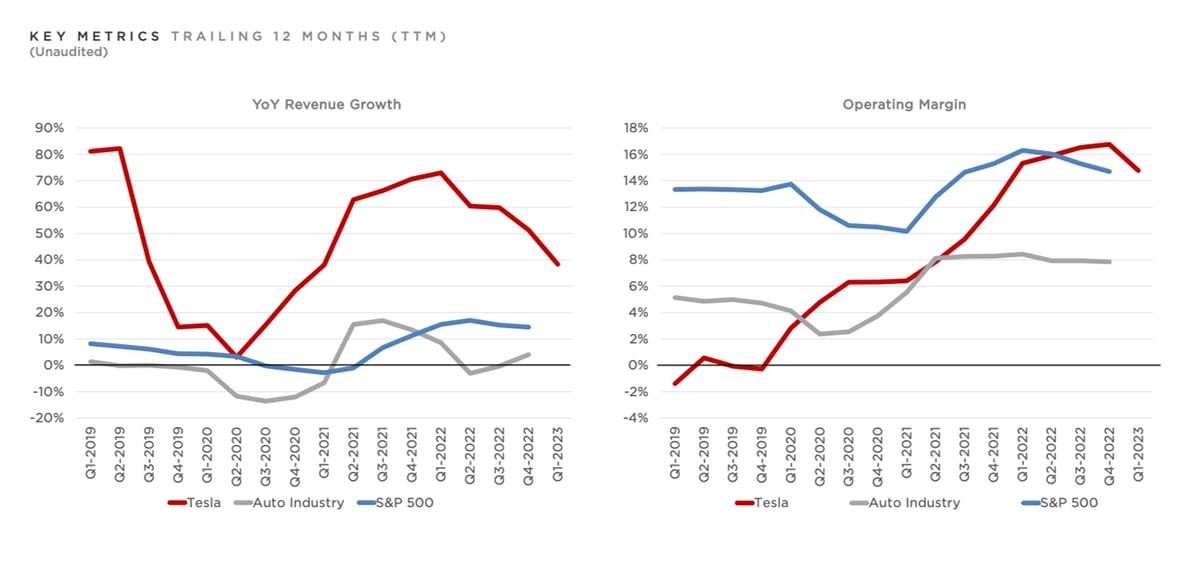

Teslas Q1 Profit Fall A Deeper Look At The Contributing Factors

Apr 24, 2025

Teslas Q1 Profit Fall A Deeper Look At The Contributing Factors

Apr 24, 2025 -

Price Gouging Allegations Surface In La Following Devastating Fires

Apr 24, 2025

Price Gouging Allegations Surface In La Following Devastating Fires

Apr 24, 2025 -

Canadian Auto Industry Unveils Five Point Strategy Amidst Us Trade Tensions

Apr 24, 2025

Canadian Auto Industry Unveils Five Point Strategy Amidst Us Trade Tensions

Apr 24, 2025