Stock Market Valuations: BofA's Case For Investor Calm

Table of Contents

BofA's Core Argument: Fair Valuation, Not Overvaluation

BofA argues that current stock market valuations are more aligned with fair value than many believe. They emphasize that while certain sectors, like technology, might appear expensive based on superficial metrics, a broader assessment using multiple valuation metrics reveals a more balanced picture. This nuanced approach is crucial for understanding the true state of the market.

- BofA's analysis incorporates various valuation metrics: Their assessment isn't solely reliant on the widely-watched price-to-earnings ratio (P/E). They also consider price-to-sales ratios (P/S), dividend yields, and other key indicators to get a complete picture of equity valuations. This multifaceted approach helps to avoid drawing conclusions based on a single, potentially misleading, metric.

- Long-term growth prospects are factored in: BofA's research goes beyond short-term fluctuations. They consider the projected long-term growth prospects of companies and sectors, which significantly influences their valuation models. This forward-looking approach acknowledges that current market conditions don't always reflect future potential.

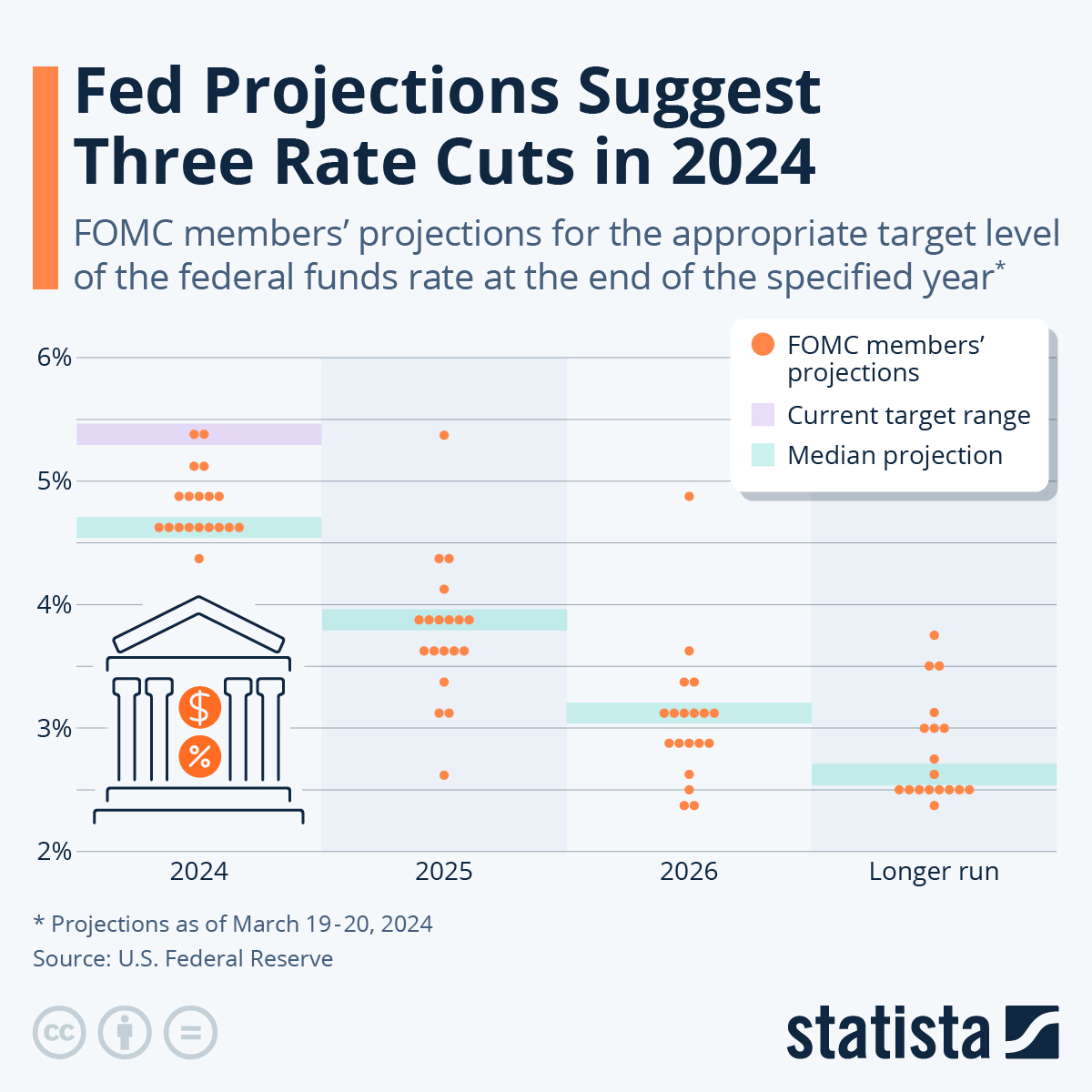

- Interest rate environments are crucial: The current interest rate environment plays a significant role in determining stock market valuations. BofA's analysis accounts for the impact of rising interest rates on discount rates used in valuation models and the attractiveness of alternative investments like bonds.

- Inflation's impact is carefully considered: The current inflationary environment significantly affects company earnings and investor sentiment. BofA's valuation models incorporate inflation projections and their potential impact on corporate profitability, helping to provide a more realistic picture of fair value.

Addressing Concerns About High Inflation and Interest Rates

High inflation and rising interest rates are major concerns for investors. The fear is that these factors could significantly impact corporate profitability and lead to a market downturn. BofA addresses these concerns by detailing how their valuation models incorporate these factors and why they believe the market has already, to a large extent, priced in these risks.

- BofA's inflation and interest rate forecasts: Their analysis includes specific forecasts for both inflation and interest rate trajectories. By incorporating these predictions, they can better estimate the future impact on company earnings and adjust their valuation models accordingly.

- Impact of monetary policy: BofA analyzes the effect of the Federal Reserve's monetary policy on equity valuations. Understanding the Fed's actions and their intended consequences is crucial for assessing the overall market outlook.

- Comparison to historical bond yields: BofA compares current bond yields to historical averages. This comparison helps to contextualize the current interest rate environment and its implications for the relative attractiveness of stocks versus bonds. This provides valuable insight into the potential for capital flight out of the equity market.

- Inflation's effect on company earnings: The impact of inflation on company earnings is central to BofA's analysis. They consider how inflation affects input costs, pricing power, and ultimately, corporate profitability. This is a key driver of their valuation adjustments.

Identifying Potential Opportunities Within the Market

Even within a seemingly fully valued market, BofA identifies specific sectors and individual stocks presenting compelling investment opportunities. They suggest investors look beyond broad market indices like the S&P 500 and adopt a more nuanced approach to stock selection focusing on fundamental analysis.

- Undervalued sectors: BofA highlights specific sectors they believe are undervalued or poised for growth, offering potential for higher returns. This sector analysis helps investors target areas with greater potential for growth amidst overall market uncertainty.

- Specific company examples: The report provides examples of individual companies with attractive valuation metrics, illustrating how to apply BofA's methodology to identify specific investment opportunities.

- Portfolio diversification: BofA emphasizes the importance of portfolio diversification to mitigate risk. Spreading investments across various sectors and asset classes helps to reduce the overall volatility of a portfolio.

- Fundamental analysis: The report details strategies for identifying undervalued companies using fundamental analysis, allowing investors to perform their own due diligence and assess individual stock valuations.

The Importance of Long-Term Investing

BofA emphasizes the importance of maintaining a long-term perspective when evaluating stock market valuations. Short-term market fluctuations are normal, and a patient, well-diversified approach often yields superior returns over the long run. This is especially crucial during periods of market volatility.

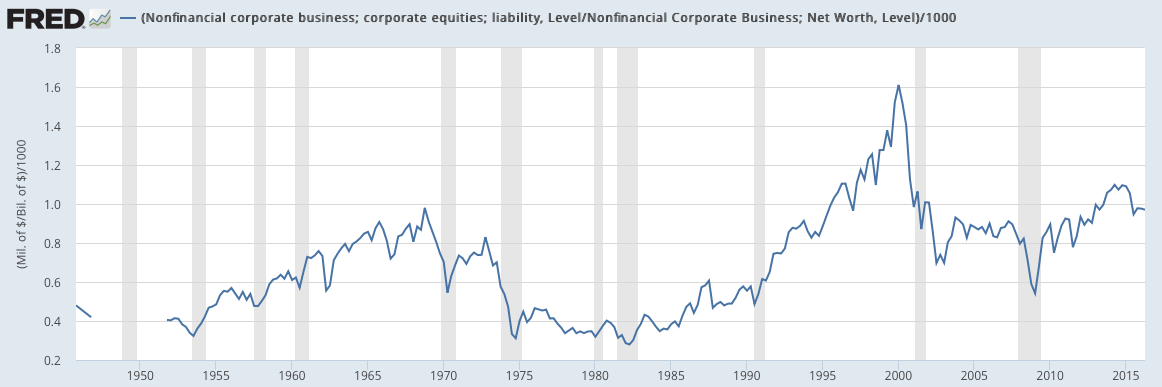

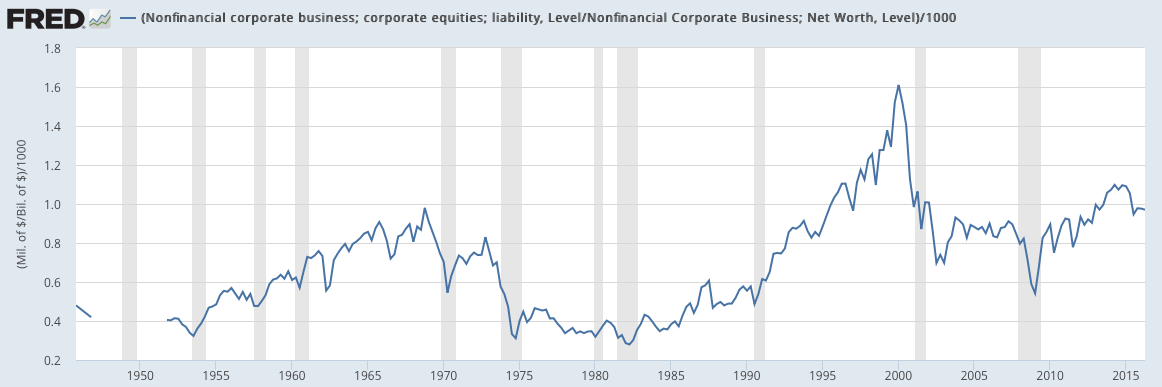

- Historical context: The report provides historical context, showing the cyclical nature of the stock market and highlighting that periods of volatility are often followed by periods of growth.

- Risk tolerance and time horizon: BofA stresses the importance of aligning investment strategy with personal risk tolerance and time horizon. A longer time horizon allows investors to weather short-term fluctuations more effectively.

- Managing emotional responses: The report offers strategies for managing emotional responses to market volatility, encouraging investors to avoid impulsive decisions driven by fear or greed.

- Dollar-cost averaging: The benefits of dollar-cost averaging and consistent investing are discussed, emphasizing the importance of regular contributions to a diversified portfolio, regardless of market conditions.

Conclusion: Maintaining Calm Amidst Stock Market Valuations

BofA's analysis suggests that while volatility is a normal part of the stock market, current stock market valuations, considering various factors like inflation, interest rates, and long-term growth prospects, don't necessarily signal an impending crash. By incorporating a long-term perspective and carefully considering sector-specific opportunities identified through fundamental analysis, investors can navigate the current environment with increased confidence. Don't let short-term fluctuations dictate your investment decisions. Analyze your own risk tolerance and investment goals, consider BofA's insights on stock market valuations, and make informed choices for your long-term financial success. Remember, understanding stock market valuations is key to navigating market uncertainty and achieving your investment objectives.

Featured Posts

-

Trumps Economic Policies And The Future Of The Federal Reserve

Apr 26, 2025

Trumps Economic Policies And The Future Of The Federal Reserve

Apr 26, 2025 -

Microsofts Design Lead Ai And The Human Element

Apr 26, 2025

Microsofts Design Lead Ai And The Human Element

Apr 26, 2025 -

The Next Fed Chair Inheriting Trumps Economic Challenges

Apr 26, 2025

The Next Fed Chair Inheriting Trumps Economic Challenges

Apr 26, 2025 -

Chainalysis And Alterya Merge Boosting Blockchain Security With Ai

Apr 26, 2025

Chainalysis And Alterya Merge Boosting Blockchain Security With Ai

Apr 26, 2025 -

Ai And Human Design Insights From Microsofts Chief Designer

Apr 26, 2025

Ai And Human Design Insights From Microsofts Chief Designer

Apr 26, 2025