Tesla's Q1 2024 Earnings Report: A 71% Drop In Net Income

Table of Contents

Analyzing the 71% Decline in Tesla's Net Income

The 71% plunge in Tesla's net income wasn't a single event but a confluence of factors impacting the company's profitability.

Price Wars and Reduced Margins

Intense price competition in the EV market significantly impacted Tesla's profitability. The company engaged in aggressive price cuts across its model lineup throughout Q1 2024.

- Significant price reductions on Model 3 and Model Y vehicles in key markets.

- Price adjustments to compete with increasingly competitive offerings from established automakers and new EV startups.

- Substantial pressure on profit margins due to the reduction in vehicle pricing.

This price war, triggered partly by increased competition and potentially overstocked inventory, directly eroded Tesla's profit margins, a key contributor to the net income decline. The keywords Tesla price cuts and Tesla profit margin highlight the core issue. Analyzing competitor actions and their subsequent impact on Tesla's pricing strategy further clarifies the situation. The effect of the EV price war on Tesla's competitive positioning needs to be carefully considered.

Increased Production Costs & Supply Chain Issues

Rising production costs and persistent supply chain challenges further strained Tesla's bottom line during Q1 2024.

- Increased costs of raw materials, particularly battery components like lithium and nickel, due to global inflation.

- Challenges in securing crucial components due to ongoing global supply chain disruptions.

- Elevated logistics costs impacting transportation and delivery.

These factors, highlighted by keywords like Tesla production costs and Tesla supply chain, significantly increased the cost of manufacturing and delivering Tesla vehicles, directly impacting profitability. The inflation impact on Tesla needs further analysis to determine its full effect. Supply chain disruptions, a persistent issue across many industries, continue to impact production output and increase expenses.

Increased Spending on Research & Development (R&D) and Expansion

Tesla's substantial investments in future technologies and global expansion also played a role in the decreased net income.

- Significant investments in research and development of cutting-edge battery technology, autonomous driving systems, and other innovative features.

- Heavy expenditure on the expansion of manufacturing capacity, including the construction of new Gigafactories globally and enhancement of existing facilities.

- Development of advanced charging infrastructure and expansion of the Supercharger network.

While these investments are crucial for long-term growth, the keywords Tesla R&D, Tesla expansion, and Tesla new factories point to the short-term financial impact. The costs associated with autonomous driving costs are particularly significant and long-term investments that are likely to be phased in over many years.

Impact on Tesla Stock and Investor Sentiment

The Q1 2024 earnings report had a considerable impact on Tesla stock and investor sentiment.

Market Reaction to the Earnings Report

The immediate market response to the release of the Q1 2024 earnings report was negative, with Tesla's stock price experiencing a significant drop.

- Sharp decline in Tesla stock price following the earnings announcement.

- Negative analyst ratings and downward revisions of future earnings projections.

- Increased volatility in Tesla stock trading.

The keywords Tesla stock price, Tesla investor sentiment, and market reaction Tesla earnings accurately capture the market's reaction.

Long-Term Outlook and Future Projections

While the Q1 2024 results were disappointing, the long-term outlook for Tesla remains a subject of ongoing debate and speculation.

- Varying predictions from financial analysts regarding Tesla's future growth and profitability.

- Tesla's strategies to improve profitability, including cost optimization, increased production efficiency, and expansion into new markets.

Keywords such as Tesla future outlook, Tesla long-term growth, and Tesla stock forecast indicate the uncertainty surrounding Tesla's future performance. Analysts’ predictions vary widely, reflecting the complex interplay of factors impacting Tesla's trajectory.

Conclusion: Understanding the Tesla Q1 2024 Earnings Report – What's Next?

Tesla's Q1 2024 earnings report revealed a significant decline in net income, primarily attributed to price wars impacting profit margins, increased production costs and supply chain issues, and substantial investments in R&D and expansion. This resulted in a negative market reaction and impacted Tesla stock. While the short-term outlook appears challenging, Tesla's long-term prospects depend on its ability to navigate the competitive landscape, manage costs effectively, and successfully execute its strategic initiatives. To stay informed about the evolving situation, follow Tesla's Q1 earnings trends and stay informed about future Tesla financial reports. Understanding the company's ongoing performance is crucial for navigating the dynamic electric vehicle market.

Featured Posts

-

Middle Managers The Bridge Between Leadership And Workforce

Apr 24, 2025

Middle Managers The Bridge Between Leadership And Workforce

Apr 24, 2025 -

The Importance Of Middle Management Driving Productivity And Employee Satisfaction

Apr 24, 2025

The Importance Of Middle Management Driving Productivity And Employee Satisfaction

Apr 24, 2025 -

Nba 3 Point Contest 2024 Herros Triumph Over Hield

Apr 24, 2025

Nba 3 Point Contest 2024 Herros Triumph Over Hield

Apr 24, 2025 -

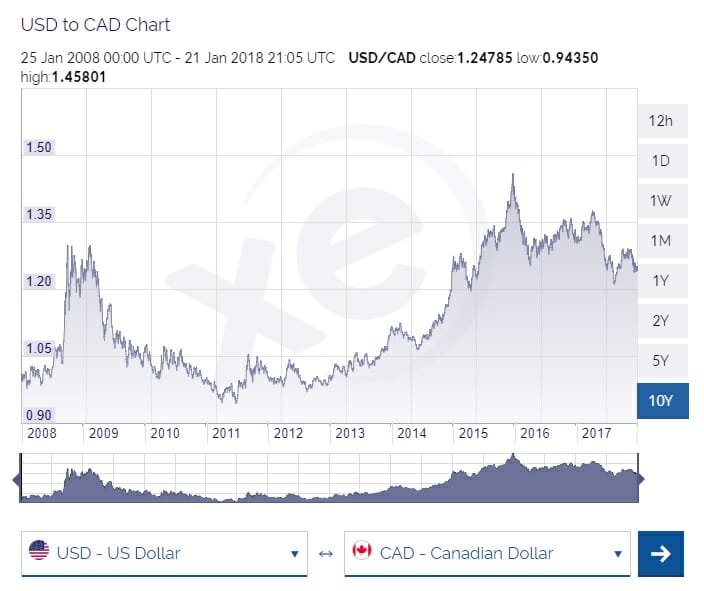

Cad Exchange Rate Fluctuations Factors Affecting The Canadian Dollar

Apr 24, 2025

Cad Exchange Rate Fluctuations Factors Affecting The Canadian Dollar

Apr 24, 2025 -

Private Credit Boom 5 Key Dos And Don Ts To Secure Your Next Role

Apr 24, 2025

Private Credit Boom 5 Key Dos And Don Ts To Secure Your Next Role

Apr 24, 2025