Tesla's Q1 Profit Decline: Impact Of Musk's Political Involvement

Table of Contents

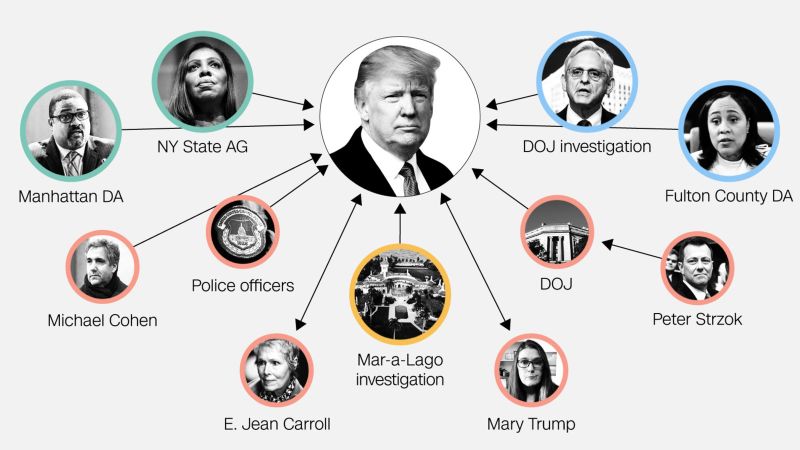

Musk's Political Activities and Their Potential Impact on Tesla's Brand

Elon Musk's highly visible and often controversial political involvement has become a defining characteristic of his public persona. His frequent and sometimes inflammatory tweets, coupled with outspoken political stances on various issues, have raised concerns about their potential negative impact on Tesla's brand image. This impact of political involvement extends beyond simple public opinion; it influences investor sentiment and potentially alienates key demographics.

- Examples of controversial tweets: Musk's tweets regarding politics, often provocative and unsubstantiated, have generated considerable negative media attention. His pronouncements on topics ranging from partisan politics to cryptocurrency have sparked debates and controversies, impacting public perception.

- Negative media coverage and its reach: The significant media coverage surrounding Musk’s political activities has often cast a shadow over Tesla's positive news. This widespread coverage extends across various platforms, reaching a broad audience and potentially impacting brand perception.

- Impact on brand perception among environmentally conscious consumers: Tesla’s brand is strongly associated with environmental sustainability. However, some of Musk’s political stances appear to contradict this image, potentially alienating environmentally conscious consumers who may reconsider their purchasing decisions.

- Potential loss of institutional investors due to reputational risk: Institutional investors often prioritize reputational risk. Musk's controversial actions could lead to a reassessment of Tesla as an investment, potentially leading to divestment and affecting the Tesla stock price.

The Economic Climate and its Effect on Tesla's Performance

It's crucial to acknowledge that factors beyond Musk's political actions significantly impacted Tesla's Q1 performance. The global economic climate played a substantial role, independent of the Elon Musk politics narrative.

- Inflation's effect on raw material costs and consumer spending: Soaring inflation increased the cost of raw materials essential for Tesla's vehicle production, squeezing profit margins and potentially affecting consumer purchasing power.

- Supply chain disruptions and their impact on production: Global supply chain disruptions continued to hamper Tesla's production capabilities, limiting output and impacting revenue generation.

- Competition from other EV manufacturers: The electric vehicle market is becoming increasingly competitive. New entrants and established automakers are stepping up their game, impacting Tesla's market share.

- Shift in consumer demand: Changes in consumer preferences, influenced by economic conditions and availability, may have also affected Tesla's sales figures.

Investor Sentiment and Tesla's Stock Price Fluctuations

A direct correlation exists between Musk’s political actions and Tesla's stock price volatility. Investor confidence is fragile and sensitive to negative news.

- Stock price changes following significant political statements: Analysis of Tesla's stock price reveals noticeable fluctuations following Musk's high-profile political statements or controversies.

- Analyst reports reflecting investor sentiment: Financial analysts' reports frequently reflect concerns about the potential negative impact of Musk's political involvement on Tesla's long-term prospects, impacting investor sentiment.

- Changes in trading volume: Periods of heightened political activity involving Musk often correlate with increased trading volume in Tesla stock, signifying investor reaction and uncertainty.

- Impact on long-term investment strategies: The uncertainty surrounding Musk's political activities introduces risk, leading some investors to reconsider their long-term investment strategies in Tesla.

Separating Musk's Personal Brand from Tesla's Business Performance

The challenge lies in disentangling Musk's personal brand from Tesla's corporate identity. To what extent is Tesla's success inextricably linked to its CEO's public image?

- Arguments for and against the inseparability of Musk and Tesla: While some argue that Musk's persona is integral to Tesla's brand, others believe that Tesla can, and should, strive to establish a distinct identity separate from its CEO's often controversial actions.

- Potential PR strategies for damage control: Implementing proactive PR strategies focused on highlighting Tesla’s technological advancements and environmental commitment could help mitigate the negative impact of Musk’s political controversies.

- Diversification strategies to reduce reliance on Musk's image: Tesla may benefit from diversification strategies to lessen its dependence on Musk’s public image, focusing on its products and technological innovation.

Conclusion: Understanding the Complex Relationship Between Musk's Politics and Tesla's Profits

The Q1 profit decline at Tesla is multifaceted, a result of both macroeconomic factors and the complexities of Musk's public persona. While the economic climate undoubtedly played a significant role, the potential negative impact of Musk’s political involvement on brand perception, investor confidence, and ultimately, the Tesla stock price, cannot be ignored. Separating Musk's personal brand from Tesla's long-term success remains a crucial challenge. To fully understand the impact of political involvement on Tesla future, continuous monitoring of both the political landscape and Tesla's financial performance is essential. Stay tuned for further analysis of Tesla's performance and the ongoing impact of Elon Musk influence on the future of the electric vehicle giant, and the broader EV market trends.

Featured Posts

-

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 24, 2025

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 24, 2025 -

Hield And Paytons Bench Heroics Lead Warriors To Victory Over Blazers

Apr 24, 2025

Hield And Paytons Bench Heroics Lead Warriors To Victory Over Blazers

Apr 24, 2025 -

Harvard Lawsuit Vs Trump Administration Potential For Negotiation

Apr 24, 2025

Harvard Lawsuit Vs Trump Administration Potential For Negotiation

Apr 24, 2025 -

Should You Vote Liberal William Watson Examines The Party Platform

Apr 24, 2025

Should You Vote Liberal William Watson Examines The Party Platform

Apr 24, 2025 -

Sharp Drop In Teslas Q1 Earnings Musks Role And Market Reaction

Apr 24, 2025

Sharp Drop In Teslas Q1 Earnings Musks Role And Market Reaction

Apr 24, 2025