Sharp Drop In Tesla's Q1 Earnings: Musk's Role And Market Reaction

Table of Contents

Reasons Behind the Sharp Decline in Tesla Q1 Earnings

Tesla's disappointing Q1 earnings can be attributed to a complex interplay of factors. Understanding these factors is crucial for assessing the company's future performance and the overall health of the electric vehicle (EV) market.

Price Cuts and Reduced Margins

Tesla's aggressive price cuts across its vehicle lineup significantly impacted its profit margins. The company implemented substantial reductions to maintain market share and compete in an increasingly crowded EV landscape. While this strategy boosted sales volume in the short-term, it came at the cost of profitability.

- Significant price reductions across all vehicle lines: Reductions ranged from a few percentage points to a much more significant percentage, depending on the model and region.

- Impact on gross margin percentage: The aggressive price cuts directly translated into a lower gross margin percentage compared to previous quarters.

- Comparison to competitor pricing strategies: Tesla's pricing strategy contrasted with competitors who maintained higher prices, sometimes at the cost of sales volume.

- Analysis of the effect on sales volume: While sales volume increased due to lower prices, the impact on overall profitability was negative for the quarter. The long-term effects on brand perception are yet to be fully determined.

Increased Production Costs and Supply Chain Issues

Rising raw material costs, particularly for lithium and nickel – essential components in EV batteries – significantly increased Tesla's production expenses during Q1. Furthermore, ongoing supply chain disruptions exacerbated these challenges, leading to production delays and increased logistics costs.

- Rising costs of battery components: The price of lithium and nickel fluctuated significantly throughout the quarter, impacting the overall cost of battery production.

- Impact of global supply chain bottlenecks: Delays in sourcing key components resulted in production slowdowns and increased inventory costs.

- Challenges in securing raw materials: Competition for raw materials among EV manufacturers intensified, making it more difficult and expensive for Tesla to secure sufficient supplies.

- Increased logistics and transportation expenses: Global shipping costs and logistical complications contributed to higher overall production costs.

Impact of Macroeconomic Factors

The global economic slowdown and persistent inflation played a significant role in dampening consumer demand for luxury EVs. Rising interest rates further reduced consumer purchasing power, making it more expensive to finance large purchases like Tesla vehicles. Geopolitical instability also added uncertainty to the market.

- Decreased consumer spending due to inflation: High inflation rates eroded consumer disposable income, affecting demand for luxury goods like Tesla vehicles.

- Impact of rising interest rates on financing options: Higher interest rates increased borrowing costs, reducing affordability for potential Tesla buyers relying on financing.

- Geopolitical risks affecting production and sales: Global political tensions and regional conflicts disrupted supply chains and impacted consumer confidence.

- Weakening consumer confidence: Overall economic uncertainty affected consumer confidence, leading to delayed or canceled purchases of big-ticket items.

Elon Musk's Role in the Earnings Decline

Elon Musk's leadership and involvement in other ventures, notably Twitter, also played a role in the Q1 earnings decline. His actions and public statements influenced investor sentiment and potentially diverted attention and resources from Tesla's core business.

Leadership Decisions and Their Consequences

Musk's significant time commitment to Twitter raised concerns about his focus on Tesla's operations. His public pronouncements and actions also impacted investor confidence, leading to market volatility.

- Time commitment to other ventures: Musk's involvement with Twitter and other projects raised concerns about potential conflicts of interest and insufficient attention to Tesla's management.

- Impact of public pronouncements on investor confidence: Musk's often controversial public statements created uncertainty and negatively influenced investor sentiment.

- Effectiveness of executive management during crisis: Questions arose regarding the effectiveness of Tesla's executive management in navigating the challenges faced during Q1.

- Analysis of strategic decision-making: The effectiveness of Tesla's strategic decision-making during a challenging period warrants further scrutiny.

Market Reaction to Tesla's Q1 Earnings

Tesla's Q1 earnings announcement triggered a significant market reaction, marked by stock price fluctuations and shifts in investor sentiment.

Stock Price Fluctuations and Investor Sentiment

The immediate impact of the earnings report on Tesla's stock price was substantial. Investor sentiment turned negative, leading to a sell-off.

- Percentage change in Tesla's stock price: The stock price experienced a significant drop following the Q1 earnings announcement.

- Investor reaction and sell-off: Many investors reacted negatively, leading to substantial selling pressure.

- Analyst ratings and predictions: Financial analysts revised their ratings and predictions for Tesla's future performance.

- Comparison to other EV company performance: Tesla's performance was compared to other major EV companies, highlighting the relative impact of the earnings decline.

Long-Term Implications for Tesla

The long-term implications of Tesla's Q1 earnings are yet to be fully determined. The company's strategic response to the challenges will be critical in shaping its future.

- Long-term effects on company valuation: The Q1 results undoubtedly impacted Tesla's overall valuation in the long term.

- Potential impact on future innovation and expansion: The financial challenges could impact Tesla's plans for future innovation and expansion.

- Tesla's strategies to recover: Tesla needs to implement effective strategies to recover from the Q1 downturn and regain investor confidence.

- Industry-wide implications: Tesla's performance reflects broader challenges and opportunities within the EV industry.

Conclusion

Tesla's sharp drop in Q1 earnings highlights a confluence of factors, including aggressive price cuts, rising production costs, macroeconomic headwinds, and the impact of Elon Musk's leadership. The market reacted swiftly, with the stock price experiencing significant fluctuations. Understanding the reasons behind this decline is crucial for investors and industry analysts alike. To stay informed on the future of Tesla and the evolving electric vehicle market, continue monitoring news and analysis regarding Tesla Q1 earnings and future financial reports. Closely observing Tesla's strategic responses to these challenges will be key in assessing the company's long-term prospects.

Featured Posts

-

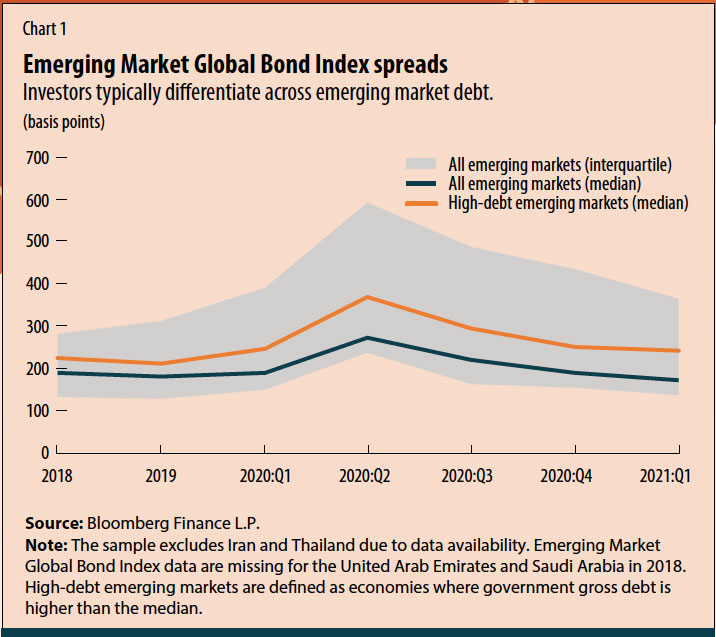

Us Market Decline Vs Emerging Market Gains Investment Analysis

Apr 24, 2025

Us Market Decline Vs Emerging Market Gains Investment Analysis

Apr 24, 2025 -

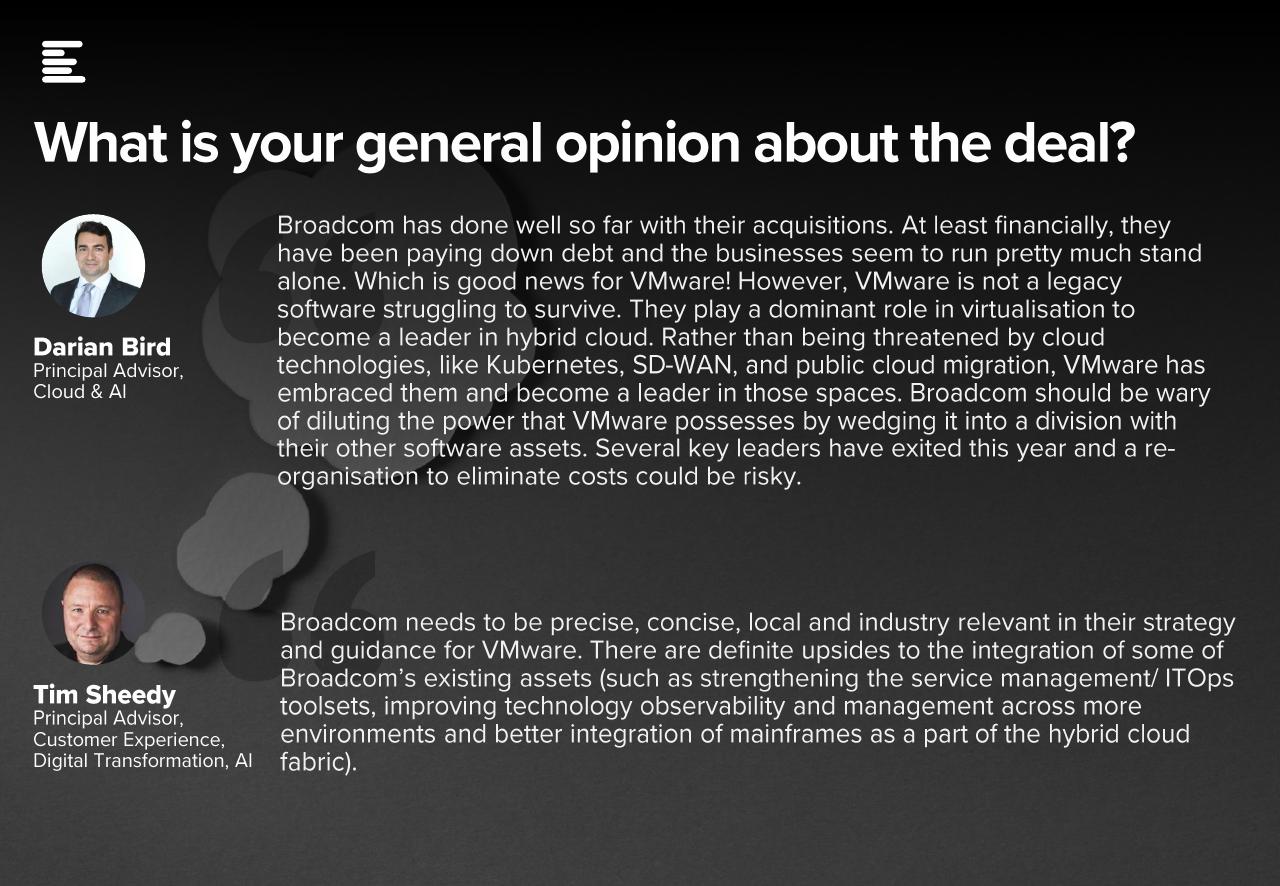

At And T Exposes Extreme Cost Increase In Broadcoms V Mware Proposal

Apr 24, 2025

At And T Exposes Extreme Cost Increase In Broadcoms V Mware Proposal

Apr 24, 2025 -

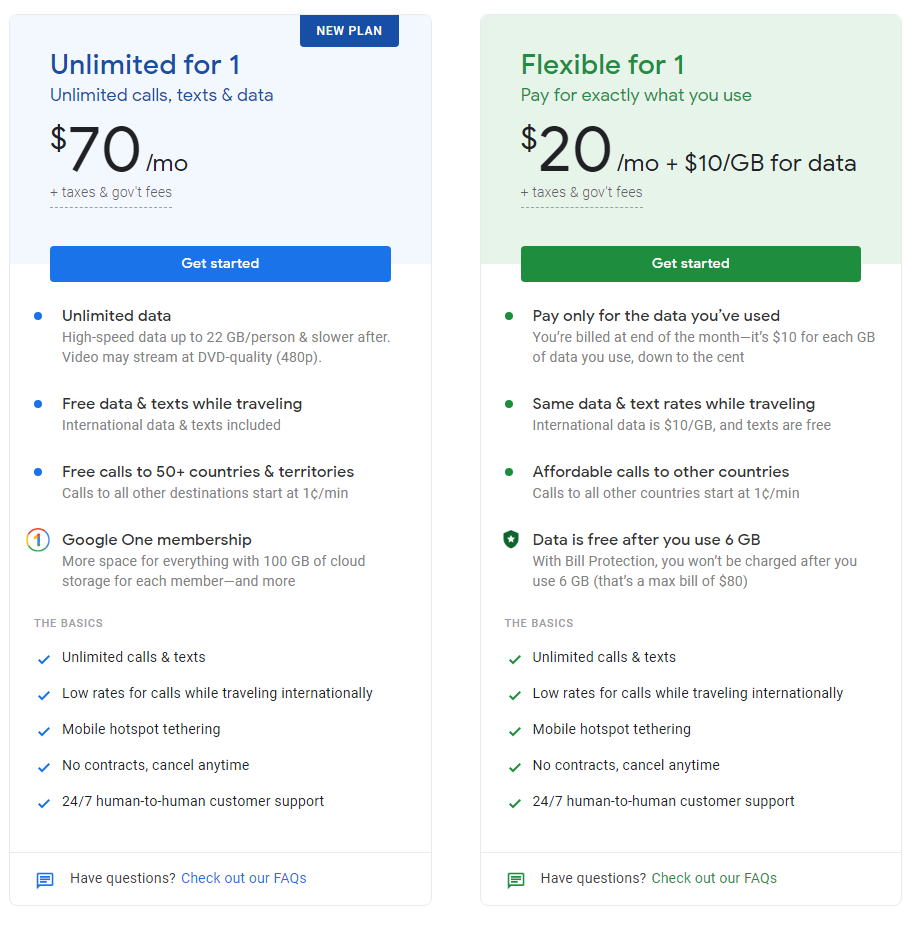

Understanding Google Fis New 35 Month Unlimited Plan

Apr 24, 2025

Understanding Google Fis New 35 Month Unlimited Plan

Apr 24, 2025 -

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025 -

Ella Travolta Kci Johna Travolte Rast I Ljepota

Apr 24, 2025

Ella Travolta Kci Johna Travolte Rast I Ljepota

Apr 24, 2025