The Impact Of X's Debt Sale On Its Financial Future

Table of Contents

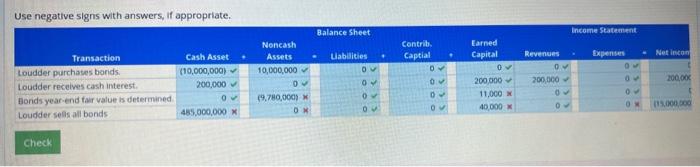

Immediate Financial Implications of Acme Corp's Debt Sale

Improved Debt-to-Equity Ratio

Acme Corp's debt sale significantly improves its debt-to-equity ratio. This crucial financial metric reflects the company's leverage. By reducing its debt burden, Acme Corp lowers its financial risk and enhances its creditworthiness.

- Improved ratios: The debt-to-equity ratio is projected to decrease from 1.5 to 1.0, a substantial improvement showcasing a healthier financial structure.

- Benefits for future borrowing: A lower debt-to-equity ratio makes it easier for Acme Corp to secure loans at more favorable interest rates in the future.

- Impact on investor confidence: Improved ratios boost investor confidence, making Acme Corp's stock more attractive.

Increased Liquidity and Cash Flow

The proceeds from Acme Corp's debt sale have substantially increased its liquidity and cash flow. This improved short-term financial position provides greater flexibility and opportunities.

- Immediate uses of funds: Acme Corp plans to utilize the funds to pay down high-interest debt, invest in operational efficiency upgrades, and explore promising new market opportunities.

- Potential for increased profitability: Improved operational efficiency and strategic investments driven by increased cash flow are likely to translate into higher profitability in the coming quarters.

Potential Dilution of Ownership

Acme Corp's debt sale did not involve issuing new equity; therefore, there was no dilution of ownership for existing shareholders. This is a significant positive for current investors, maintaining their proportional stake in the company.

- No percentage dilution: The capital raised came solely from debt reduction strategies, leaving the ownership structure unchanged.

- No impact on earnings per share (EPS): The absence of equity dilution means no negative impact on earnings per share.

- Positive shareholder reaction: The market reacted favorably to the news of the debt sale, reflecting confidence in the strategy and lack of dilution.

Long-Term Strategic Implications of Acme Corp's Debt Sale

Investment in Growth and Innovation

The increased liquidity resulting from the debt sale allows Acme Corp to invest strategically in growth and innovation. This promises long-term benefits for the company.

- Specific investments planned: Acme Corp plans to invest heavily in R&D for its next-generation products, aiming to strengthen its market position and expand into new markets.

- Potential market share growth: These investments are projected to lead to a significant increase in market share over the next five years.

- Long-term revenue increase projections: The company forecasts substantial revenue growth, fueled by innovation and expansion into new markets.

Reduced Financial Risk and Improved Stability

Lower debt levels significantly reduce Acme Corp's financial risk and enhance its long-term stability, making it more resilient to economic downturns.

- Reduced interest payments: The lower debt burden translates into significantly reduced interest payments, freeing up capital for other strategic initiatives.

- Improved resilience to economic downturns: A stronger financial position makes Acme Corp better equipped to withstand economic fluctuations and potential market disruptions.

- Increased creditworthiness: The improved financial health will lead to an even better credit rating, further facilitating future financing opportunities.

Potential Risks and Challenges

While the debt sale presents significant opportunities, Acme Corp faces potential challenges. Effective risk management is crucial for successful execution of the strategy.

- Risks related to specific investments: Market changes could impact the return on investment for specific projects. Meticulous due diligence is essential.

- Potential impact of economic fluctuations: Unexpected economic downturns could impact revenue and profitability, making it crucial to maintain financial flexibility.

- Contingency plans: Acme Corp has established contingency plans to address potential setbacks and adjust its strategies as needed.

Market Reaction and Investor Sentiment

Stock Price Performance

Acme Corp's stock price initially experienced a positive reaction following the announcement of the debt sale, reflecting investor confidence in the strategy. Long-term performance will depend on the successful execution of the planned investments.

- Short-term volatility: While the initial reaction was positive, some short-term volatility is expected as the market absorbs the news.

- Long-term price trends: Analysts predict a positive long-term trend, contingent on the success of Acme Corp's strategic initiatives.

- Investor reaction and analysis: Early investor reaction is largely favorable, viewing the debt sale as a strategic move that enhances the company's financial health.

Credit Rating Agencies' Assessment

Major credit rating agencies have responded positively to Acme Corp's debt sale, anticipating a potential upgrade in the company's credit rating in the near future.

- Changes in credit rating: While not immediate, an upgrade is expected due to the improved financial metrics.

- Impact on future borrowing costs: A higher credit rating will translate into lower borrowing costs in the future, enhancing the company's financial flexibility.

- Investor confidence: The potential credit rating upgrade further strengthens investor confidence in Acme Corp’s financial health and stability.

Analyst Opinions and Predictions

Financial analysts have generally expressed positive views on Acme Corp's debt sale strategy, anticipating long-term benefits for the company and its shareholders.

- Key arguments for the strategy: Analysts highlight the improved debt-to-equity ratio, increased liquidity, and potential for increased profitability as key benefits.

- Consensus predictions for Acme Corp's financial future: The consensus points toward a positive outlook for Acme Corp’s financial future, driven by its strengthened financial position and strategic investments.

Conclusion: Assessing the Long-Term Effects of Acme Corp's Debt Sale

Acme Corp's debt sale represents a significant strategic move with potentially substantial long-term benefits. While short-term gains are evident in improved liquidity and financial ratios, the ultimate success will hinge on the effective implementation of its growth and innovation plans. The positive market reaction and favorable analyst opinions suggest confidence in the strategy. However, the company must remain vigilant about potential risks and adapt its approach as needed. Keep an eye on Acme Corp's financial statements to further analyze the long-term impact of this debt sale on its financial future and understand how debt management contributes to its overall success.

Featured Posts

-

Abwzby Mntda Alabtkar Fy Mjal Alelaj Wtb Alhyat Alshyt Almdydt

Apr 28, 2025

Abwzby Mntda Alabtkar Fy Mjal Alelaj Wtb Alhyat Alshyt Almdydt

Apr 28, 2025 -

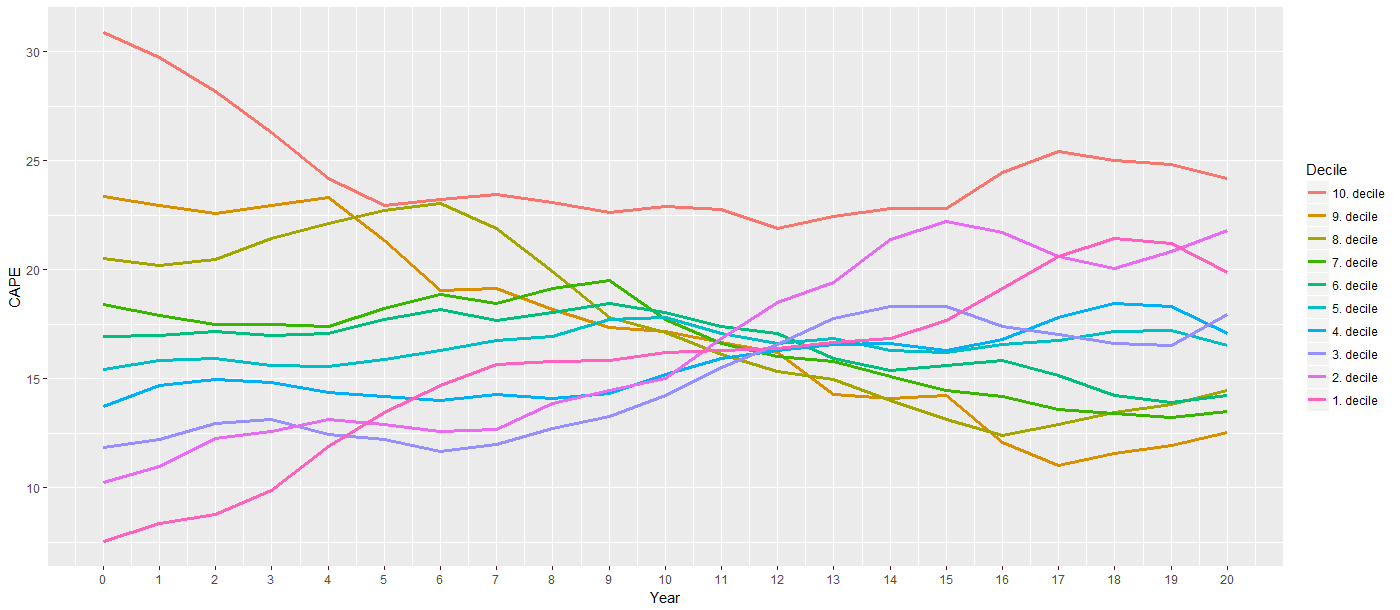

Addressing High Stock Market Valuations Bof As View

Apr 28, 2025

Addressing High Stock Market Valuations Bof As View

Apr 28, 2025 -

Federal Trade Commission Appeals Ruling Allowing Microsoft Activision Merger

Apr 28, 2025

Federal Trade Commission Appeals Ruling Allowing Microsoft Activision Merger

Apr 28, 2025 -

Blue Jays Vs Red Sox Complete Lineups And Buehlers Return

Apr 28, 2025

Blue Jays Vs Red Sox Complete Lineups And Buehlers Return

Apr 28, 2025 -

Unstoppable A Mets Rivals Starting Pitcher

Apr 28, 2025

Unstoppable A Mets Rivals Starting Pitcher

Apr 28, 2025