The Recent Market Dip: A Case Study Of Professional Vs. Individual Investor Behavior

Table of Contents

The recent market dip has sent shockwaves through the financial world, highlighting the stark contrast between how professional and individual investors react to volatility. This case study will analyze the distinct behavioral patterns observed during this downturn, exploring the strategies employed and the resulting outcomes for each group. Understanding these differences is crucial for navigating future market fluctuations and making informed investment decisions. This analysis will help you better understand how to protect your investments during a market dip.

<h2>Professional Investor Response to the Market Dip</h2>

Professional investors, with their access to sophisticated tools and years of experience, typically demonstrate a more measured and strategic response to market dips. Their actions often differ significantly from those of individual investors, leading to vastly different outcomes.

<h3>Strategic Asset Allocation Adjustments</h3>

Professionals often employ sophisticated models and diversification strategies designed to weather market storms. Their approach involves proactive adjustments to their asset allocation based on changing market conditions.

- Reduced exposure to high-risk assets: During a market dip, professional investors often reduce their holdings in high-risk assets like technology stocks, which are often more volatile and susceptible to significant price swings.

- Increased allocation to safer havens: They increase their allocation to safer haven assets, such as government bonds and gold, which are considered less volatile and often hold their value during market downturns. This is a classic defensive strategy during a market correction.

- Utilized hedging strategies: Sophisticated hedging strategies, such as using derivatives, are often employed to mitigate potential losses and protect existing investments.

Detail: For example, many large institutional investors, according to reports from Bloomberg and the Financial Times, shifted significant portions of their portfolios from growth stocks to more defensive sectors like consumer staples and utilities during the recent downturn. This strategic reallocation helped cushion the impact of the market dip.

<h3>Disciplined Risk Management</h3>

Professional investors prioritize risk management above short-term gains. Their approach emphasizes a long-term perspective and adherence to pre-defined risk parameters.

- Maintaining a long-term investment horizon: Professionals understand that market dips are a normal part of the investment cycle and focus on the long-term growth potential of their investments.

- Sticking to pre-defined risk tolerance levels: They adhere to pre-defined risk tolerance levels established in line with their client’s objectives and constraints, avoiding impulsive decisions driven by short-term market fluctuations.

- Employing stop-loss orders: Stop-loss orders are frequently utilized to automatically sell assets when they reach a predetermined price, limiting potential losses.

Detail: Professional risk management involves sophisticated quantitative analysis and the use of advanced risk models to assess and mitigate potential downside risks. This contrasts sharply with many individual investors who lack these resources.

<h2>Individual Investor Behavior During the Market Dip</h2>

Individual investors, lacking the experience and resources of professionals, often react to market dips with emotion rather than a strategic approach. This can lead to poor decisions and potentially significant losses.

<h3>Emotional Reactions and Panic Selling</h3>

Individual investors are often susceptible to emotional decision-making, particularly during market downturns. Fear and panic can lead to impulsive actions that exacerbate losses.

- Increased susceptibility to fear and panic: During market dips, fear and uncertainty can lead to panicked selling of assets.

- Selling assets at a loss: This selling often occurs at precisely the wrong time, locking in losses and missing out on future potential gains.

- Following market trends impulsively: Investors may impulsively follow trends based on fear without proper analysis of their personal portfolios.

Detail: Behavioral finance research extensively documents the psychological biases that influence individual investor behavior during market volatility. Fear of missing out (FOMO) and herd behavior play significant roles in driving poor decision-making.

<h3>Lack of Diversification and Risk Management</h3>

Many individual investors lack the expertise and resources necessary for effective diversification and risk management. This increases their vulnerability during market dips.

- Over-concentration in specific sectors or stocks: A lack of diversification increases the impact of negative events within specific sectors.

- Inadequate understanding of risk tolerance: Many investors don’t fully understand their risk tolerance or how it should guide their investment choices.

- Limited access to sophisticated investment tools: Individual investors often lack access to the sophisticated tools and strategies used by professionals.

Detail: Proper diversification and a realistic assessment of risk tolerance are crucial for managing portfolio volatility during market corrections.

<h3>Impact of Social Media and News</h3>

Social media and news cycles can significantly influence individual investor behavior during market dips, often exacerbating fear and uncertainty.

- Amplification of fear and uncertainty: Online platforms can amplify fear and uncertainty, creating a contagious sense of panic.

- Susceptibility to misinformation and market rumors: Unverified information and rumors spread rapidly online, influencing investment decisions.

- Herding behavior based on perceived trends: Individual investors often engage in herding behavior, mimicking the actions of others without proper due diligence.

Detail: The rapid spread of misinformation on social media platforms can significantly amplify panic selling during a market dip.

<h2>Key Differences and Lessons Learned</h2>

The recent market dip starkly highlights the differences between professional and individual investor approaches. Professionals demonstrate a disciplined, long-term approach, while many individual investors react emotionally, leading to potentially costly mistakes.

- Comparison of approaches and outcomes: Professionals’ strategic asset allocation and disciplined risk management generally led to better outcomes compared to the emotional responses of many individual investors.

- Importance of financial literacy: Financial literacy and education are essential for making informed investment decisions.

- Long-term strategy and sound risk management: A long-term investment strategy based on sound risk management principles is paramount.

Detail: Individual investors should strive to improve their financial literacy, diversify their portfolios, develop a well-defined risk tolerance, and consider seeking professional financial advice.

<h2>Conclusion</h2>

The recent market dip serves as a powerful case study illustrating the contrasting behaviors of professional and individual investors. Professionals, with their disciplined approach to risk management and strategic asset allocation, generally weathered the storm more effectively. Individual investors, on the other hand, often succumbed to emotional responses, leading to potentially significant losses. Understanding these differences is crucial for navigating future market dips. To effectively manage your investments during periods of market volatility, prioritize financial literacy, diversify your portfolio, develop a long-term investment strategy, and consider seeking professional advice. Don’t let future market dips catch you unprepared; learn from this case study and implement a robust investment plan that protects your capital and maximizes your returns. Prepare for the next market dip by taking control of your investment strategy.

Featured Posts

-

Abwzby Tstdyf Fn Abwzby Abtdae Mn 19 Nwfmbr

Apr 28, 2025

Abwzby Tstdyf Fn Abwzby Abtdae Mn 19 Nwfmbr

Apr 28, 2025 -

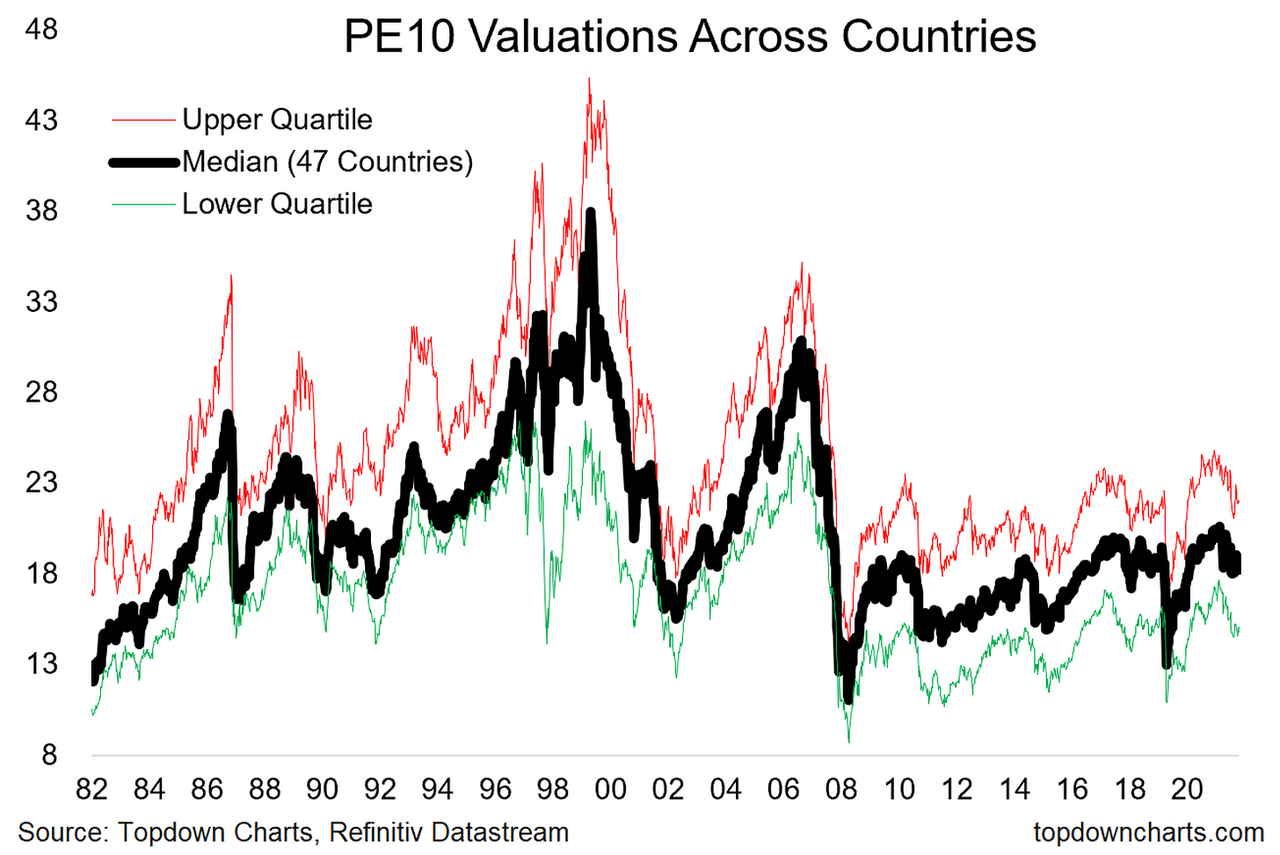

Bof As Take Are High Stock Market Valuations Cause For Concern

Apr 28, 2025

Bof As Take Are High Stock Market Valuations Cause For Concern

Apr 28, 2025 -

Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela Red Sox Injury Report

Apr 28, 2025

Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela Red Sox Injury Report

Apr 28, 2025 -

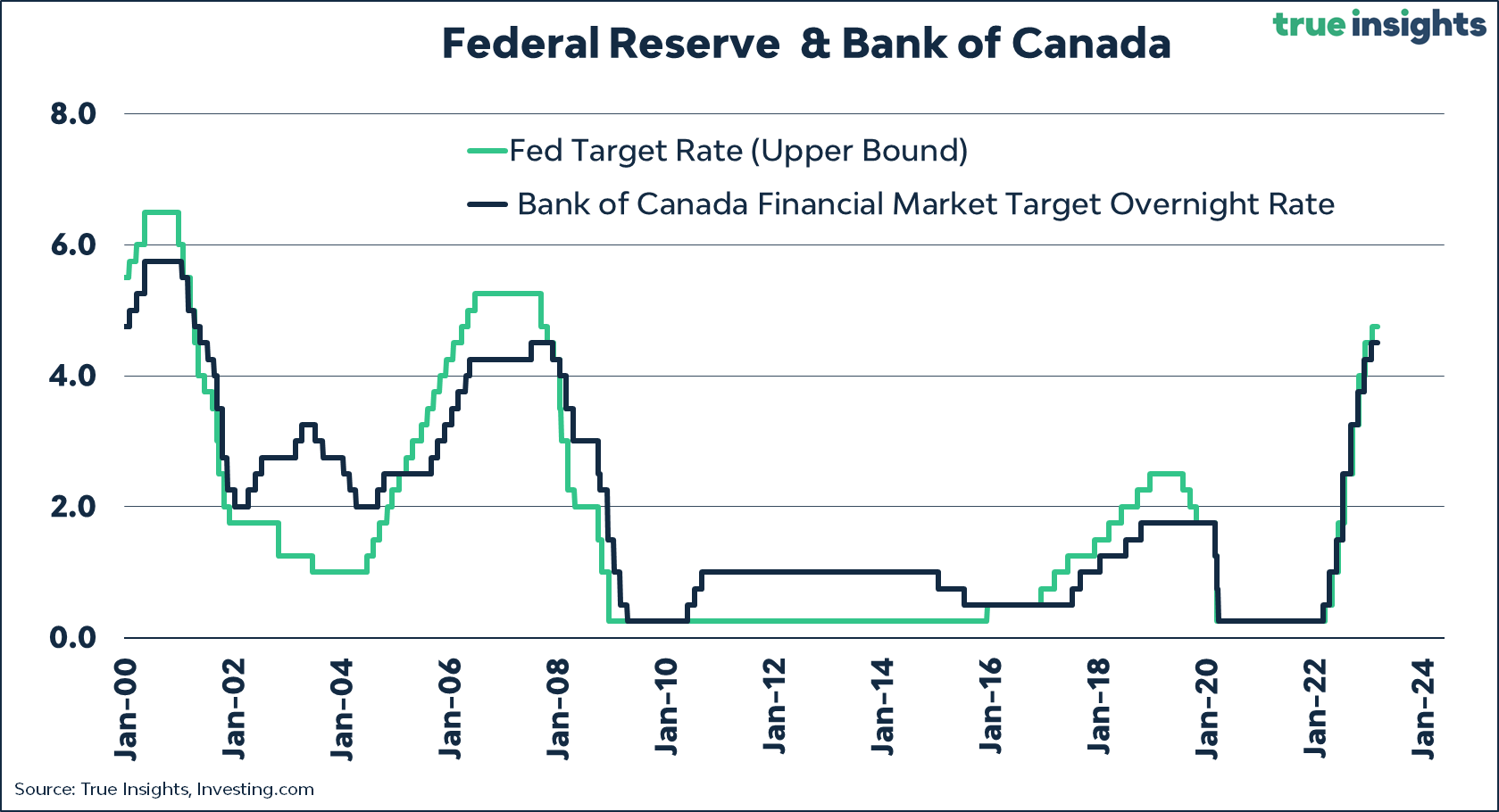

Grim Retail Sales Data Pressure Mounts On Bank Of Canada To Cut Rates

Apr 28, 2025

Grim Retail Sales Data Pressure Mounts On Bank Of Canada To Cut Rates

Apr 28, 2025 -

Brnamj Fealyat Fn Abwzby 19 Nwfmbr

Apr 28, 2025

Brnamj Fealyat Fn Abwzby 19 Nwfmbr

Apr 28, 2025