The U.S. Dollar And The First 100 Days: A Nixon-Era Parallel?

Table of Contents

Nixon's Shock: Closing the Gold Window and its Immediate Impact

In August 1971, President Nixon's momentous decision to close the gold window—ending the Bretton Woods system's convertibility of the U.S. dollar to gold—sent shockwaves through the global financial system. This unilateral action effectively devalued the U.S. dollar, ushering in an era of floating exchange rates. The immediate consequences were far-reaching and continue to shape the international monetary landscape today.

- Impact on the Global Monetary System: The collapse of the fixed exchange rate system created significant uncertainty. Currencies began to fluctuate wildly, impacting international trade and investment.

- Short-term and Long-term Consequences: The short-term effects included increased inflation in the U.S. and a decline in the dollar's value against other major currencies. Long-term, it led to a shift in global power dynamics, with the U.S. losing some of its economic dominance.

- Bullet Points:

- Increased inflation, impacting consumer prices and purchasing power.

- Significant changes in international trade dynamics, as exchange rate fluctuations made imports and exports more unpredictable.

- A shift in global power dynamics, as other countries gained greater economic influence.

Economic Policies of the Biden Administration: A Comparative Analysis

The Biden administration's economic policies have focused on addressing several key challenges, including the COVID-19 pandemic's economic fallout, income inequality, and climate change. These initiatives, while vastly different in their specifics from Nixon's actions, share some common threads when it comes to their impact on the U.S. dollar.

- Monetary Policy: The Federal Reserve's actions under Biden, including interest rate adjustments and quantitative easing, directly influence the dollar's value. These policies aim for stable growth and low inflation, a contrast to the inflationary pressures seen under Nixon.

- Trade Deals and International Relations: The Biden administration's approach to international trade differs markedly from Nixon's protectionist tendencies. However, trade disputes and shifts in global supply chains inevitably impact the dollar's value.

- Bullet Points:

- The American Rescue Plan's massive stimulus spending increased the money supply, potentially impacting inflation and the dollar's value.

- Negotiations around new trade deals could strengthen or weaken the dollar's position in global markets.

- A comparison reveals differing approaches to managing international economic relations, impacting the U.S. dollar's role in the global economy.

The Role of Geopolitical Factors: Then and Now

Nixon's decision to close the gold window was heavily influenced by the Vietnam War and the Cold War's economic pressures. The U.S. was facing a balance of payments deficit, and the gold standard was becoming unsustainable. Today, the geopolitical landscape presents different yet equally significant challenges to the U.S. dollar's stability.

- Geopolitical Context: The rise of China, ongoing tensions with Russia, and global uncertainties create new pressure points impacting the U.S. dollar's role as a reserve currency.

- International Pressures: Both administrations faced external pressures, but the nature of those pressures has shifted significantly. Nixon faced challenges largely from within the existing Bretton Woods system; Biden faces challenges from the rise of multipolarity and competing economic powers.

- Bullet Points:

- Key international events like the Ukraine conflict and the ongoing trade war with China impact investor confidence and the dollar's value.

- The influence of global power dynamics on the U.S. dollar is undeniable. The shift away from U.S. dollar dominance is a growing concern.

- The response of both administrations to external pressures reflects their respective economic philosophies and priorities.

The U.S. Dollar's Value and Global Confidence: Measuring Success and Failure

Measuring the success or failure of economic policies impacting the U.S. dollar requires examining several key metrics. Both Nixon's and Biden's administrations can be judged by their impact on these indicators.

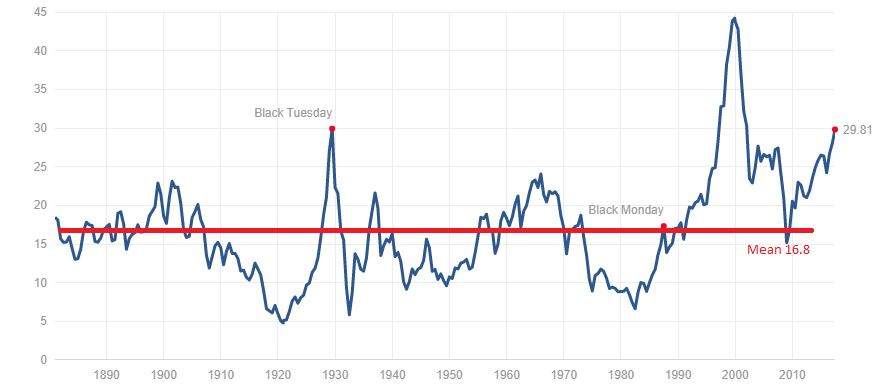

- Exchange Rates: The dollar's value relative to other major currencies (euro, yen, pound) provides a clear indication of its strength or weakness.

- Inflation Rates: High inflation erodes the dollar's purchasing power and negatively affects its global standing.

- Economic Growth: Sustained economic growth generally supports a strong dollar.

- Global Market Confidence: Investor confidence and the demand for U.S. Treasury bonds are crucial indicators of global trust in the dollar.

- Bullet Points:

- Analyzing exchange rates reveals shifts in the dollar's value during both periods.

- Inflation rates under both administrations offer insights into their success in managing monetary policy.

- Comparing economic growth indicators shows the overall impact on the U.S. economy and the dollar's strength.

- Analyzing global market confidence reveals shifts in investor sentiment towards the U.S. dollar.

Conclusion: Lessons Learned and Future Outlook for the U.S. Dollar

While the economic contexts differ significantly, both Nixon's and Biden's administrations faced challenges impacting the U.S. dollar's value and global standing. Nixon's shock therapy abruptly ended a fixed exchange rate system, while Biden's administration grapples with a more complex global economic landscape. Understanding these historical parallels is crucial for navigating current uncertainties.

The future of the U.S. dollar is intertwined with the success of current economic policies and the evolving geopolitical landscape. Staying informed about the ongoing developments surrounding the U.S. dollar and its implications for the global economy is vital. Further research into the history of the U.S. dollar, international monetary systems, and geopolitical economics is highly recommended for a deeper understanding of this crucial topic.

Featured Posts

-

The Mets Rotation Battle Pitchers Name S Prospects

Apr 28, 2025

The Mets Rotation Battle Pitchers Name S Prospects

Apr 28, 2025 -

Remembering 2000 Key Moments Featuring Joe Torre And Andy Pettitte

Apr 28, 2025

Remembering 2000 Key Moments Featuring Joe Torre And Andy Pettitte

Apr 28, 2025 -

Bubba Wallace Secures New Partnership With 23 Xi Racing

Apr 28, 2025

Bubba Wallace Secures New Partnership With 23 Xi Racing

Apr 28, 2025 -

Signs Your Silent Divorce Is Happening And What To Do

Apr 28, 2025

Signs Your Silent Divorce Is Happening And What To Do

Apr 28, 2025 -

High Stock Market Valuations Why Bof A Says Investors Shouldnt Worry

Apr 28, 2025

High Stock Market Valuations Why Bof A Says Investors Shouldnt Worry

Apr 28, 2025