Today's Stock Market Update: Dow Futures And China's Economic Response To Tariffs

Table of Contents

Dow Futures: A Current Snapshot

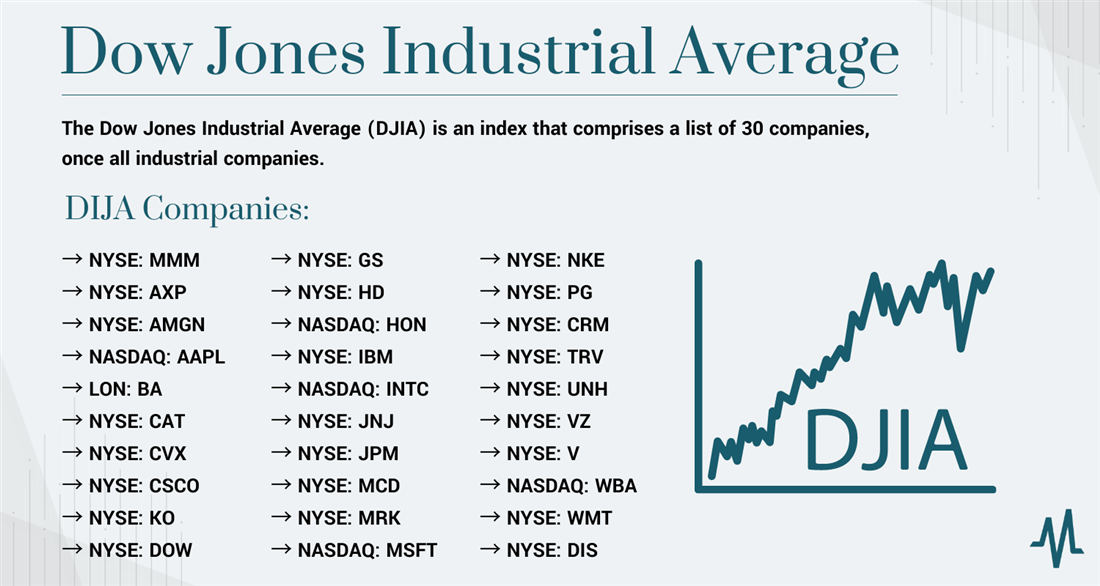

Dow futures, essentially contracts to buy or sell the Dow Jones Industrial Average at a future date, serve as a powerful predictor of overall market sentiment and performance. They offer investors a glimpse into the likely direction of the stock market before the official opening bell. Analyzing Dow futures is a vital tool for understanding the market's short-term trajectory and potential volatility.

Current Dow Futures Performance

As of [Insert Time and Date], Dow futures are showing a [Up/Down/Sideways] trend, with a change of [Specific Number] points. This represents a [Percentage] change compared to the previous closing. (Note: Replace bracketed information with the actual data at the time of publication). This movement reflects the current market sentiment regarding various economic and geopolitical factors.

Factors Influencing Dow Futures

Several interconnected factors contribute to the current movement in Dow futures:

-

Impact of recent interest rate announcements: The recent interest rate decision by the Federal Reserve [mention specific action, e.g., a rate hike or hold] has [explain its positive or negative impact on Dow futures and investor sentiment]. Higher rates generally impact borrowing costs for businesses and consumers.

-

Influence of corporate earnings reports: Recent earnings reports from key companies in the Dow Jones Industrial Average have [explain the overall effect – positive or negative] influenced investor confidence, leading to [describe the effect on Dow futures]. Strong earnings typically boost market optimism.

-

Effect of global uncertainty: Geopolitical events, such as [mention specific events like international conflicts or political instability], contribute to global uncertainty, creating volatility in Dow futures and prompting investors to seek safer havens. Uncertainty often leads to decreased investment and market correction.

China's Economic Response to Tariffs

China's response to ongoing trade tariffs has been multifaceted and continues to evolve. Understanding its strategies is key to predicting market movements.

Recent Countermeasures

China has implemented various countermeasures to mitigate the economic impact of tariffs. Recent actions include: [List specific actions, e.g., retaliatory tariffs on specific US goods, currency adjustments aimed at maintaining competitiveness, and increased investment in domestic infrastructure projects as stimulus]. These measures aim to offset the negative impacts on its economy.

Impact on Chinese Economy

The effects of these countermeasures on the Chinese economy are significant and far-reaching. While some sectors have experienced negative impacts, others show signs of resilience.

-

Impact on specific Chinese industries: Industries heavily reliant on exports to the US, such as [mention specific industries like agriculture or manufacturing], have faced considerable challenges due to the tariffs.

-

Changes in consumer spending: The trade war has impacted consumer confidence and spending patterns in China, leading to [explain the effect – reduced or increased spending]. This affects domestic market growth.

-

Foreign investment implications: The ongoing trade tensions have created uncertainty for foreign investors, impacting the inflow of foreign direct investment into China.

The Interplay Between Dow Futures and China's Response

The relationship between Dow futures and China's economic response to tariffs is complex and deeply intertwined. China's economic actions directly and indirectly influence the performance of Dow futures. Any significant shift in the Chinese economy ripples through the global market.

The interconnectedness of the global economy is clearly demonstrated in this situation. China's actions influence global supply chains, commodity prices, and investor confidence, all of which have a profound impact on US markets and, thus, Dow futures.

Investor Sentiment and Market Volatility

The uncertainty surrounding the trade war and China's response significantly impacts investor sentiment. This translates into increased market volatility.

-

Examples of how specific news affects investor behavior: Negative news regarding trade negotiations can trigger a sell-off in the stock market, leading to a decline in Dow futures. Conversely, positive developments can boost investor confidence and lead to a rally.

-

Discussion of risk assessment and hedging strategies: Investors are employing various risk assessment strategies and hedging techniques to protect their portfolios from the volatility caused by these interconnected global factors.

Conclusion

Today's stock market update highlights the significant interplay between fluctuating Dow futures and China's dynamic response to trade tariffs. China's countermeasures have created ripples throughout the global economy, significantly impacting investor sentiment and market volatility. Understanding this complex relationship is crucial for navigating the current investment landscape.

Stay tuned for tomorrow's stock market update for a continued analysis of Dow futures and China's economic response to tariffs. Understanding these market dynamics is crucial for successful investing. Regularly checking for updates on this evolving situation will allow you to make more informed investment decisions and better manage your portfolio's risk.

Featured Posts

-

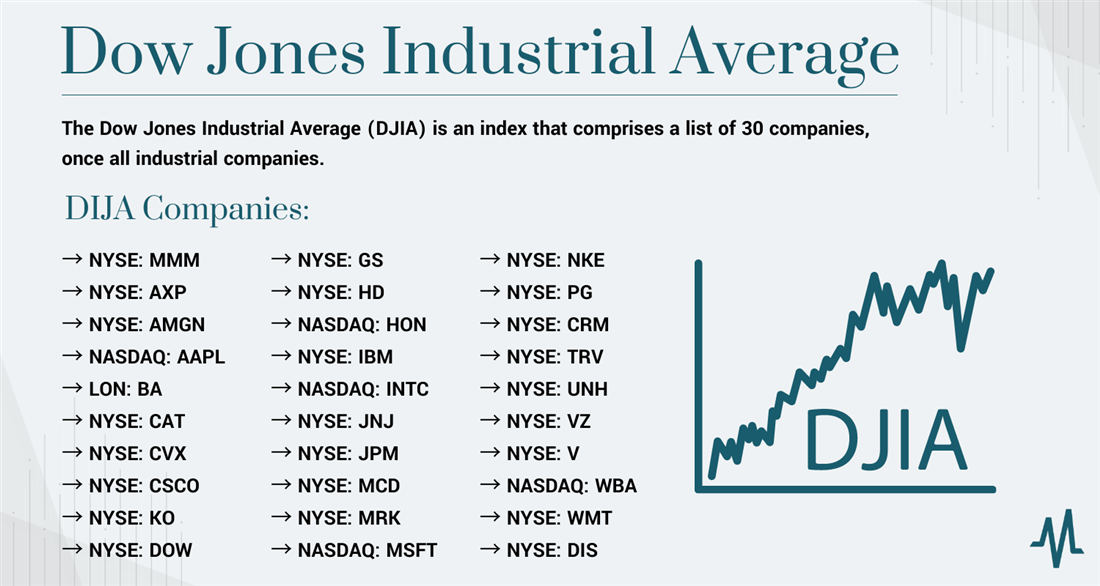

16 Million Fine For T Mobile Details On Three Years Of Data Breaches

Apr 26, 2025

16 Million Fine For T Mobile Details On Three Years Of Data Breaches

Apr 26, 2025 -

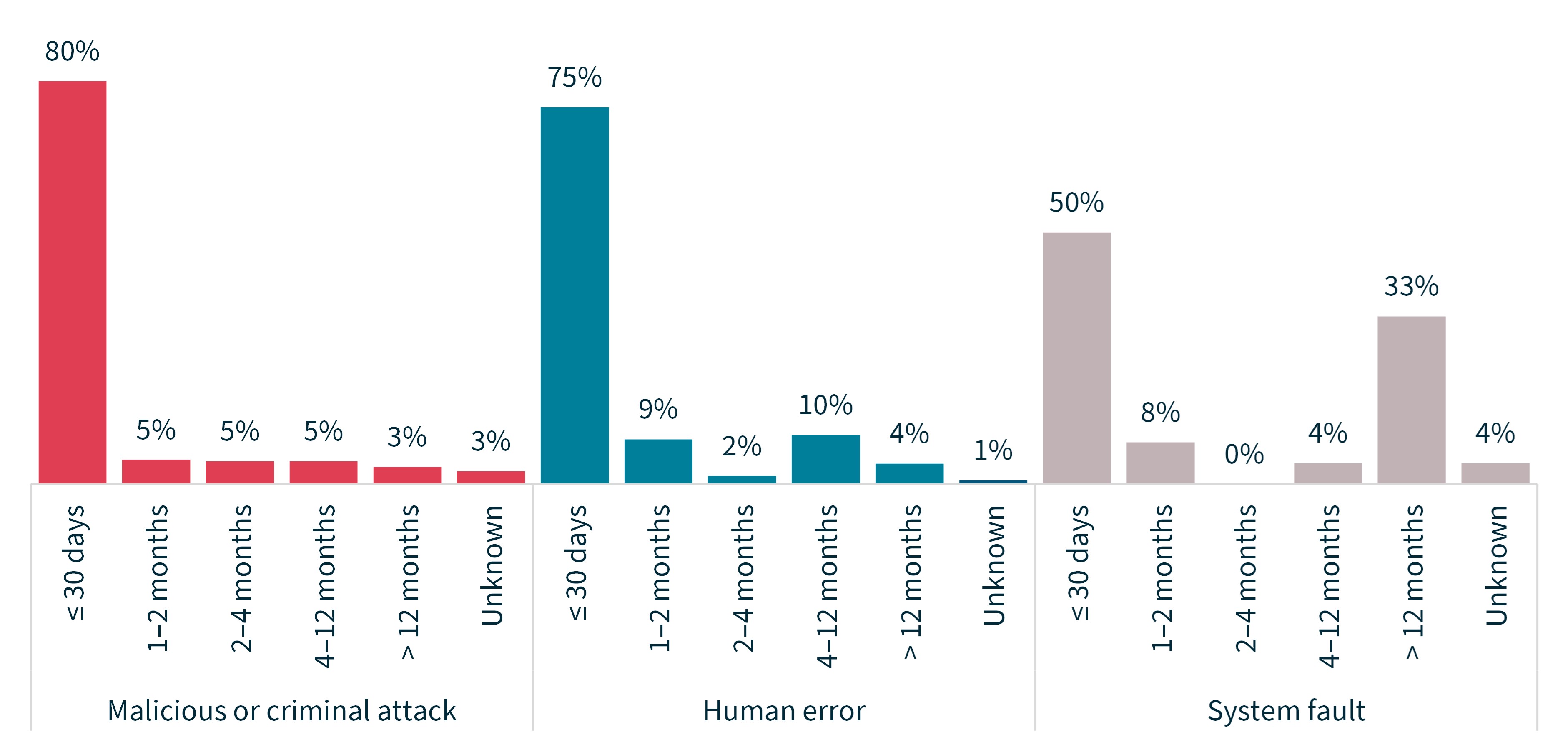

Abb Vie Abbv New Drugs Fuel Sales Beat Leading To Upgraded Profit Projections

Apr 26, 2025

Abb Vie Abbv New Drugs Fuel Sales Beat Leading To Upgraded Profit Projections

Apr 26, 2025 -

Double Trouble In Hollywood Writers And Actors Strikes Halt Production

Apr 26, 2025

Double Trouble In Hollywood Writers And Actors Strikes Halt Production

Apr 26, 2025 -

The Karen Read Case A Detailed Timeline Of Legal Proceedings

Apr 26, 2025

The Karen Read Case A Detailed Timeline Of Legal Proceedings

Apr 26, 2025 -

Ai Regulation Showdown Trump Administration Vs Europe

Apr 26, 2025

Ai Regulation Showdown Trump Administration Vs Europe

Apr 26, 2025