Trade War Fallout: China's LPG Sourcing Shifts To The Middle East

Table of Contents

The ongoing trade war has significantly impacted global energy markets, with China, the world's largest LPG importer, experiencing a major restructuring of its sourcing strategies. This article explores how the fallout from trade disputes has led to a considerable increase in China's LPG imports from the Middle East, altering established supply chains and impacting regional energy dynamics. We will examine the factors driving this shift, its implications for both China and the Middle East, and what the future holds for this crucial energy commodity.

Reduced US LPG Imports

Tariffs and Trade Tensions

US tariffs on Chinese goods triggered retaliatory measures, significantly impacting LPG imports. These tariffs increased the cost of US LPG in the Chinese market, making it less competitive compared to suppliers in the Middle East.

- Specific Tariff Impacts: Tariffs imposed on US LPG imports into China ranged from X% to Y%, leading to price increases of Z% on average. This rendered US LPG significantly more expensive than alternatives.

- Decreased Competitiveness: The added tariff burden substantially reduced the competitiveness of US LPG in the Chinese market, prompting Chinese buyers to seek alternative sources.

Diversification of Supply Chains

Facing increased costs and potential supply disruptions from the US, China implemented a strategy to diversify its LPG import sources. This move reduces reliance on a single supplier and enhances energy security.

- Advantages of Diversification: Diversified sourcing offers numerous advantages, including:

- Improved price negotiation power through competition among suppliers.

- Reduced vulnerability to geopolitical instability or supply shocks originating from a single source.

- Enhanced resilience against unexpected market fluctuations.

- Energy Security: Securing a reliable and diversified energy supply is crucial for China's continued economic growth and stability. The shift away from US LPG is a direct reflection of this strategic priority.

The Rise of Middle Eastern LPG Exports

Increased Capacity and Production

Middle Eastern LPG producers have significantly increased their production capacity, filling the void left by the reduced US imports to China.

- Major Exporters: Saudi Arabia, Qatar, and the UAE are among the major LPG exporters that have benefited from this shift, witnessing substantial increases in their exports to China.

- Production and Export Data: [Insert relevant data on increased production and export volumes from Middle Eastern countries to China, citing reliable sources].

Competitive Pricing and Proximity

Middle Eastern LPG suppliers offer competitive pricing and geographical advantages compared to their US counterparts.

- Shorter Shipping Distances: The shorter shipping distances from the Middle East to China translate to significantly reduced transportation costs and transit times, making Middle Eastern LPG more cost-effective.

- Long-Term Partnerships: The increased trade volume fosters the development of long-term contracts and strategic partnerships between China and Middle Eastern nations, securing reliable and stable energy supplies for China.

Implications for Global LPG Markets

Price Volatility and Market Share

China's shifting LPG import strategy has had a notable impact on global LPG prices and market share.

- Price Fluctuations: The increased demand from China has influenced LPG prices in both Asian and global markets, potentially causing price volatility. [Include data and analysis on price changes if available].

- Market Share Shifts: Middle Eastern LPG producers have gained significant market share, while the share of US LPG exports to China has correspondingly decreased.

Geopolitical Ramifications

The increased reliance on Middle Eastern energy resources has significant geopolitical implications.

- Strengthened Ties: China's increased LPG imports from the Middle East have strengthened economic and diplomatic ties between China and several Middle Eastern nations.

- Regional Power Dynamics: This shift alters regional power dynamics and strengthens China's influence in the Middle East, influencing global energy security and political landscapes.

Conclusion

The trade war fallout has fundamentally reshaped China's LPG import strategy, leading to a significant shift towards Middle Eastern suppliers. This realignment has created new opportunities for Middle Eastern producers while simultaneously impacting global LPG prices and geopolitical relationships. The diversification of China's energy sources demonstrates a broader trend of nations seeking to secure their energy supplies through multiple avenues.

Call to Action: To stay updated on the evolving dynamics of China's energy imports and the impact of global trade relations on LPG sourcing, continue following our analysis on China's LPG sourcing shifts and the Middle East's growing role in the global energy market. Stay informed about the latest developments in the ongoing impact of the trade war on China's LPG sourcing.

Featured Posts

-

Selling Sunset Star Calls Out La Landlord Price Gouging After Fires

Apr 24, 2025

Selling Sunset Star Calls Out La Landlord Price Gouging After Fires

Apr 24, 2025 -

Ted Lassos Revival Brett Goldsteins Resurrected Cat Analogy Explained

Apr 24, 2025

Ted Lassos Revival Brett Goldsteins Resurrected Cat Analogy Explained

Apr 24, 2025 -

Inside John Travoltas 3 Million Home A Look At The Recent Photo Incident

Apr 24, 2025

Inside John Travoltas 3 Million Home A Look At The Recent Photo Incident

Apr 24, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Capitol Attack

Apr 24, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Capitol Attack

Apr 24, 2025 -

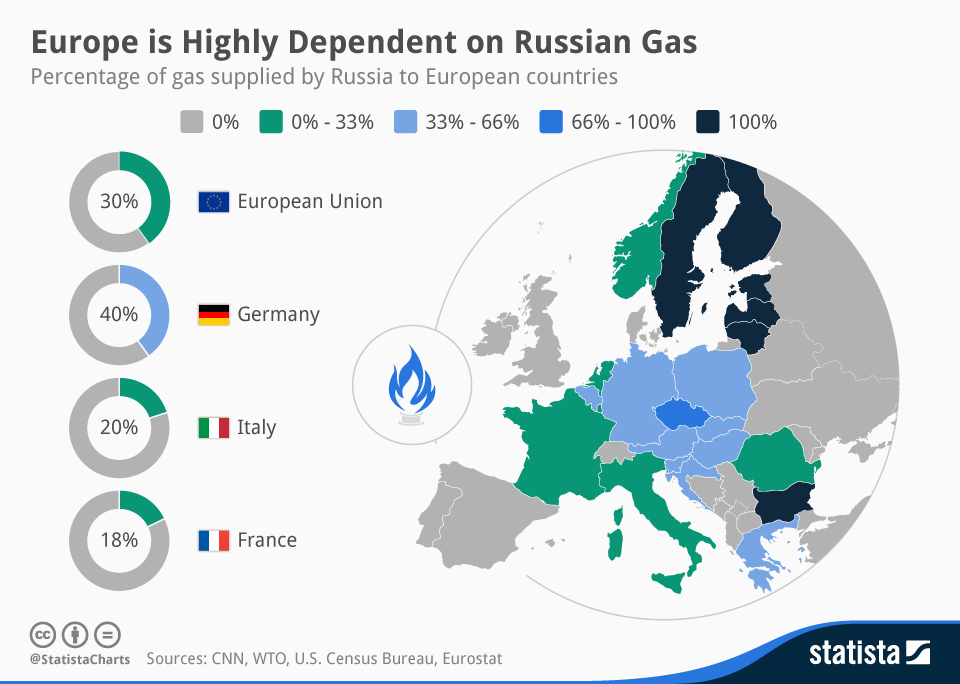

Spot Market Focus Eu Deliberations On Russian Gas Ban

Apr 24, 2025

Spot Market Focus Eu Deliberations On Russian Gas Ban

Apr 24, 2025