Understanding Elevated Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Perspective on Current Market Valuations

Bank of America's stance on current market valuations is nuanced. While acknowledging the historically high levels of certain valuation metrics, BofA doesn't necessarily label them as a market bubble ready to burst. Their analysis suggests a more complex picture, influenced by several interacting factors.

-

Key Arguments: BofA's analysts often point to the exceptionally low interest rate environment and continued strong corporate earnings as key supports for current valuations. They also highlight the ongoing impact of quantitative easing policies on market liquidity. However, they simultaneously caution against complacency.

-

Metrics Used: BofA employs various metrics in its analysis, including the widely followed Price-to-Earnings ratio (P/E ratio), both trailing and forward-looking, and the cyclically adjusted price-to-earnings ratio (Shiller PE), which attempts to smooth out earnings fluctuations over longer periods. They also consider other valuation multiples like Price-to-Sales and Price-to-Book ratios to get a more comprehensive picture.

-

Warnings and Cautions: Despite their measured optimism, BofA issues warnings about the potential for increased volatility and the vulnerability of the market to interest rate hikes and inflationary pressures. They emphasize the need for careful risk management and a diversified investment strategy in the face of these elevated valuations.

Factors Contributing to Elevated Stock Market Valuations

Several macroeconomic factors have contributed to the elevated stock market valuations observed in recent years. Understanding these factors is crucial for assessing the sustainability of current market levels.

-

Low Interest Rates: Historically low interest rates have made borrowing cheaper for companies and attractive for investors seeking yield. This has fueled corporate investment and increased demand for stocks, pushing up prices.

-

Quantitative Easing (QE): QE programs implemented by central banks injected significant liquidity into the financial system, further boosting stock prices. This increased money supply made investments cheaper and more readily available.

-

Strong Corporate Earnings Growth: In many periods, robust corporate earnings growth has supported elevated valuations. Profitable companies attract investment, driving up stock prices and making P/E ratios appear less excessive.

-

Technological Advancements: The rapid growth of technology companies and the continued innovation within the sector have contributed significantly to market valuations. Investors often place a premium on companies perceived as having high future growth potential.

-

Geopolitical Factors: Geopolitical events, both positive and negative, can impact market sentiment and valuations. Uncertainty can sometimes lead to flight-to-safety behavior, but significant events can also cause shifts in investment flows.

Assessing the Risks Associated with High Valuations

While elevated stock market valuations can signal strong economic fundamentals, they also carry significant risks. Investors should carefully consider these potential downsides:

-

Interest Rate Hikes and Inflation: Rising interest rates increase borrowing costs for companies, potentially slowing economic growth and reducing corporate earnings. Inflation erodes the purchasing power of future earnings, making high valuations less attractive.

-

Increased Market Volatility and Corrections: Markets with high valuations are often more susceptible to sharp corrections. A sudden negative event can trigger a sell-off, leading to significant price declines.

-

Asset Bubbles: Extremely elevated valuations in specific sectors or asset classes can indicate the formation of asset bubbles. The bursting of these bubbles can lead to significant losses for investors.

-

Unforeseen Economic Events: Recessions, pandemics, or other unforeseen economic events can severely impact market performance, especially when valuations are already stretched.

BofA's Predictions and Investment Strategies

BofA's outlook on the market and its recommended strategies often change with economic conditions. While specific predictions and recommendations vary over time, they often emphasize:

-

Market Outlook: BofA's outlook might range from cautiously optimistic to more bearish, depending on the prevailing economic climate and the level of uncertainty. Their analysts carefully consider multiple scenarios when forming their predictions.

-

Sector/Asset Class Recommendations: BofA may suggest favoring sectors perceived as less sensitive to interest rate changes or inflation, or may recommend a more defensive posture during periods of heightened uncertainty.

-

Diversification and Risk Management: They consistently advocate for diversification across different asset classes and geographies to mitigate risk. Risk management strategies, such as hedging, are also usually recommended.

-

Specific Investment Products/Strategies: BofA may suggest specific investment products or strategies aligned with their market outlook, such as actively managed funds, index funds, or alternative investments.

Conclusion

Understanding elevated stock market valuations is critical for making informed investment decisions. BofA's analysis highlights the complex interplay of factors driving current market levels, including low interest rates, quantitative easing, and corporate earnings growth. However, they also caution about the increased risks associated with these high valuations, including vulnerability to interest rate hikes, inflation, and market corrections. Staying informed about BofA's ongoing analysis and other expert opinions is crucial. Further research into [link to BofA research reports or relevant financial news] will enhance your understanding of elevated stock market valuations and help you make sound investment choices.

Featured Posts

-

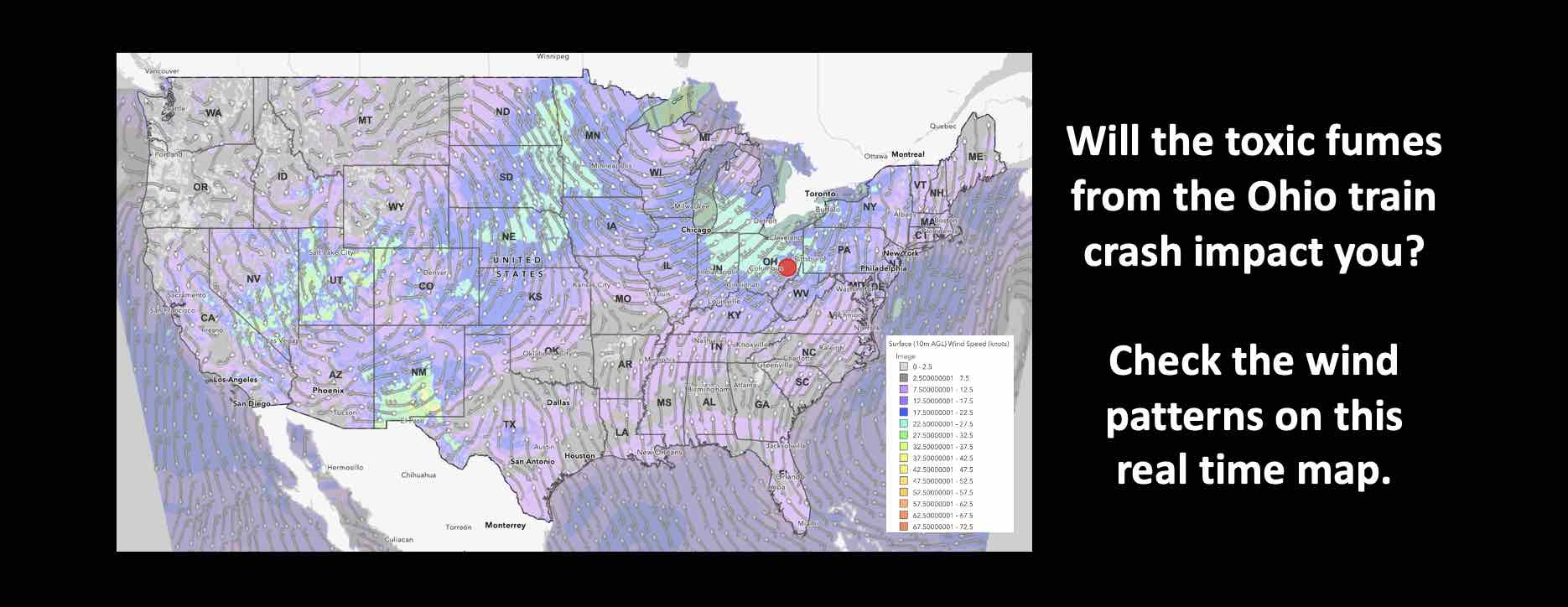

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 24, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 24, 2025 -

Death Of Sophie Nyweide Mammoth And Noah Actress Passes Away At 24

Apr 24, 2025

Death Of Sophie Nyweide Mammoth And Noah Actress Passes Away At 24

Apr 24, 2025 -

The Destruction Of Pope Francis Signet Ring Tradition And Symbolism

Apr 24, 2025

The Destruction Of Pope Francis Signet Ring Tradition And Symbolism

Apr 24, 2025 -

Trump Rejects Calls To Dismiss Federal Reserve Chair Powell

Apr 24, 2025

Trump Rejects Calls To Dismiss Federal Reserve Chair Powell

Apr 24, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 24, 2025

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 24, 2025