BTC Price Increase: Analyzing The Impact Of Trump's Policies And Fed Decisions

Table of Contents

Trump's Economic Policies and Their Ripple Effect on BTC

Former President Trump's economic agenda significantly impacted the global financial landscape, creating conditions that indirectly influenced the BTC price increase. Understanding these connections is crucial for grasping the complexities of the cryptocurrency market.

Fiscal Stimulus and Inflationary Pressures

Trump's significant tax cuts and increased government spending injected substantial capital into the US economy. This fiscal stimulus, while intended to boost economic growth, also fueled concerns about potential inflation. Investors, seeking to protect their portfolios from inflation's eroding effects, often turn to alternative assets perceived as inflation hedges. Bitcoin, with its limited supply and decentralized nature, emerged as an attractive option for some.

- Increased national debt and its implications on the dollar's value: The expansion of the national debt raised concerns about the long-term stability of the US dollar, potentially driving investors towards Bitcoin as a less volatile store of value.

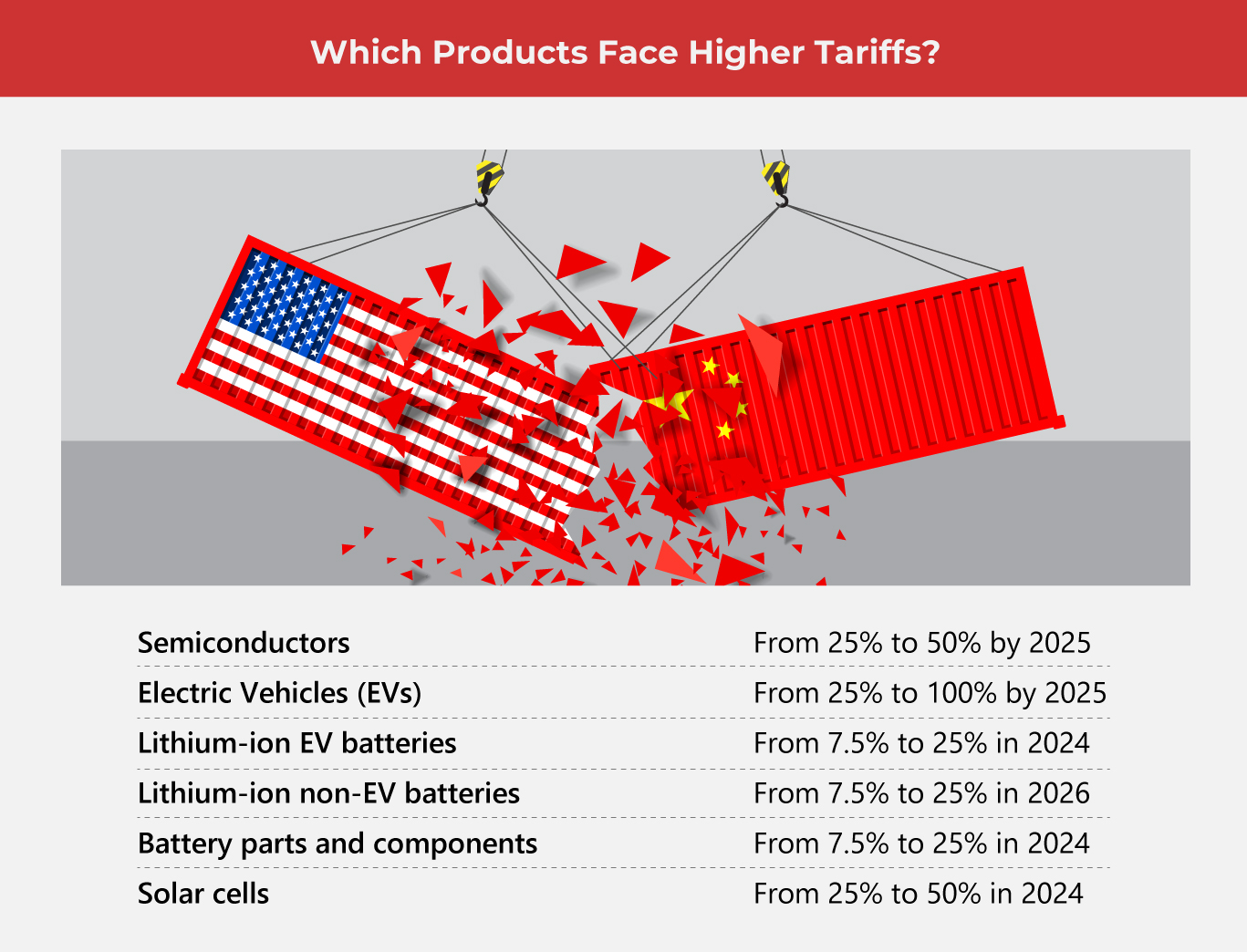

- Impact of trade wars on global economic uncertainty and Bitcoin's safe-haven appeal: Trump's trade policies introduced significant global economic uncertainty, further boosting Bitcoin's appeal as a safe-haven asset, driving up demand and contributing to a BTC price increase.

- Examples of how inflation affected traditional markets and drove investors towards Bitcoin: As inflation started to rise in traditional markets, investors sought assets that could potentially outperform inflation. The limited supply of Bitcoin made it an appealing alternative to fiat currencies.

Regulatory Uncertainty and its Influence on BTC Volatility

Trump's administration's approach to cryptocurrency regulation was often inconsistent and unpredictable. This regulatory uncertainty significantly influenced investor sentiment and contributed to the volatility of the BTC price.

- Examples of pro-crypto and anti-crypto statements or actions from the Trump administration: Conflicting statements from various government officials created uncertainty, causing fluctuations in the cryptocurrency market.

- The effect of regulatory uncertainty on market volatility and investor confidence: The lack of clear regulatory frameworks led to increased market volatility as investors reacted to conflicting signals and perceived risks.

- How this uncertainty potentially contributed to both upward and downward swings in the BTC price: Periods of perceived regulatory crackdown could lead to price drops, while periods of seemingly positive rhetoric could trigger price surges.

The Federal Reserve's Monetary Policy and its Correlation with BTC

The Federal Reserve's monetary policy, independent of but influenced by Trump's administration, played a crucial role in shaping the financial landscape and indirectly impacted the BTC price increase. Understanding the Fed's actions is essential in assessing Bitcoin's price movements.

Interest Rate Decisions and their Effect on BTC Price

The Fed's decisions on interest rates influence the flow of capital throughout the financial system. Low interest rates encourage investment in riskier assets, potentially driving capital towards Bitcoin. Conversely, rising interest rates might incentivize investors to move capital from riskier assets like BTC into more stable, traditional investments.

- Correlation between low interest rates and increased investment in riskier assets like BTC: During periods of low interest rates, Bitcoin's relative riskiness seemed less significant, attracting investors seeking higher returns.

- How rising interest rates might have triggered capital flight from BTC to more traditional investments: As interest rates rose, the attractiveness of traditional, safer investments increased, possibly leading to a decrease in demand for Bitcoin.

- Specific examples of Fed decisions and their subsequent impact on Bitcoin's price: Analyzing specific Fed rate announcements and their subsequent impact on the BTC price provides empirical evidence supporting this correlation.

Quantitative Easing and its Impact on Bitcoin's Value

The Fed's quantitative easing (QE) programs, designed to stimulate the economy, involved injecting vast sums of money into the financial system. This increased money supply contributed to inflationary pressures, potentially increasing the demand for Bitcoin as a store of value and contributing to a BTC price increase.

- Explain QE and its impact on the money supply: QE increases the money supply, potentially leading to inflation if not managed effectively.

- How increased money supply could lead to inflation and drive investors to Bitcoin: Fear of inflation pushed investors to look for assets that could maintain or increase their value during inflationary periods.

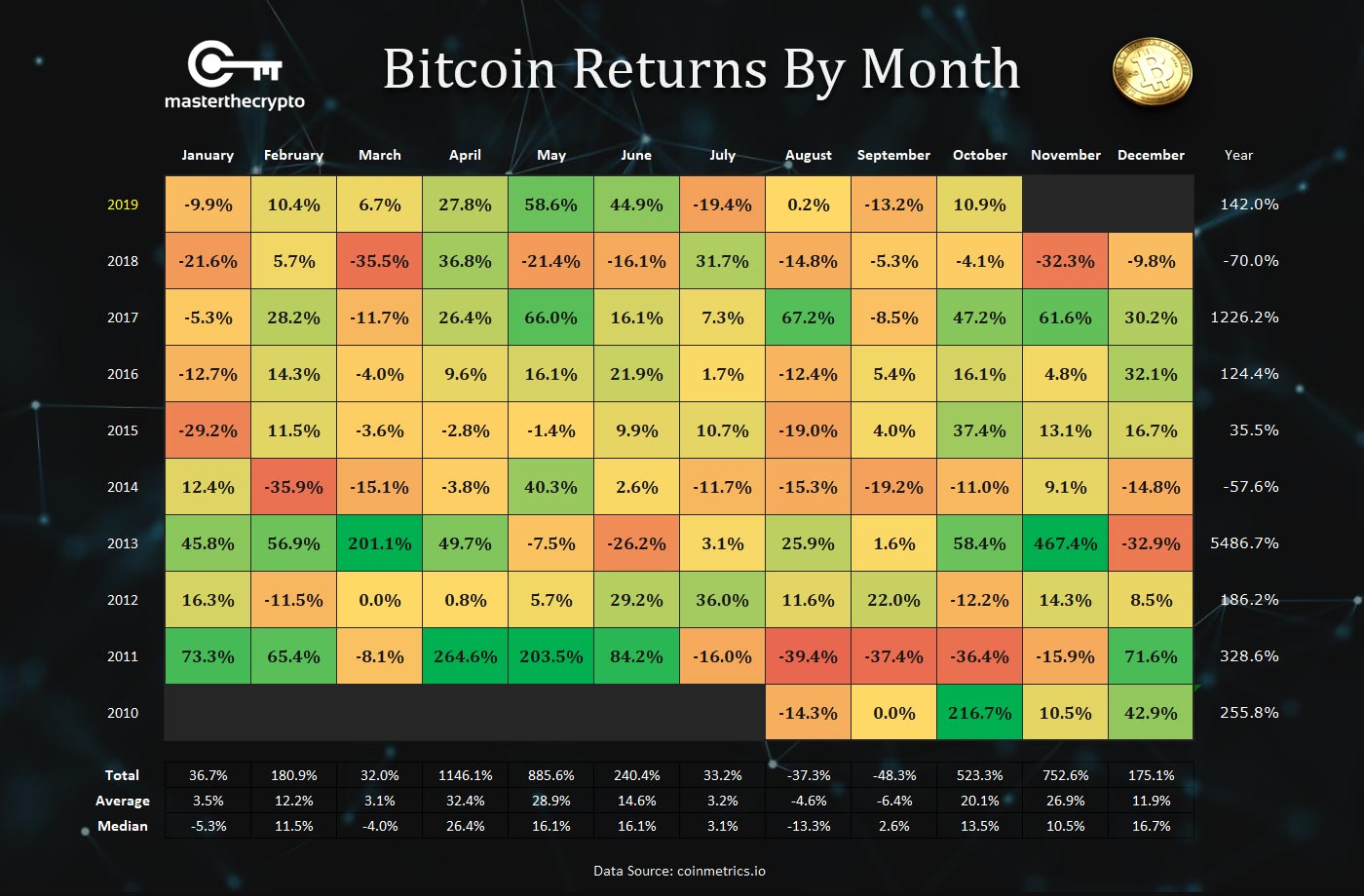

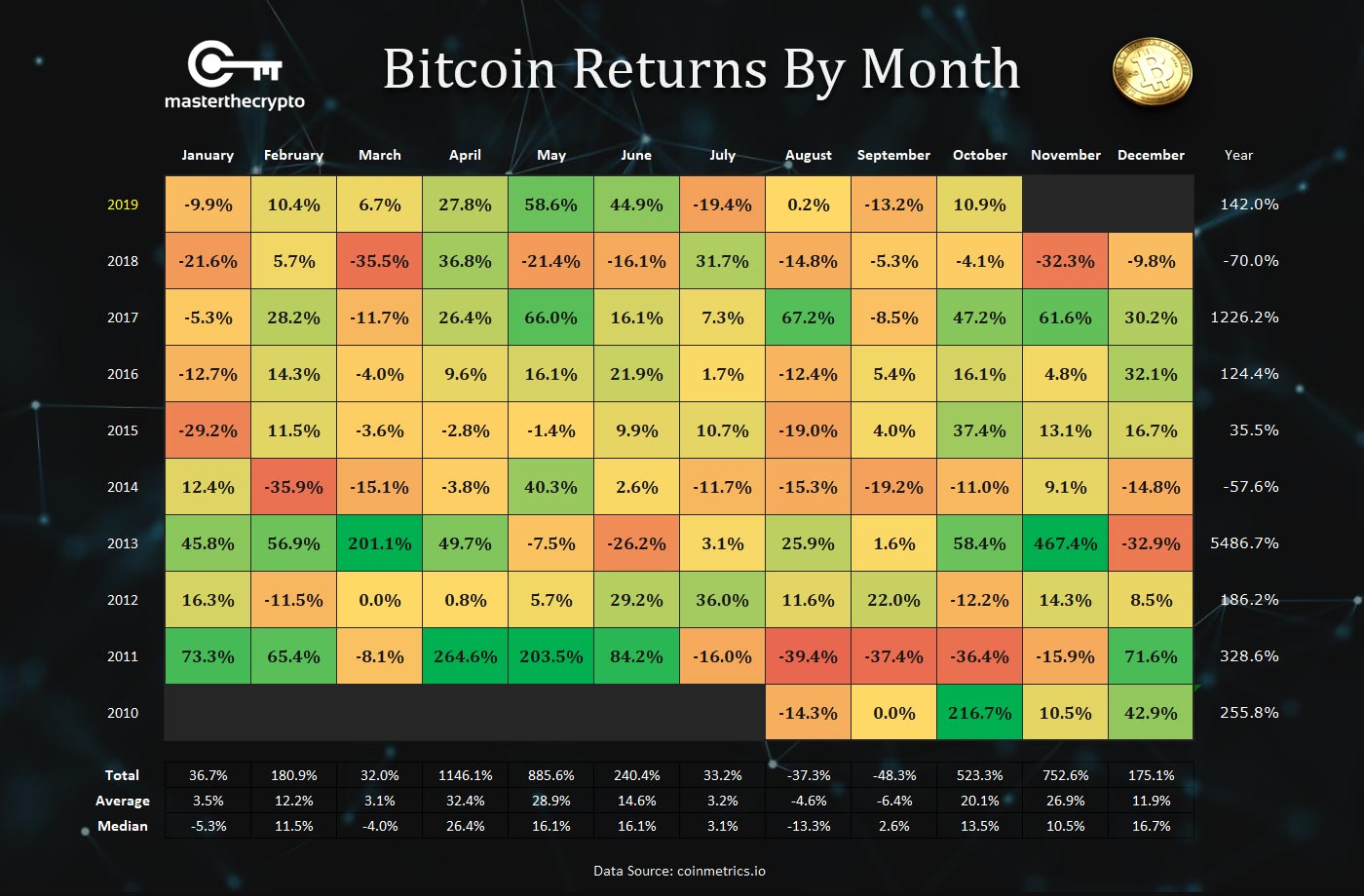

- Analysis of the correlation between QE periods and BTC price movements: Historical data can be analyzed to explore the relationship between periods of QE and Bitcoin's price performance.

Conclusion

This analysis reveals a complex interplay between former President Trump's economic policies, the Federal Reserve's monetary decisions, and the resulting impact on the BTC price increase. Factors like fiscal stimulus, regulatory uncertainty, interest rate adjustments, and quantitative easing all played a role in shaping Bitcoin's trajectory. While a direct causal link isn't always immediately apparent, the correlation between these macroeconomic factors and Bitcoin's price movements is undeniable.

Understanding the intricate relationship between macroeconomic policies and cryptocurrency markets is crucial for navigating the volatile world of Bitcoin investment. Continue your research into the factors influencing BTC price increase and its volatility to make informed decisions in this dynamic landscape. Learn more about the impact of government policies and central bank actions on your BTC holdings and how they can affect your portfolio.

Featured Posts

-

Reduced Us Lpg Imports Chinas Growing Dependence On The Middle East

Apr 24, 2025

Reduced Us Lpg Imports Chinas Growing Dependence On The Middle East

Apr 24, 2025 -

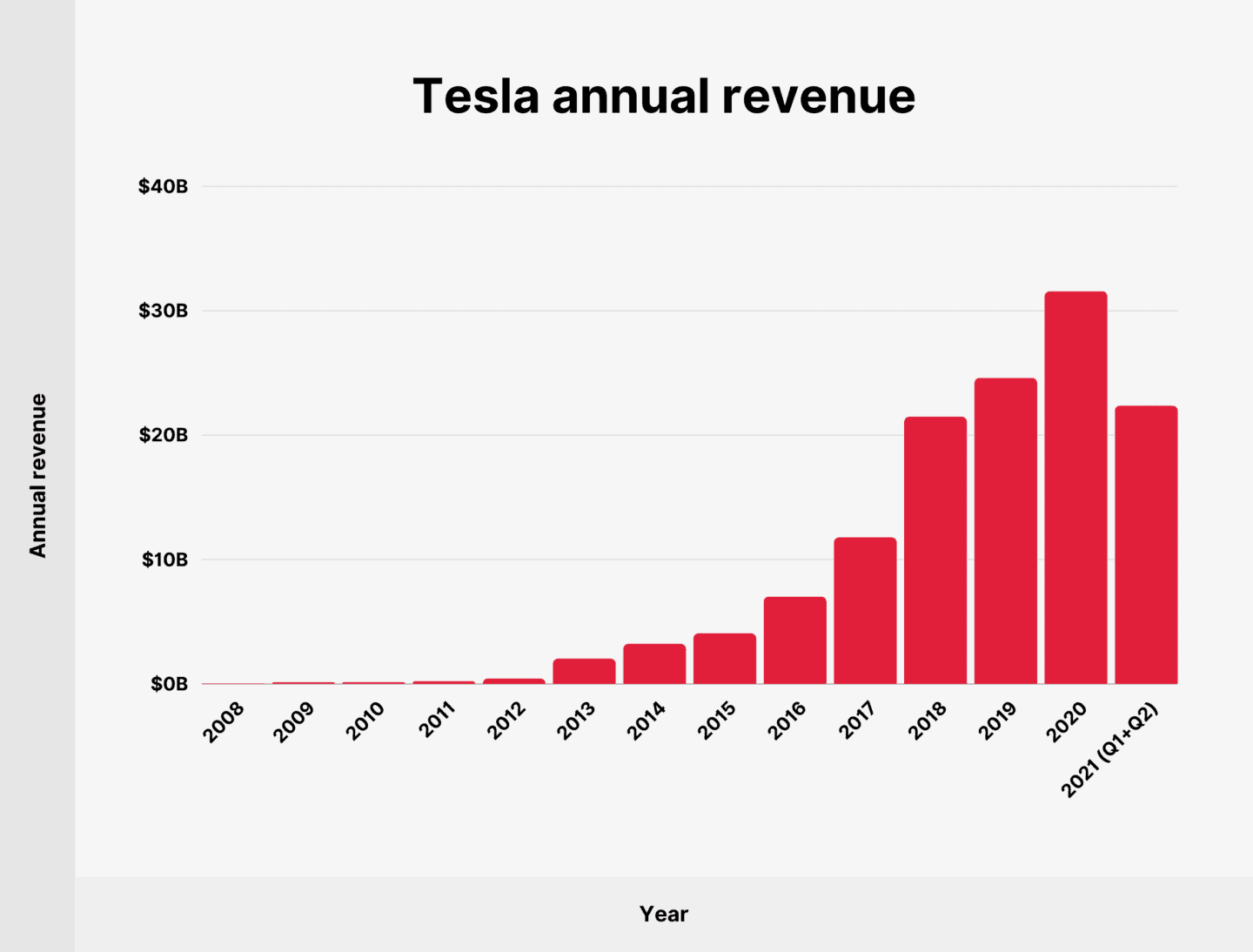

Tesla Earnings Decline 71 Net Income Drop In First Quarter

Apr 24, 2025

Tesla Earnings Decline 71 Net Income Drop In First Quarter

Apr 24, 2025 -

Us Tariffs Spur Chinas Lpg Reliance On Middle East Suppliers

Apr 24, 2025

Us Tariffs Spur Chinas Lpg Reliance On Middle East Suppliers

Apr 24, 2025 -

Chinas Lpg Supply Chain Navigating The Impact Of Us Tariffs

Apr 24, 2025

Chinas Lpg Supply Chain Navigating The Impact Of Us Tariffs

Apr 24, 2025 -

January 6th Conspiracy Theories Ray Epps Defamation Case Against Fox News Explained

Apr 24, 2025

January 6th Conspiracy Theories Ray Epps Defamation Case Against Fox News Explained

Apr 24, 2025