US Market Decline Vs. Emerging Market Gains: Investment Analysis

Table of Contents

Understanding the US Market Decline

Several interconnected factors contribute to the recent underperformance of the US stock market.

Economic Factors

The US economy is facing significant macroeconomic headwinds. High inflation, fueled by supply chain disruptions and robust consumer demand, has forced the Federal Reserve to aggressively raise interest rates. These rate hikes, while aimed at curbing inflation, increase borrowing costs for businesses and consumers, potentially slowing economic growth and even triggering a recession. Geopolitical instability, particularly the ongoing war in Ukraine, further exacerbates these challenges, impacting energy prices and global supply chains.

- High Inflation: Inflation consistently exceeding the Federal Reserve's target rate dampens consumer spending and business investment.

- Rising Interest Rates: Increased borrowing costs make expansion more challenging for businesses and reduce consumer spending on big-ticket items.

- Geopolitical Instability: The war in Ukraine and other global conflicts contribute to uncertainty and volatility in the market.

- Supply Chain Disruptions: Lingering supply chain issues continue to impact production and increase prices for goods and services.

Data from the Federal Reserve and leading economic forecasting firms paint a picture of slowing growth and increased uncertainty in the US economy, directly impacting investor sentiment and market performance.

Sector-Specific Performance

The underperformance of the US market isn't uniform across all sectors. While some sectors, such as energy, have benefited from geopolitical factors, others, like technology, have experienced significant corrections.

- Tech Sector Correction: High valuations and rising interest rates have led to a significant pullback in the tech sector, impacting many high-growth companies.

- Energy Sector Volatility: While energy prices have risen, the sector remains volatile due to geopolitical risks and the transition towards renewable energy sources.

- Impact of Interest Rate Hikes on Financial Institutions: Rising interest rates, while benefiting banks in the short term, can also increase loan defaults and reduce overall lending activity.

Investor Sentiment and Market Volatility

Negative investor sentiment, driven by fears of a recession and decreased consumer confidence, has fueled increased market volatility. This uncertainty makes investors hesitant to commit capital, contributing to lower stock prices.

- Fear of Recession: Concerns about a potential recession are prompting investors to adopt a more cautious approach.

- Decreased Consumer Confidence: Falling consumer confidence signals weakening demand, impacting corporate earnings and stock valuations.

- Impact on Investor Behavior: Increased volatility encourages short-term trading and reduces long-term investment.

The Rise of Emerging Markets

In contrast to the challenges facing the US market, emerging markets are experiencing robust growth driven by several key factors.

Growth Potential and Emerging Economies

Emerging economies boast significant growth potential, fueled by a rapidly expanding middle class, substantial infrastructure development, and advancements in technology.

- Rapid Economic Growth in Specific Regions: Countries in Asia (e.g., India, Vietnam) and Latin America (e.g., Brazil) are experiencing rapid economic expansion.

- Increasing Consumer Spending: A growing middle class in many emerging markets is driving increased consumer spending, boosting domestic demand.

- Government Investments in Infrastructure: Many emerging market governments are investing heavily in infrastructure projects, creating economic opportunities and stimulating growth.

Diversification Benefits and Risk Mitigation

Investing in emerging markets offers significant diversification benefits and helps mitigate the risks associated with over-reliance on the US market.

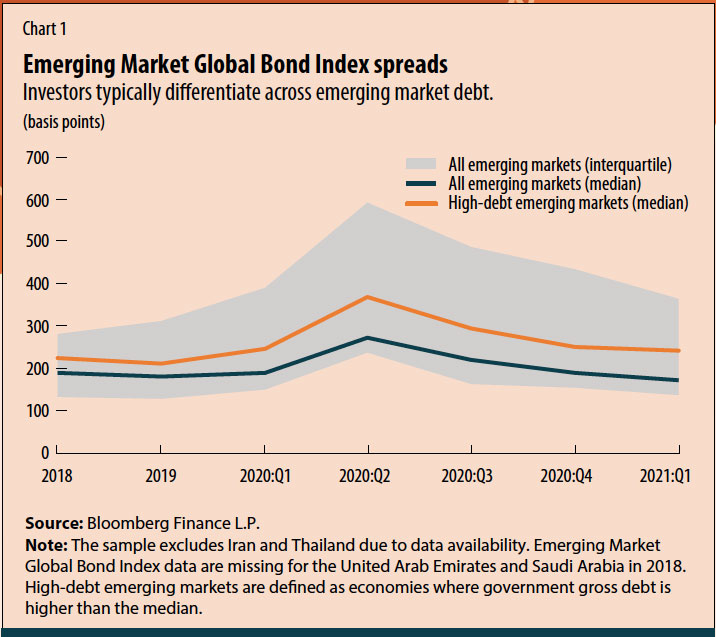

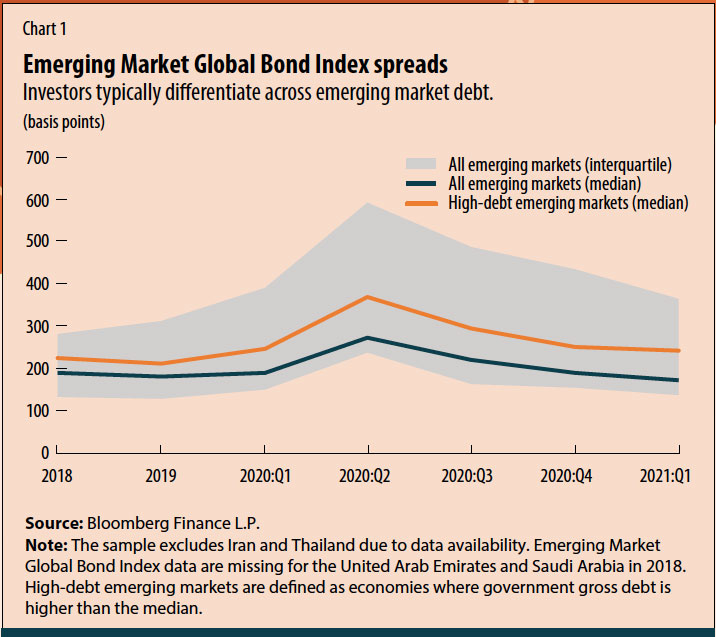

- Reduced Correlation with US Markets: Emerging markets often exhibit lower correlation with the US market, reducing overall portfolio risk.

- Opportunities for Higher Returns: Emerging markets often offer the potential for higher returns, although with higher risk.

- Geographical Diversification: Investing in emerging markets spreads risk geographically, reducing vulnerability to regional economic downturns.

Specific Emerging Market Opportunities

Several emerging markets present compelling investment opportunities. India, with its robust IT sector and growing consumer market, is a prime example. Vietnam's manufacturing sector and its strategic geographical location are also attracting significant investment. Brazil, despite its political and economic challenges, offers potential in various sectors, including renewable energy. Careful due diligence and understanding of country-specific risks are, however, crucial.

Investment Strategies for Navigating Market Shifts

Successfully navigating the current market environment requires a well-defined investment strategy.

Diversification Strategies

Diversification is crucial to mitigate risk and capture growth opportunities. This includes geographic diversification (investing across different regions), asset class diversification (stocks, bonds, real estate, etc.), and sector diversification (spreading investments across various industries).

- Geographic Diversification: Investing in emerging markets alongside developed markets reduces reliance on any single economy.

- Asset Class Diversification: Combining different asset classes helps to balance risk and return.

- Sector Diversification: Investing in various sectors reduces the impact of underperformance in any single industry.

Active vs. Passive Management

Investors must carefully consider whether active or passive management aligns better with their investment goals and risk tolerance.

- Active Management: Active managers aim to outperform the market by selecting specific investments, but this approach involves higher fees.

- Passive Management: Passive strategies, such as index funds, track a market index and typically have lower fees.

Conclusion

The divergence between US market decline and emerging market gains reflects a complex interplay of economic factors, sector-specific performance, and investor sentiment. Understanding these factors is crucial for investors seeking to navigate this challenging environment. A key takeaway is the importance of diversification. By strategically allocating assets across different geographies, asset classes, and sectors, including exposure to the growth potential of emerging markets, investors can mitigate risk and enhance their long-term returns. To capitalize on emerging market gains and build a robust investment portfolio, consider diversifying your portfolio with emerging market investment strategies. Further research and consultation with a financial advisor are recommended to develop a personalized investment plan tailored to your specific needs and risk tolerance.

Featured Posts

-

Increased Tornado Risks Amidst Trumps Budget Cuts Expert Analysis

Apr 24, 2025

Increased Tornado Risks Amidst Trumps Budget Cuts Expert Analysis

Apr 24, 2025 -

Hopes New Living Arrangement And Liams Crisis B And B Thursday Recap April 3

Apr 24, 2025

Hopes New Living Arrangement And Liams Crisis B And B Thursday Recap April 3

Apr 24, 2025 -

Analyzing The Link Between Trumps Cuts And A More Dangerous Tornado Season

Apr 24, 2025

Analyzing The Link Between Trumps Cuts And A More Dangerous Tornado Season

Apr 24, 2025 -

Canadas Economic Outlook The Need For Fiscal Responsibility

Apr 24, 2025

Canadas Economic Outlook The Need For Fiscal Responsibility

Apr 24, 2025 -

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025