US Tariffs Spur China's LPG Reliance On Middle East Suppliers

Table of Contents

The Impact of US Tariffs on China's LPG Imports

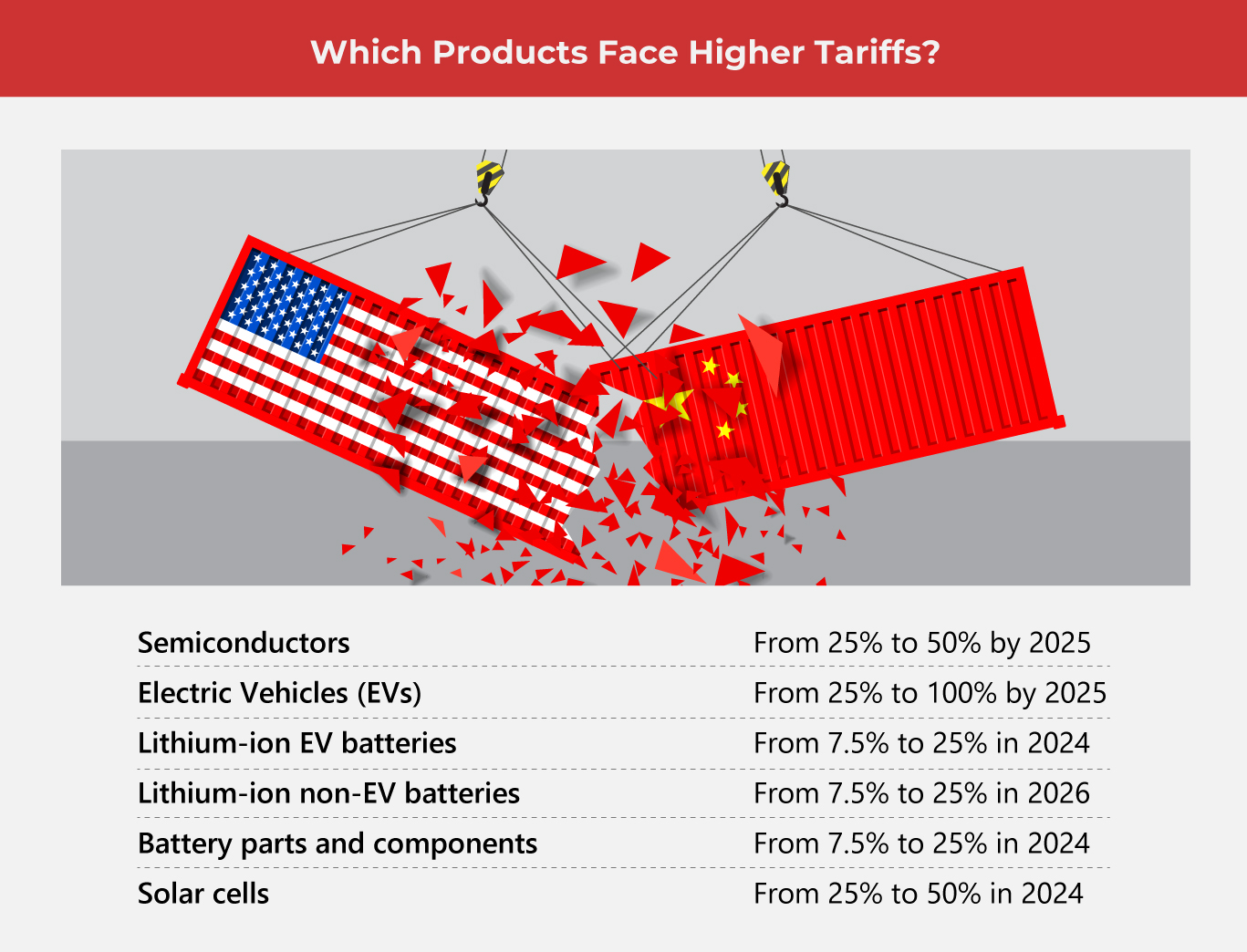

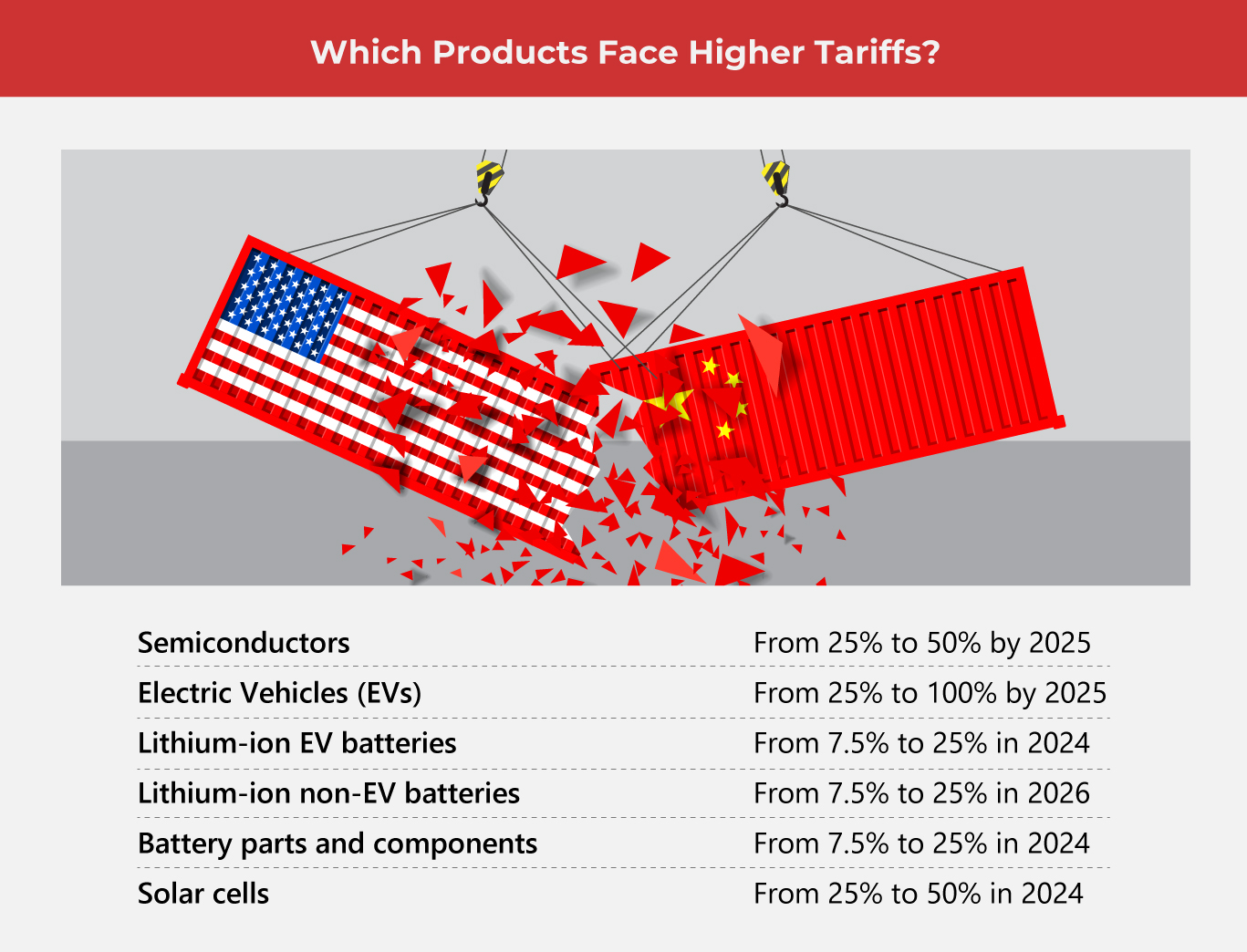

US tariffs on LPG imports into China have dramatically altered the country's sourcing strategy. These tariffs made procuring LPG from the US significantly more expensive, rendering American suppliers less competitive in the Chinese market. This forced Chinese buyers to seek alternative sources, primarily in the Middle East.

- Increased import costs due to tariffs: The tariffs added a substantial percentage to the cost of US LPG, making it unviable for many Chinese buyers.

- Reduced competitiveness of US LPG in the Chinese market: The price increase immediately impacted the competitiveness of US LPG, pushing it out of favor with Chinese importers.

- Shift in demand towards Middle Eastern suppliers: As US LPG became less attractive, Chinese companies turned to Middle Eastern suppliers who could offer more competitive prices.

- Analysis of tariff rates and their impact on pricing: The specific tariff rates implemented by the US government directly correlated with the increase in the cost of LPG for Chinese importers. The higher the tariff, the greater the price increase, making the shift towards Middle Eastern sources even more pronounced.

- Discussion of the timing of the tariffs and the subsequent shift in sourcing: The timing of tariff implementation played a crucial role. The immediate impact was felt swiftly, forcing a rapid reassessment of sourcing strategies by Chinese companies. This resulted in a fast and significant increase in China LPG imports from Middle Eastern countries.

Middle East's Rise as a Dominant LPG Supplier to China

Countries in the Middle East, notably Saudi Arabia and Qatar, have swiftly filled the gap left by the decreased US LPG imports. These nations have capitalized on the increased demand, becoming major LPG exporters to China.

- Increased export volumes from Middle Eastern nations to China: Export figures show a dramatic rise in LPG shipments from the Middle East to China, directly corresponding to the decline in US imports.

- Competitive pricing strategies of Middle Eastern suppliers: Middle Eastern producers offered prices significantly lower than tariff-inflated US LPG, making them highly attractive to Chinese buyers.

- Improved logistical infrastructure facilitating efficient transport: Efficient shipping routes and established infrastructure between the Middle East and China facilitated the smooth transition to new supply chains.

- Geopolitical implications of this increased reliance: China's increased dependence on Middle Eastern LPG has significant geopolitical implications, impacting regional relationships and energy security strategies.

- Analysis of specific Middle Eastern LPG production and export capacity: The ability of Saudi Arabia and Qatar to ramp up production and exports to meet China's growing demand underscores their significant role in the global LPG market.

Implications for the Global LPG Market

This realignment of supply and demand has created ripples throughout the global LPG market. The shift in China LPG imports from the US to the Middle East has significantly impacted several aspects of the global energy landscape.

- Impact on global LPG prices: The increased demand from China has influenced global LPG prices, potentially driving prices up in other regions.

- Shifts in LPG trade routes and shipping patterns: Global LPG trade routes have shifted, with increased traffic between the Middle East and China, while shipments from the US to China have diminished.

- Changes in market share for various LPG producing and exporting nations: The market share of Middle Eastern LPG exporters has increased significantly, while the US has seen a considerable decline in its share of the Chinese market.

- The role of international LPG trading companies: International trading companies have played a significant role in facilitating this shift, adjusting their operations to meet the changed demand.

- Potential long-term consequences for energy security and market stability: The increased reliance of China on a single region for a significant portion of its LPG needs introduces new considerations for energy security and potential market volatility.

China's Long-Term Energy Strategy and LPG Sourcing

China's long-term energy strategy and its approach to LPG sourcing need careful consideration. The current reliance on Middle Eastern suppliers is unlikely to be a permanent state.

- China's overall energy security concerns: China's government is keenly aware of the risks associated with relying heavily on a single source for a critical energy resource.

- The role of LPG in China's energy mix: LPG plays a significant role in China’s energy mix, fueling various sectors, including residential heating and industrial processes.

- Potential for diversification of LPG sources beyond the Middle East: China is likely to explore diversifying its LPG imports to reduce dependence on the Middle East.

- Investment in domestic LPG production capabilities: Increasing domestic production of LPG is a key element of China's long-term energy security strategy.

- Government policies impacting LPG imports and domestic production: Government policies will play a crucial role in shaping China's future LPG sourcing strategies, encouraging both domestic production and strategic diversification of imports.

Conclusion

The imposition of US tariffs has profoundly altered China's LPG import landscape, leading to a significant increase in reliance on Middle Eastern suppliers. This shift in China LPG imports has considerable implications for the global LPG market, influencing prices, trade routes, and the overall energy security of various nations. Understanding the dynamics of China LPG imports is crucial for businesses and policymakers alike. Further research into the long-term effects of this shift and the potential for future disruptions in the global LPG market is vital. Stay informed on developments in China LPG imports and their impact on the global energy landscape.

Featured Posts

-

The Bold And The Beautiful What To Expect In The Next 14 Days Hope Liam And Lunas Impact

Apr 24, 2025

The Bold And The Beautiful What To Expect In The Next 14 Days Hope Liam And Lunas Impact

Apr 24, 2025 -

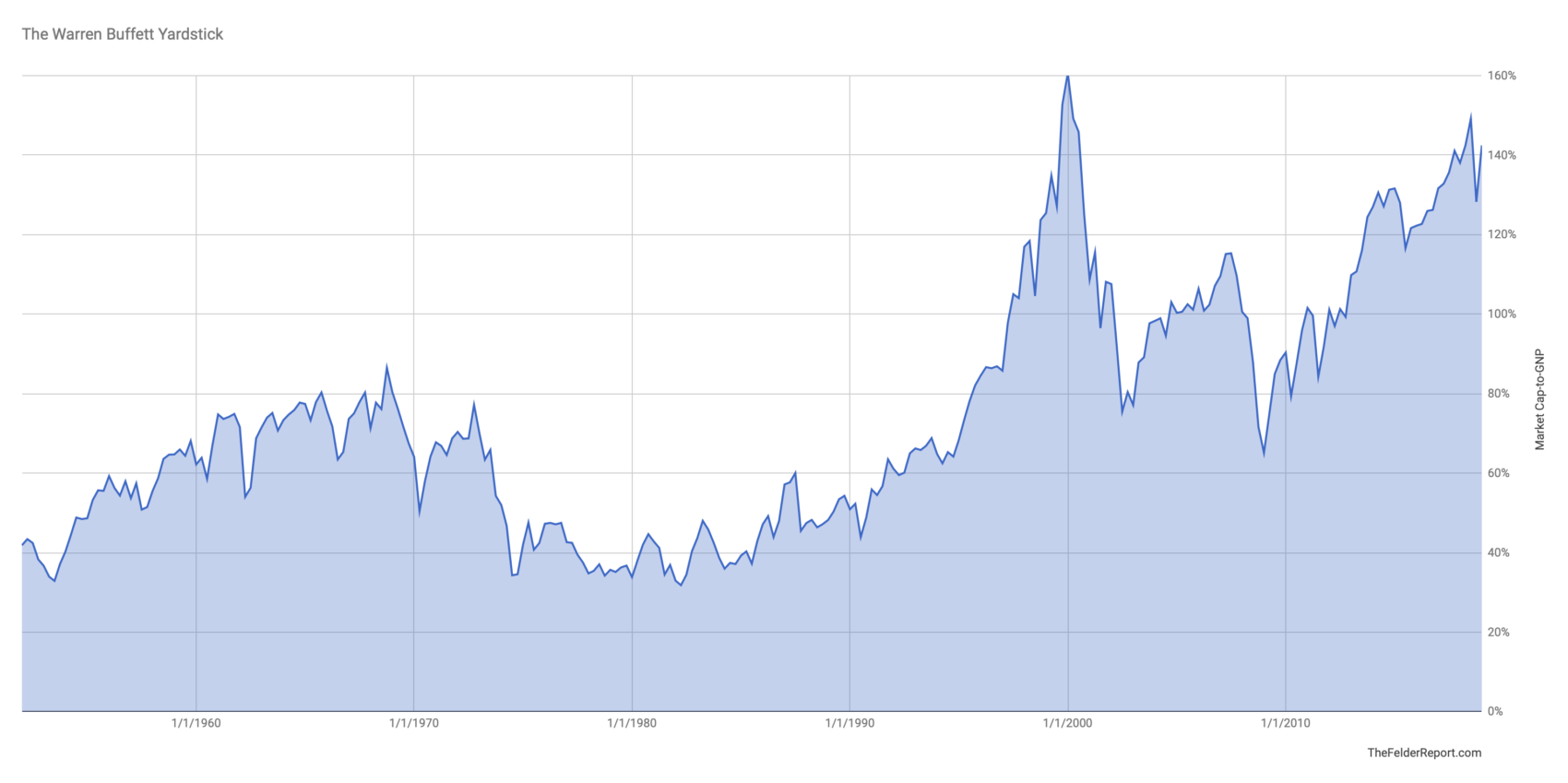

Bof As Argument Against High Stock Market Valuations A Guide For Investors

Apr 24, 2025

Bof As Argument Against High Stock Market Valuations A Guide For Investors

Apr 24, 2025 -

Ai And Blockchain Convergence Chainalysis Acquisition Of Alterya

Apr 24, 2025

Ai And Blockchain Convergence Chainalysis Acquisition Of Alterya

Apr 24, 2025 -

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025 -

Hong Kongs Chinese Stock Market A Rally Driven By Trade Hopes

Apr 24, 2025

Hong Kongs Chinese Stock Market A Rally Driven By Trade Hopes

Apr 24, 2025