Will Minnesota Film Tax Credits Attract More Productions?

Table of Contents

Minnesota's film industry holds immense potential, but its growth trajectory hinges on strategic initiatives. Recent years have seen a fluctuating level of production, prompting critical examination of existing support mechanisms. This article delves into the effectiveness of Minnesota film tax credits in attracting film and television productions to the state, analyzing their impact and suggesting improvements for a more vibrant future. We will argue that while the current program offers some benefits, significant enhancements are needed to make Minnesota a truly competitive filming destination.

<h2>Current State of Minnesota's Film Industry</h2>

<h3>Current Production Levels</h3>

While Minnesota boasts a rich history of filmmaking, consistently tracking precise production numbers remains a challenge. Data on the number of productions, their economic impact, and job creation is often fragmented across various state agencies. However, anecdotal evidence suggests that production levels fluctuate, with some years showing significant activity and others experiencing a lull. This inconsistency highlights the need for more comprehensive data collection and reporting to accurately gauge the industry's health.

<h3>Competitive Landscape</h3>

Minnesota's film tax credit program faces stiff competition from neighboring states and established filming hubs. A comparison reveals significant differences in incentive structures.

| State | Tax Credit Rate | Other Incentives |

|---|---|---|

| Minnesota | [Insert current rate]% | [List any other incentives, e.g., grants] |

| Wisconsin | [Insert current rate]% | [List any other incentives] |

| Iowa | [Insert current rate]% | [List any other incentives] |

| North Dakota | [Insert current rate]% | [List any other incentives] |

| California | [Insert current rate]% | [List any other incentives, e.g., workforce programs] |

| Georgia | [Insert current rate]% | [List any other incentives] |

- Example of recent Minnesota production: (Insert example, with link to source if available. If no specific examples are readily available, replace with general statements about types of productions filmed.) For example, "While specific recent productions utilizing the tax credits are not publicly documented in detail, various independent films and commercials have utilized Minnesota's locations."

- Economic Impact Data: (Insert data on job creation and revenue generated, citing sources. If data is unavailable, state this and suggest where to find it.)

- Successful Productions: (If applicable, list productions that successfully utilized the tax credits and their quantifiable positive impact.)

<h2>Analysis of Minnesota's Film Tax Credit Program</h2>

<h3>Structure and Eligibility</h3>

Minnesota's film tax credit program generally offers a [Insert percentage]% credit on eligible production expenses. Eligible productions typically include feature films, television series, commercials, and documentaries that meet specific criteria regarding spending within the state. Specific details on eligibility and expense categories are crucial for prospective filmmakers to understand.

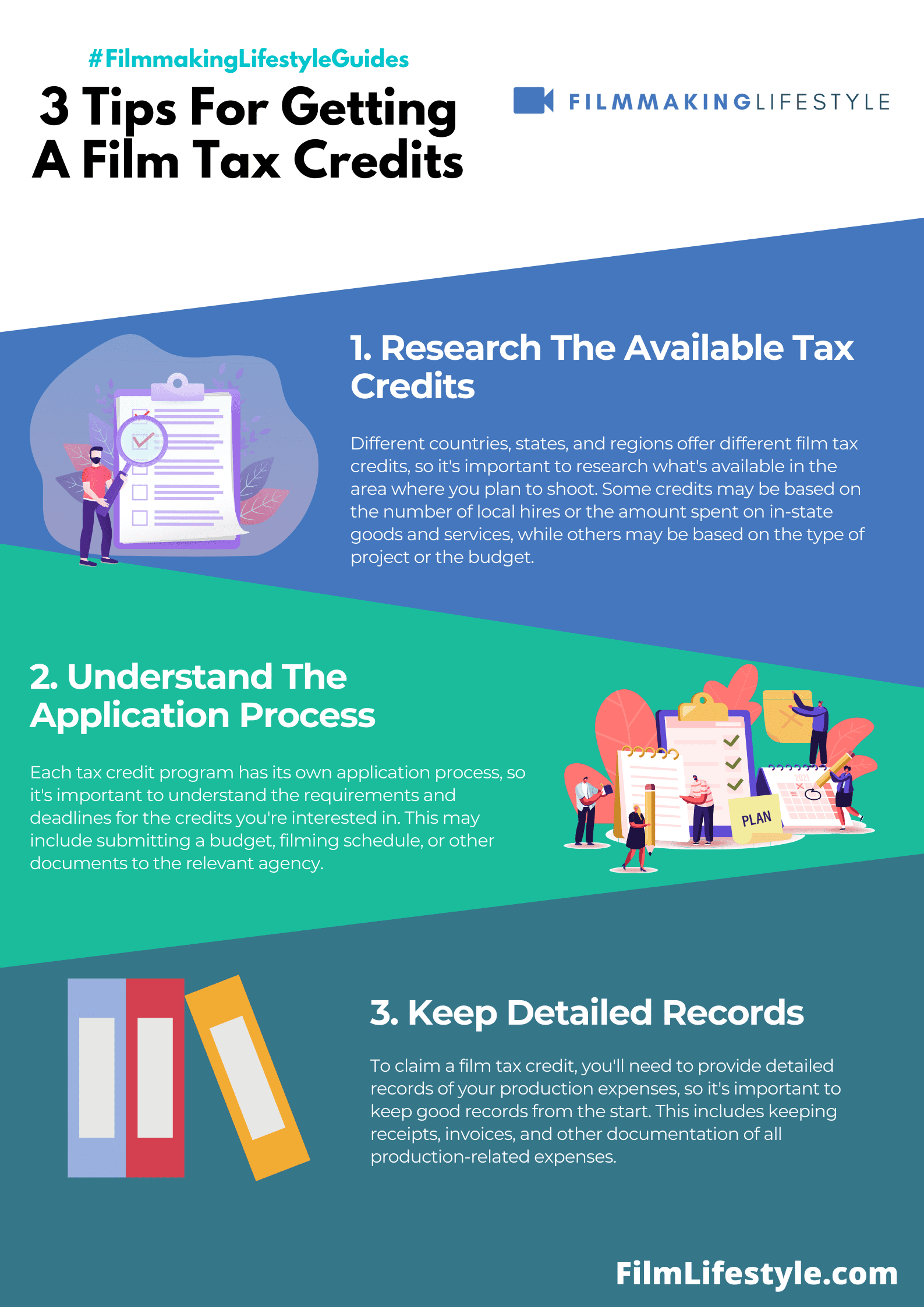

<h3>Application Process and Bureaucracy</h3>

The application process for Minnesota film tax credits is often cited as a potential hurdle for productions. Anecdotal evidence suggests that the process can be complex and time-consuming, requiring extensive documentation. Simplifying the application process, clarifying guidelines, and streamlining communication between applicants and the relevant state agencies are critical for attracting more productions.

- Application Process Details: (Provide details about the timeline, required documentation, and any potential bottlenecks.)

- Examples of Applications: (If possible, provide examples of successful and unsuccessful applications – this may require contacting the Minnesota Film Office or conducting interviews with industry professionals.)

- Expert Opinions: (Include quotes or summaries of opinions from film professionals or government officials on the program’s effectiveness and any bureaucratic challenges.)

<h2>Impact of Tax Credits on Production Decisions</h2>

<h3>Attracting Productions</h3>

Determining whether Minnesota's tax credits are a primary factor in production decisions requires careful analysis. While the credits may incentivize some productions, location scouting often considers factors beyond financial incentives, such as available crew, infrastructure, and unique filming locations.

<h3>Job Creation and Economic Growth</h3>

The correlation between tax credits and economic growth needs rigorous evaluation. While the credits stimulate spending within the state, it's essential to quantify the return on investment for taxpayers. This requires tracking not only direct job creation in the film industry but also the ripple effects on related sectors like hospitality and catering.

- Case Studies: (Include case studies of productions that chose Minnesota due to tax credits and those that chose other locations despite the incentives. This could involve surveys or interviews with production companies.)

- Return on Investment: (Analyze the state’s return on investment in the tax credit program. This may involve comparing the cost of the credits to the economic benefits generated.)

<h2>Potential Improvements to the Minnesota Film Tax Credit Program</h2>

<h3>Increasing Competitiveness</h3>

To enhance competitiveness, Minnesota could consider increasing the tax credit rate, broadening eligibility criteria to include a wider range of productions, or introducing additional incentives such as grants for pre-production activities or workforce training programs. Benchmarking against successful programs in other states and countries is vital.

<h3>Streamlining the Application Process</h3>

Significant improvements could be made by simplifying the application process, creating a user-friendly online portal, providing clear and concise guidelines, and establishing faster turnaround times for approvals. The goal is to reduce bureaucratic hurdles and make the application process as efficient as possible.

- Specific Recommendations: (Offer concrete suggestions for improving the program's structure, such as digitizing the application process, creating clearer guidelines, or establishing a dedicated point of contact for applicants.)

- Examples of Successful Programs: (Provide examples of film incentive programs in other states or countries that Minnesota could learn from. This could involve researching states like Georgia or Canada.)

- Long-Term Economic Benefits: (Highlight the potential long-term economic benefits of fostering a strong film industry in Minnesota, such as job growth, tourism, and enhanced brand image.)

<h2>Conclusion: The Future of Minnesota Film Tax Credits and Productions</h2>

Our analysis reveals that while Minnesota film tax credits offer some incentive, they are not currently sufficient to make Minnesota a highly competitive filming destination. The program needs significant improvements in terms of competitiveness and ease of access. While the economic impact of the existing program requires further comprehensive analysis, enhancing the current program through increased rates, streamlined application processes, and potentially expanding eligibility, will significantly bolster the film industry and generate more substantial economic growth. We recommend a review and substantial revision of the current program to align it with best practices in other jurisdictions.

Explore Minnesota film tax credits and their potential to boost the state’s economy. Contact your legislators to advocate for improvements to the program, or explore the opportunities to invest in and participate in Minnesota's growing film industry. Learn more about boosting Minnesota film productions by exploring the potential of a strengthened and more competitive tax credit system. Invest in Minnesota's film industry – the future is bright with the right incentives.

Featured Posts

-

Court Awards Ayesha Howard Custody After Anthony Edwards Paternity Dispute

Apr 29, 2025

Court Awards Ayesha Howard Custody After Anthony Edwards Paternity Dispute

Apr 29, 2025 -

The Ccp United Front In Minnesota An In Depth Look

Apr 29, 2025

The Ccp United Front In Minnesota An In Depth Look

Apr 29, 2025 -

Assessing The Influence Of Tax Credits On Minnesotas Film Industry

Apr 29, 2025

Assessing The Influence Of Tax Credits On Minnesotas Film Industry

Apr 29, 2025 -

The Effectiveness Of Tax Credits In Attracting Film And Tv To Minnesota

Apr 29, 2025

The Effectiveness Of Tax Credits In Attracting Film And Tv To Minnesota

Apr 29, 2025 -

Adidas Anthony Edwards 2 Unveiling The Design And Specs

Apr 29, 2025

Adidas Anthony Edwards 2 Unveiling The Design And Specs

Apr 29, 2025