High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

BofA's Key Findings on High Stock Market Valuations

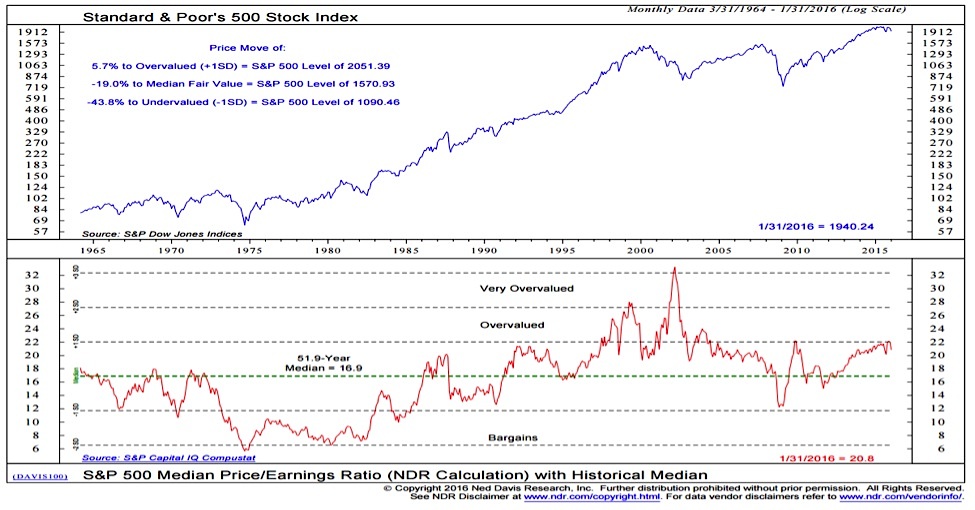

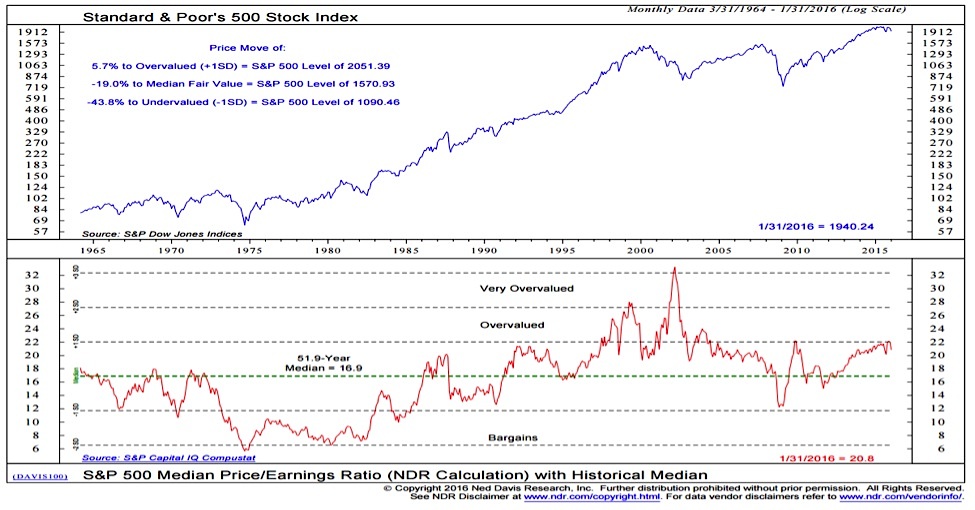

Bank of America's analysis of current stock market valuations often incorporates a range of metrics, providing a comprehensive view of the market's health. Their assessment typically includes a look at key valuation metrics like the price-to-earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE), comparing current levels to historical averages. This allows them to gauge whether the market is overvalued, undervalued, or trading within a historically normal range.

-

Summary of BofA's assessment of current valuations relative to historical averages: BofA's recent reports (Note: Always refer to the most recent BofA reports for up-to-date information) may indicate that certain market indices are trading at elevated levels compared to historical averages, potentially suggesting an overvalued market. However, the specific assessment varies depending on the chosen metrics and the time horizon considered.

-

Specific sectors identified as overvalued or undervalued by BofA: BofA's analysis often dissects the market by sector, identifying specific areas that appear to be overvalued or undervalued based on their valuation metrics and future growth prospects. For example, certain technology sectors might be flagged as overvalued while others, like energy or financials, might be seen as relatively undervalued (Note: This is a general example; specific sectors identified will vary based on BofA's current research).

-

BofA's predictions regarding future market movements based on their valuation analysis: BofA's outlook usually incorporates their valuation analysis into broader market predictions. They might project moderate growth, potential corrections, or even more significant market shifts depending on their assessment of current valuations and macroeconomic factors. It's crucial to understand that these are predictions, not guarantees.

-

Mention of any significant caveats or limitations in BofA's analysis: It's essential to remember that any market analysis, including BofA's, has limitations. Factors like unforeseen geopolitical events, unexpected economic shifts, or changes in investor sentiment can significantly impact market performance, regardless of valuation metrics.

Understanding the Implications for Investors

BofA's analysis on high stock market valuations has significant implications for investors, regardless of their investment horizon or risk tolerance. Understanding these implications allows for better informed decision-making.

-

Strategies for managing risk in a market with high valuations: In a market with high valuations, risk management becomes paramount. Strategies such as diversification across different asset classes (stocks, bonds, real estate), investing in defensive stocks (less volatile companies), and employing stop-loss orders can help mitigate potential losses.

-

Recommendations for investors with a long-term horizon versus those with a shorter-term outlook: Long-term investors may be more willing to ride out market fluctuations, while short-term investors might need a more conservative approach. BofA's insights can inform both groups on how to adjust their portfolios. Long-term investors might focus on fundamental analysis and value investing, while short-term investors may emphasize tactical asset allocation.

-

Potential investment opportunities identified by BofA's analysis (sectors, specific stocks): While BofA may highlight potential overvaluations, they may also identify sectors or specific stocks that appear undervalued relative to their growth potential, offering investment opportunities. However, always conduct your own thorough research before investing.

-

The importance of considering individual risk tolerance when making investment decisions: No single investment strategy fits every investor. Risk tolerance, financial goals, and time horizon should guide investment decisions, regardless of market valuations.

Alternative Perspectives and Contrarian Views

While BofA's analysis provides valuable insights, it's crucial to consider alternative perspectives and contrarian views on high stock market valuations. A balanced approach ensures a well-rounded understanding of the market.

-

Mention other analysts' or economists' contrasting opinions on market valuations: Many analysts and economists hold differing opinions on market valuations, often citing factors that BofA may not emphasize. Some might argue that current valuations are justified by low interest rates or strong corporate earnings growth, while others may emphasize potential risks.

-

Discussion of alternative valuation models beyond those used by BofA: Different valuation models exist, each with its strengths and weaknesses. Considering alternative models can provide a more complete picture. For example, some models may focus on cash flow analysis or discounted future earnings.

-

Analysis of macroeconomic factors that could influence stock market valuations: Macroeconomic factors like interest rate hikes, inflation, and geopolitical events can significantly impact stock market valuations. Considering these external factors is crucial in forming a comprehensive view.

-

Highlight the importance of independent research and due diligence: Relying solely on one source, even a reputable one like BofA, is risky. Conducting your own research and due diligence, including analyzing financial statements and understanding a company's business model, is essential for making informed investment decisions.

Conclusion

BofA's analysis of high stock market valuations offers a valuable perspective but shouldn't be the sole basis for investment decisions. Understanding their key findings, along with alternative viewpoints and macroeconomic factors, is essential. Investors should prioritize diversification, risk management strategies suitable to their individual circumstances, and thorough independent research. Remember that navigating high stock market valuations requires a well-defined plan tailored to your risk tolerance and financial goals. Take control of your investments today and navigate the complexities of high stock market valuations with a well-defined plan.

Featured Posts

-

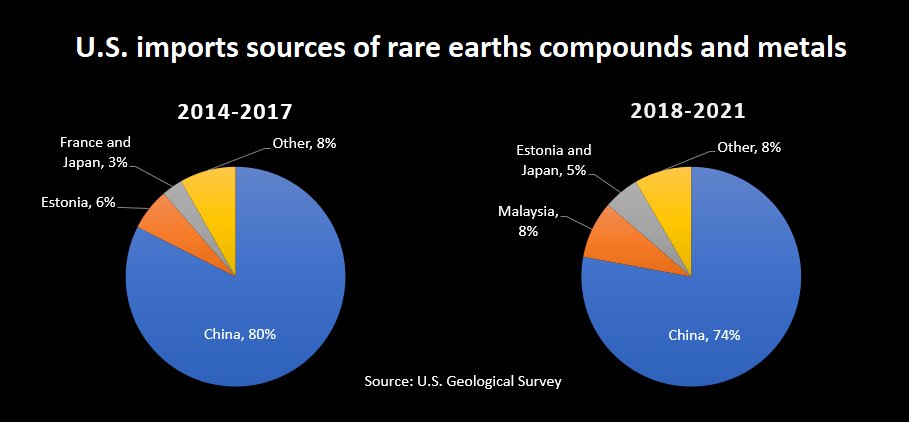

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Robot Development

Apr 24, 2025

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Robot Development

Apr 24, 2025 -

Bitcoin Price Surge Trumps Actions Ease Market Fears

Apr 24, 2025

Bitcoin Price Surge Trumps Actions Ease Market Fears

Apr 24, 2025 -

Indias Stock Market Surge Factors Contributing To Niftys Rally

Apr 24, 2025

Indias Stock Market Surge Factors Contributing To Niftys Rally

Apr 24, 2025 -

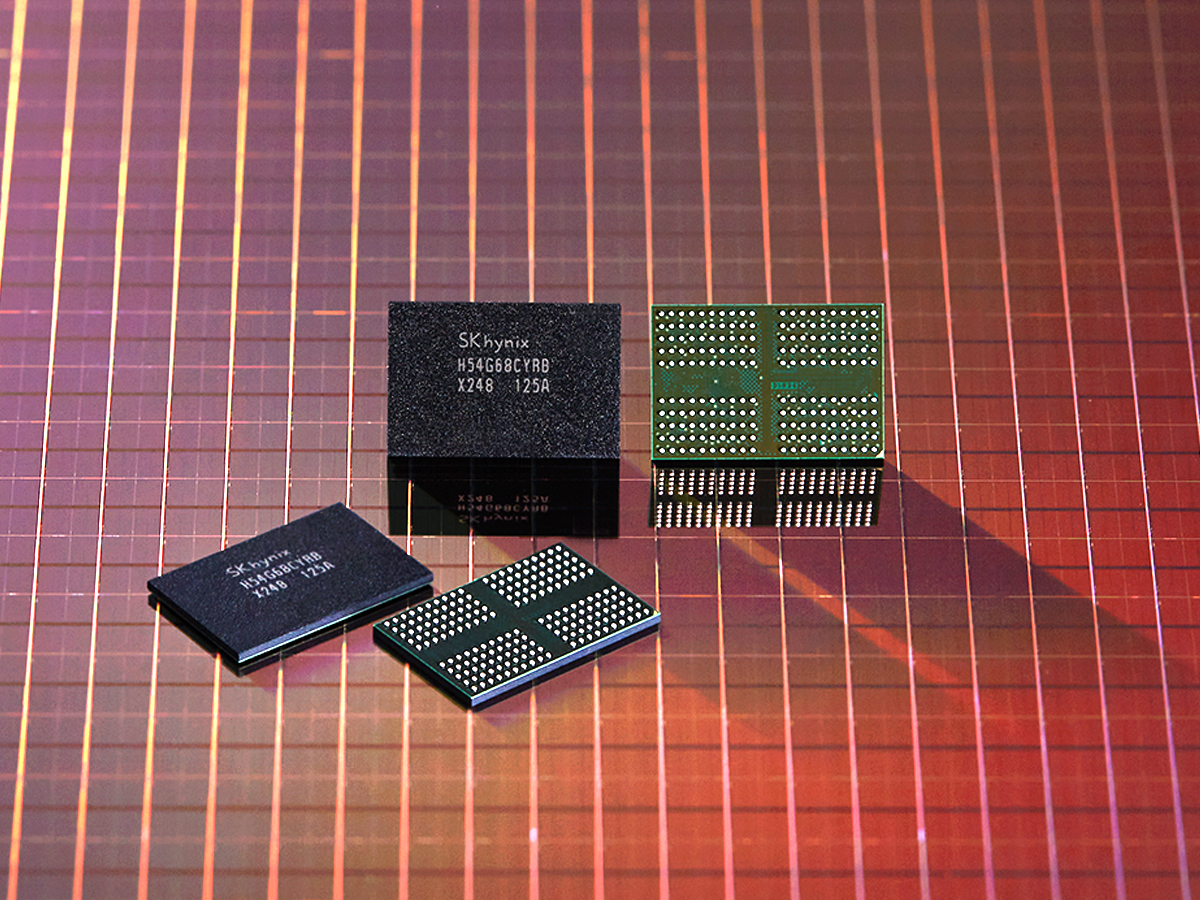

Is Sk Hynix The New Dram King Ai Technology Plays A Key Part

Apr 24, 2025

Is Sk Hynix The New Dram King Ai Technology Plays A Key Part

Apr 24, 2025 -

The Bold And The Beautiful What To Expect In The Next 14 Days Hope Liam And Lunas Impact

Apr 24, 2025

The Bold And The Beautiful What To Expect In The Next 14 Days Hope Liam And Lunas Impact

Apr 24, 2025