How Bundestag Elections Shape The German Dax Index And Business Sentiment

Table of Contents

Policy Uncertainty and Market Volatility

The period leading up to and immediately following Bundestag elections is often characterized by increased market volatility. This uncertainty stems from several factors:

-

Uncertainty surrounding potential coalition governments and their policy platforms: The German electoral system often leads to coalition governments, requiring negotiations that can take weeks or even months. This prolonged uncertainty creates anxiety in the markets as investors grapple with the unknown policy direction of the future government. Different coalition partners may have vastly different economic priorities, leading to unpredictable outcomes.

-

Impact of differing party platforms on key economic sectors (e.g., automotive, renewable energy): Specific sectors are highly sensitive to policy changes. For example, the automotive industry's future direction is heavily influenced by a government's stance on electric vehicles and emission regulations. Similarly, the renewable energy sector's fortunes are tied to the government's commitment to climate change targets and investment in green technologies. These sectoral impacts directly influence the Dax, as these sectors represent significant components of the index.

-

Short-term investor reactions to election results and potential policy shifts: Investor reactions to election results are often immediate and dramatic. A surprise outcome or a perceived shift towards a more economically risky policy can trigger a sell-off, while a result seen as positive for the economy can lead to a rally. Analyzing past election results and their immediate effect on the Dax offers valuable insight into these short-term market responses.

-

Examples of past elections and their immediate impact on the Dax: The 2005 election, which saw Angela Merkel become Chancellor, initially resulted in a period of market stability. However, other elections have shown more immediate volatility, depending on the unexpectedness of the results and the perceived implications for economic policy. Examining these historical precedents is crucial for understanding future market reactions.

Fiscal Policy and the Dax

The winning party's fiscal policy approach significantly affects the Dax. This includes:

-

Impact of tax policies on corporate profits and investment: Changes to corporate tax rates, capital gains taxes, and other tax policies directly influence corporate profitability and investment decisions. Lower taxes generally stimulate investment and growth, while higher taxes can have the opposite effect. This directly translates into Dax performance.

-

Government spending plans and their effect on economic growth: Government investment in infrastructure, education, and research and development (R&D) can boost economic growth and stimulate demand. Conversely, austerity measures, characterized by reduced government spending, can dampen economic activity and negatively impact the Dax.

-

Influence of differing stances on debt and deficit spending: Parties hold different views on acceptable levels of government debt and deficit spending. These contrasting approaches can affect investor confidence and borrowing costs for German companies, influencing investment decisions and thus the Dax's trajectory.

-

Examples of how specific fiscal policies have historically affected the Dax: Periods of robust government spending and investment have often correlated with positive Dax performance, while periods of fiscal restraint have sometimes been associated with slower growth and lower Dax values. Analyzing these historical correlations provides valuable insight into the future impact of fiscal policy decisions.

Regulatory Changes and Business Sentiment

Regulatory changes proposed or implemented by the new government play a crucial role in shaping business sentiment and the Dax. This includes:

-

Impact of environmental regulations on specific industries: Stringent environmental regulations can impact industries like automotive and energy. While they promote sustainability, they may also increase compliance costs and potentially reduce short-term profitability for some businesses, affecting their stock prices.

-

Changes in labor laws and their effect on business costs: Alterations in minimum wage laws, working conditions, and employment regulations directly affect business costs. Changes can either boost or hurt profitability, depending on the specific nature of the adjustments and the industry.

-

Effects of trade policy changes on export-oriented companies: Germany's strong export sector is highly sensitive to trade policy changes. A protectionist approach or changes in international trade agreements can either benefit or harm export-oriented companies, reflected in their stock performance and consequently, the Dax.

-

How regulatory uncertainty can impact business investment and overall sentiment: Uncertainty surrounding upcoming regulatory changes can deter businesses from investing and negatively impact overall sentiment. Clarity and predictability in regulatory frameworks are essential for maintaining investor confidence and fostering economic growth.

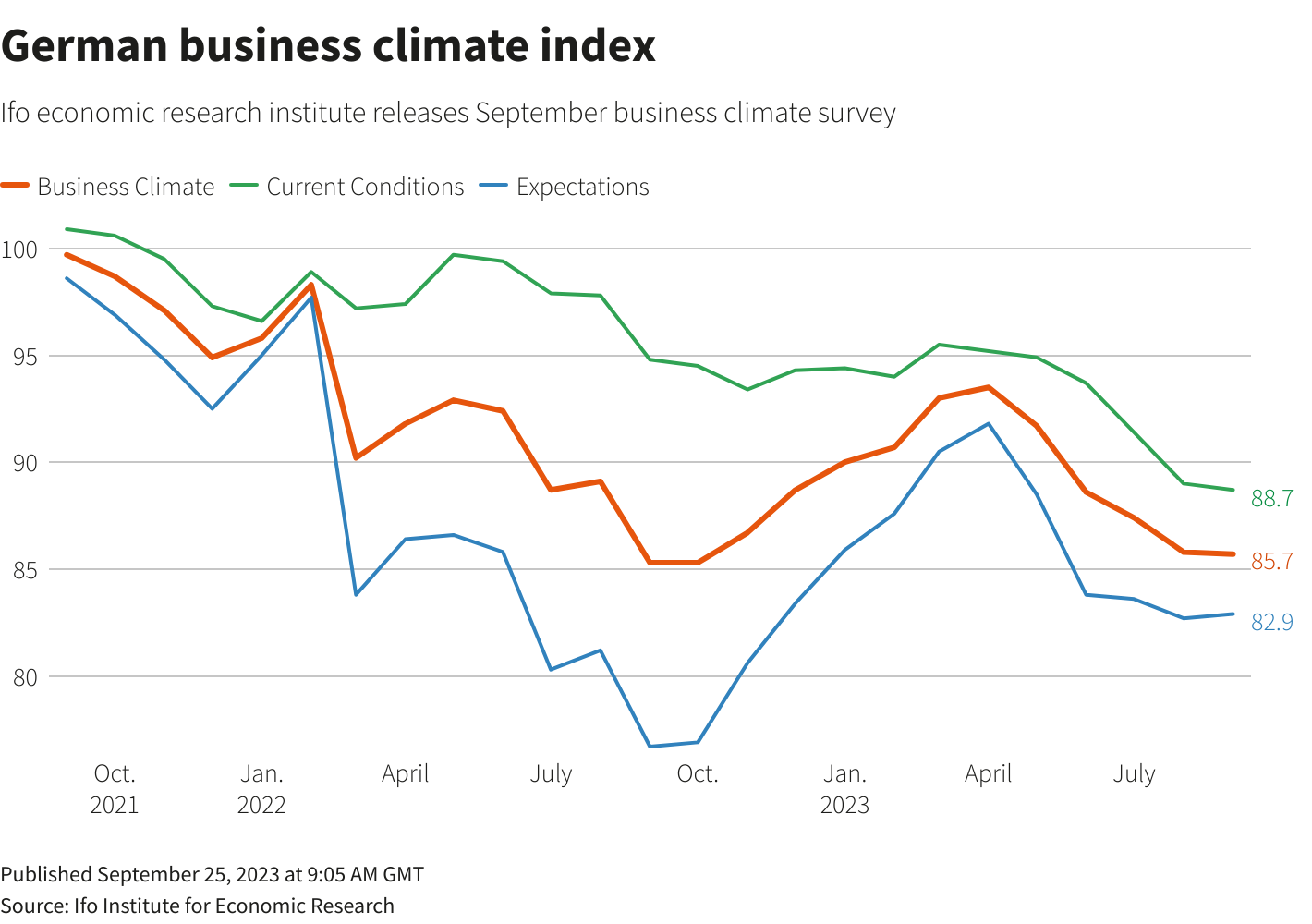

Measuring Business Sentiment

Surveys and indices like the Ifo Business Climate Index provide valuable insights into business confidence in the post-election period. These gauges help economists and investors understand the overall mood within the German business community. A strong correlation exists between business sentiment, investor confidence, and Dax performance. Positive business sentiment often translates to higher investor confidence and a rising Dax, and vice-versa.

Long-Term Economic Impacts of Bundestag Elections

The lasting effects of election outcomes on the German economy and the Dax extend beyond the immediate post-election period:

-

Influence on long-term economic growth trajectories: The policies implemented by a new government can have a profound and lasting impact on the country's economic growth rate over the long term. Investments in infrastructure, education, and innovation drive long-term growth.

-

Impact on foreign investment in Germany: A government's economic policies and overall political stability influence the level of foreign investment in the country. Stable and business-friendly policies generally attract greater foreign investment, boosting economic growth and the Dax.

-

Effects on Germany's role in the European Union: Germany's role within the European Union is significant. A government's stance on European integration and cooperation affects economic relations with other EU members and, consequently, German businesses and the Dax.

Conclusion

Bundestag elections exert a considerable influence on the German Dax Index and business sentiment, impacting market volatility, fiscal policy, and regulatory changes. The period surrounding the elections is characterized by uncertainty, but the long-term consequences of the new government's policies can significantly shape Germany's economic trajectory and the performance of its leading companies. Understanding the intricate interplay between political shifts and economic outcomes is crucial for investors and businesses alike.

Call to action: Stay informed about the upcoming Bundestag elections and their potential impact on your investments. Understanding the relationship between Bundestag elections, the German Dax Index, and business sentiment is crucial for navigating the German market successfully. Continue learning about how Bundestag elections shape the German economy and make informed investment decisions.

Featured Posts

-

Nueve Meses Despues De Ser Madre El Impresionante Regreso De Bencic Al Triunfo

Apr 27, 2025

Nueve Meses Despues De Ser Madre El Impresionante Regreso De Bencic Al Triunfo

Apr 27, 2025 -

Bencic Triumphs First Wta Tournament Win Post Partum

Apr 27, 2025

Bencic Triumphs First Wta Tournament Win Post Partum

Apr 27, 2025 -

New Ecb Task Force To Tackle Banking Regulatory Complexity

Apr 27, 2025

New Ecb Task Force To Tackle Banking Regulatory Complexity

Apr 27, 2025 -

Credit Weekly Examining The Widening Cracks In The Private Credit Market

Apr 27, 2025

Credit Weekly Examining The Widening Cracks In The Private Credit Market

Apr 27, 2025 -

Local Jeweler Assists Nfl Players With Fresh Starts In Mc Cook

Apr 27, 2025

Local Jeweler Assists Nfl Players With Fresh Starts In Mc Cook

Apr 27, 2025