Navigate The Private Credit Boom: 5 Key Do's And Don'ts

Table of Contents

Do Your Due Diligence: Thorough Research is Paramount

Thorough research is paramount before investing in private credit. Rushing into investments without proper due diligence can lead to significant losses. A comprehensive approach to due diligence involves understanding both the borrower and the specifics of the deal.

Understand the Borrower: A Deep Dive into Creditworthiness

Analyzing the borrower's financial health is the cornerstone of successful private credit investment. This involves a meticulous examination of several key aspects:

- Financial Statement Analysis: Scrutinize the borrower's financial statements (balance sheets, income statements, cash flow statements) to assess their revenue, profitability, debt levels, and overall financial strength. Look for trends and red flags.

- Management Team Assessment: Evaluate the experience, track record, and reputation of the borrower's management team. A strong management team is crucial for navigating challenges and ensuring successful repayment.

- Industry and Competitive Landscape Research: Investigate the borrower's industry, its growth prospects, and the competitive landscape. Understanding the industry's dynamics helps assess the borrower's long-term viability and repayment capacity. Consider conducting a thorough SWOT analysis.

Keywords: Private Credit Investment, Due Diligence, Borrower Analysis, Credit Risk Assessment, Financial Statement Analysis, Management Team Assessment, Industry Analysis.

Evaluate the Deal Terms: Protecting Your Investment

Carefully reviewing the loan agreement is critical. Don't simply focus on the interest rate; understand the entire structure.

- Loan Agreement Review: Examine the loan agreement meticulously, paying close attention to interest rates, repayment terms (amortization schedule, balloon payments), collateral, covenants, and any prepayment penalties.

- Risk Assessment: Clearly identify all associated risks, including the potential for default, changes in interest rates, and macroeconomic factors that might impact the borrower's ability to repay.

- Comparative Analysis: Compare the terms of the private credit deal to similar investments in the market to ensure you're receiving competitive terms and appropriate risk-adjusted returns.

Keywords: Loan Agreement, Private Credit Terms, Investment Terms, Risk Management, Due Diligence, Interest Rates, Repayment Terms, Collateral.

Diversify Your Private Credit Portfolio: Don't Put All Your Eggs in One Basket

Diversification is a fundamental principle of successful investing. Applying this principle to your private credit portfolio is crucial for mitigating risk and enhancing returns.

Spread Your Investments: Reducing Overall Portfolio Risk

Spreading your investments across various borrowers, industries, and loan structures is paramount. This approach reduces the impact of a single bad investment on your overall portfolio performance.

- Borrower Diversification: Invest in multiple borrowers with different business models, risk profiles, and industries to reduce your exposure to any single borrower's default.

- Industry Diversification: Diversify across different sectors to mitigate risks associated with industry-specific downturns or economic shocks.

- Geographic Diversification: Consider investing in borrowers located in different geographic regions to reduce your sensitivity to regional economic fluctuations.

Keywords: Portfolio Diversification, Private Credit Portfolio Management, Risk Mitigation, Diversified Portfolio, Asset Allocation.

Seek Professional Advice: Leverage Expert Knowledge

Navigating the complexities of the private credit market can be challenging. Seeking professional guidance is highly recommended.

Consult with Professionals: Expertise for Informed Decisions

Engaging experienced professionals can significantly enhance your investment success.

- Private Credit Investment Professionals: Work with experienced private credit investment professionals who can provide valuable insights and guidance throughout the investment process.

- Legal and Tax Counsel: Obtain legal and tax advice tailored to your specific investment strategy to ensure compliance and optimize tax efficiency.

- Financial Advisors: Utilize the expertise of financial advisors specializing in alternative investments to ensure your private credit investments align with your broader financial goals.

Keywords: Private Credit Advisors, Financial Advisors, Legal Advice, Tax Planning, Investment Strategy, Expert Advice.

Don't Neglect Liquidity: Understanding the Illiquid Nature of Private Credit

Private credit investments are often illiquid, meaning they cannot be easily converted into cash. Understanding this constraint is crucial.

Understand Liquidity Constraints: Planning for Long-Term Investments

Private credit investments typically have longer lock-up periods than more liquid investments.

- Liquidity Needs: Carefully consider your personal liquidity needs and investment timeline before investing in private credit.

- Investment Horizon: Ensure your investment horizon aligns with the expected return timeline of your private credit investments. Don't invest money you might need urgently.

- Allocation Strategy: Avoid over-allocating to private credit if you anticipate needing quick access to funds for unexpected expenses or opportunities.

Keywords: Private Credit Liquidity, Illiquid Investments, Investment Timeline, Capital Access, Liquidity Risk, Long-Term Investments.

Don't Overlook Risk Management: Proactive Risk Mitigation

Risk assessment and mitigation are paramount in private credit investing. A robust risk management strategy is essential to protect your investments.

Implement Robust Risk Management: Monitoring and Mitigation Strategies

Proactive risk management involves continuous monitoring and the development of strategies to mitigate potential issues.

- Investment Monitoring: Regularly monitor your private credit investments, tracking key performance indicators (KPIs) and financial health of the borrowers.

- Risk Mitigation Strategies: Develop strategies to address potential defaults, interest rate changes, and other risks that may impact your portfolio.

- Stress Testing and Scenario Analysis: Utilize stress testing and scenario analysis to evaluate the potential impact of adverse economic conditions on your investments.

Keywords: Risk Management, Private Credit Risk, Default Risk, Investment Risk, Risk Assessment, Stress Testing, Scenario Analysis.

Conclusion: Navigate the Private Credit Boom with Confidence

The private credit boom offers significant investment opportunities, but success requires careful planning and a strategic approach. By following these do's and don'ts – performing thorough due diligence, diversifying your portfolio, seeking professional advice, understanding liquidity constraints, and implementing robust risk management – you can increase your chances of navigating the private credit market successfully and achieving your investment goals. Remember to always conduct thorough research and consider seeking expert advice before making any private credit investments. Don’t delay; start exploring the potential of the private credit market today!

Featured Posts

-

Ceos Sound Alarm Trump Tariffs Harm Economy Frighten Consumers

Apr 26, 2025

Ceos Sound Alarm Trump Tariffs Harm Economy Frighten Consumers

Apr 26, 2025 -

Hegseth Rattled Exclusive Details On Pentagon Leaks Polygraph Threats And Internal Fights

Apr 26, 2025

Hegseth Rattled Exclusive Details On Pentagon Leaks Polygraph Threats And Internal Fights

Apr 26, 2025 -

Bof A Says Dont Worry About Stretched Stock Market Valuations

Apr 26, 2025

Bof A Says Dont Worry About Stretched Stock Market Valuations

Apr 26, 2025 -

American Battleground A David Vs Goliath Showdown With The Worlds Richest Man

Apr 26, 2025

American Battleground A David Vs Goliath Showdown With The Worlds Richest Man

Apr 26, 2025 -

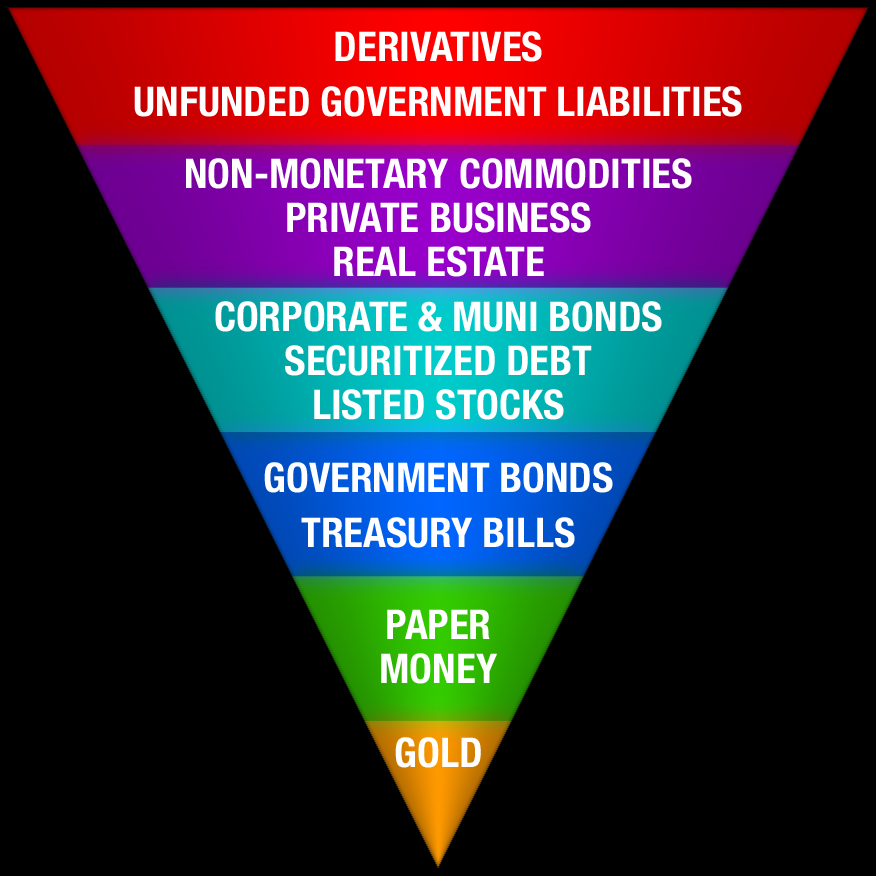

Is Gold A Safe Haven Analyzing Bullions Performance During Trade Disputes

Apr 26, 2025

Is Gold A Safe Haven Analyzing Bullions Performance During Trade Disputes

Apr 26, 2025