Trump Denies Plans To Fire Federal Reserve Chairman Jerome Powell

Table of Contents

Trump's Public Statements Denying the Firing

President Trump has repeatedly and publicly denied any intention to dismiss Chairman Powell. These denials, while seemingly definitive, have done little to quell the speculation surrounding the future of this crucial relationship. Understanding the nuances of these statements is critical to grasping the current political climate.

-

October 26, 2023: In a press conference, President Trump stated (insert direct quote if available and cite source), effectively dismissing rumors circulating in the financial press. The tone was notably less aggressive than previous pronouncements regarding Powell.

-

October 27, 2023: A tweet from the President's official account (insert tweet if available and cite source) reiterated the denial, using the phrase "[insert key phrase from tweet]" to further emphasize his position. The brevity and directness of the tweet suggested a deliberate attempt to control the narrative.

-

Analysis: The shift in tone from previous, more overtly critical statements might indicate a strategic recalibration. The use of various platforms—press conferences and social media—highlights the administration's efforts to reach a broad audience and directly counter negative press coverage.

The Background of Trump-Powell Tensions

The strained relationship between President Trump and Chairman Powell stems primarily from differing views on monetary policy, particularly regarding interest rate hikes. President Trump has repeatedly criticized Powell's decisions, viewing them as detrimental to the US economy and his reelection chances. These disagreements highlight a fundamental conflict between the President's short-term political goals and the Fed's mandate of long-term economic stability.

-

Specific instances of public criticism: President Trump has frequently labeled Powell's interest rate hikes as "too slow" or "too aggressive," depending on the economic climate. (cite specific examples with dates and sources).

-

Powell's responses: Chairman Powell has consistently maintained the independence of the Federal Reserve and the necessity of its actions based on economic data, often deflecting direct criticism. (cite examples of Powell's public responses).

-

Economic indicators: Fluctuations in inflation rates, economic growth, and unemployment figures have undoubtedly fueled these disagreements, providing ammunition for both sides of the argument. (cite relevant economic data and analysis).

-

Federal Reserve independence: The Federal Reserve's independence is a cornerstone of US economic policy. Its mandate is to promote maximum employment, stable prices, and moderate long-term interest rates, free from direct political interference. The President's criticism challenges this crucial aspect of the system.

Political Implications of a Potential Powell Firing

The potential ramifications of firing Chairman Powell extend far beyond the immediate political fallout. Such an action would severely damage the perceived independence of the Federal Reserve, potentially triggering a crisis of confidence in US economic institutions.

-

Potential reactions from Congress and the public: A dismissal of Powell would likely face intense scrutiny from Congress, potentially leading to hearings and investigations. Public opinion could also turn significantly against the President.

-

Potential impact on investor confidence: The firing could send shockwaves through financial markets, leading to increased volatility and potentially a decline in investor confidence. This could have significant repercussions for the US and global economy.

-

Legal framework: While the President has the authority to appoint and remove the Fed Chairman, doing so without clear cause could face legal challenges. The legal precedents surrounding such actions are limited and complex.

-

Historical precedents: Historically, presidential interference in Federal Reserve decisions has been relatively rare, although there have been instances of tension and disagreement. The potential consequences of this action could set a concerning precedent.

The Future of the Trump-Powell Relationship

Predicting the future of the Trump-Powell relationship is challenging. While the President’s denials may signal a temporary de-escalation, the underlying tension remains. Continued disagreement over economic policy, particularly regarding interest rates and inflation, could easily reignite the conflict. The economic outlook will play a significant role in shaping this dynamic. A strong economy might ease tensions, while a downturn could exacerbate them.

Conclusion

President Trump's repeated denials of plans to fire Jerome Powell, while seemingly reassuring, haven't entirely resolved the underlying tension in their relationship. This ongoing friction stems from fundamental disagreements over economic policy, specifically interest rate management. The potential consequences of removing Powell—impacting Federal Reserve independence, investor confidence, and overall economic stability—are considerable. The future of the Trump-Powell dynamic remains uncertain, contingent upon evolving economic indicators and the President's evolving political priorities.

Call to Action: Stay informed about this evolving situation surrounding President Trump and Federal Reserve Chairman Jerome Powell. Continue to follow our coverage for the latest updates on the Trump-Powell relationship and its impact on the US economy. For more in-depth analysis on Federal Reserve policy, visit [link to relevant content].

Featured Posts

-

417 5 Million Deal Approved Alcon Acquires Village Roadshow

Apr 24, 2025

417 5 Million Deal Approved Alcon Acquires Village Roadshow

Apr 24, 2025 -

Nba Probe Into Ja Morant Incident What We Know So Far

Apr 24, 2025

Nba Probe Into Ja Morant Incident What We Know So Far

Apr 24, 2025 -

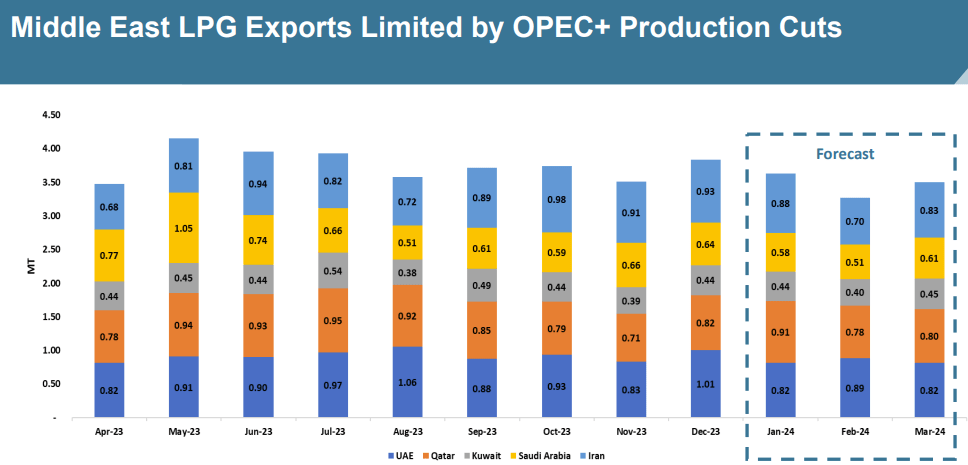

Impact Of Us Tariffs China Turns To Middle East For Lpg Imports

Apr 24, 2025

Impact Of Us Tariffs China Turns To Middle East For Lpg Imports

Apr 24, 2025 -

John Travolta Analyzing His Surprisingly Low Rotten Tomatoes Score

Apr 24, 2025

John Travolta Analyzing His Surprisingly Low Rotten Tomatoes Score

Apr 24, 2025 -

Canadas Fiscal Future A Vision For Responsible Spending

Apr 24, 2025

Canadas Fiscal Future A Vision For Responsible Spending

Apr 24, 2025