Canada's Fiscal Future: A Vision For Responsible Spending

Table of Contents

The Current State of Canada's Finances

Analyzing Canada's Debt and Deficit

Canada's national debt and budget deficit are significant concerns. While the exact figures fluctuate yearly, we consistently see substantial amounts allocated to servicing this debt. For example, (insert most recent data on Canada's national debt and deficit from a reputable source, e.g., Statistics Canada). These figures have implications for future generations, potentially limiting government spending on essential services and infrastructure. Contributing factors include:

- Economic downturns, such as the COVID-19 pandemic, necessitating significant government intervention and increased spending.

- The rising costs of social programs, driven by an aging population and increasing healthcare demands.

- The substantial investment required in infrastructure renewal and modernization to maintain competitiveness.

Assessing the Long-Term Fiscal Outlook

Projecting Canada's long-term fiscal outlook presents significant challenges, given inherent uncertainties. However, several trends are clear:

- Demographic Shifts: An aging population will place increasing strain on healthcare and pension systems, requiring higher government expenditure.

- Climate Change Costs: The financial burden of mitigating and adapting to climate change will be substantial, requiring significant investment in green technologies and infrastructure.

- Global Economic Uncertainty: Geopolitical instability and global economic fluctuations pose considerable risks to Canada's fiscal stability.

These factors underscore the urgency for proactive fiscal planning and responsible spending policies.

Comparing Canada's Fiscal Health to Other Developed Nations

Benchmarking Canada's fiscal performance against other developed nations, particularly within the OECD, offers valuable insights. (Insert comparative data on debt-to-GDP ratios, budget deficits, and other relevant fiscal indicators for Canada and several peer countries. Cite sources). This comparison helps identify best practices and potential areas for improvement in Canada's fiscal management.

Strategies for Responsible Fiscal Management

Prioritizing Government Spending

Optimizing government spending is paramount for securing Canada's fiscal future. This requires a strategic approach focused on:

- Improving Program Efficiency: Streamlining program delivery processes can significantly reduce costs while maintaining or improving service quality.

- Eliminating Waste and Duplication: Identifying and eliminating redundant programs and bureaucratic inefficiencies can free up substantial resources.

- Focusing on High-Impact Programs: Prioritizing investments in programs with demonstrably high social and economic returns ensures maximum impact for taxpayer dollars.

Examples from other countries, such as (mention examples of successful cost-saving initiatives in other developed nations), demonstrate the potential for significant savings through efficient management.

Enhancing Revenue Generation

Responsible fiscal management necessitates exploring options to increase government revenue without stifling economic growth. Potential strategies include:

- Tax Reform: Addressing tax loopholes and simplifying the tax system can enhance fairness and improve revenue collection.

- Exploring New Revenue Streams: Implementing a well-designed carbon tax, for example, can generate revenue while incentivizing environmental sustainability.

Each option requires careful consideration of its potential impact on various segments of the population and the broader economy. A balanced approach is crucial.

Investing in Long-Term Growth

Investing in areas that foster long-term economic growth is not just prudent; it's essential for fiscal sustainability. This includes:

- Infrastructure Development: Investing in modern transportation, energy, and communication infrastructure enhances productivity and attracts investment.

- Education and Skills Training: A well-educated and skilled workforce is vital for a competitive economy and long-term prosperity.

- Research and Development: Investing in innovation drives technological advancement, creating new industries and high-paying jobs.

These investments, although requiring upfront expenditure, generate significant long-term returns, contributing to a more robust and sustainable economy.

Promoting Transparency and Accountability

The Role of Open Government Data

Open government data is a cornerstone of transparency and accountability in fiscal management. Making government spending data readily accessible to the public empowers citizens to scrutinize government decisions and hold their elected officials accountable.

Strengthening Fiscal Oversight Mechanisms

Independent fiscal agencies and robust parliamentary oversight are crucial for ensuring responsible fiscal management. These bodies provide critical analysis of government spending plans and fiscal policies, promoting accountability and informed decision-making.

Conclusion: A Path Towards a Sustainable Canada's Fiscal Future

Securing Canada's fiscal future demands a multi-faceted approach combining responsible spending, strategic revenue generation, and unwavering commitment to transparency and accountability. The challenges are substantial, but with proactive planning and a focus on long-term sustainability, Canada can build a stronger and more prosperous future. Demand transparency and accountability from your government to ensure a sustainable Canada's fiscal future. Learn more about Canada's fiscal policy and how you can contribute to responsible spending decisions that benefit all Canadians.

Featured Posts

-

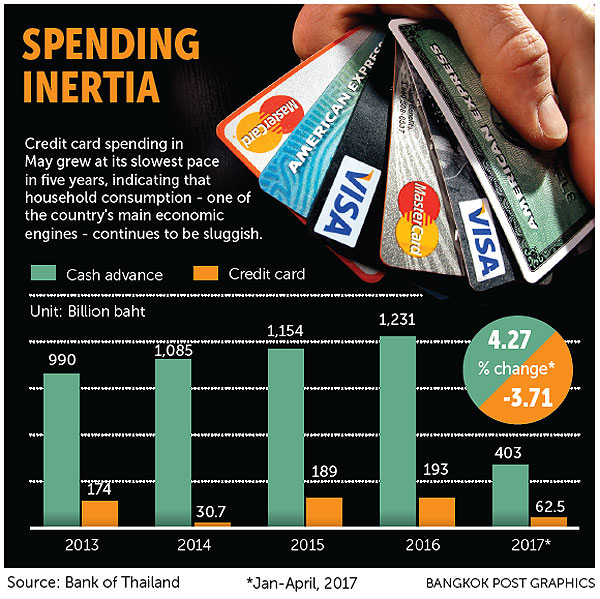

The Impact Of Reduced Non Essential Spending On Credit Card Companies

Apr 24, 2025

The Impact Of Reduced Non Essential Spending On Credit Card Companies

Apr 24, 2025 -

Hisd Mariachi Headed To Uil State Championships After Viral Whataburger Video

Apr 24, 2025

Hisd Mariachi Headed To Uil State Championships After Viral Whataburger Video

Apr 24, 2025 -

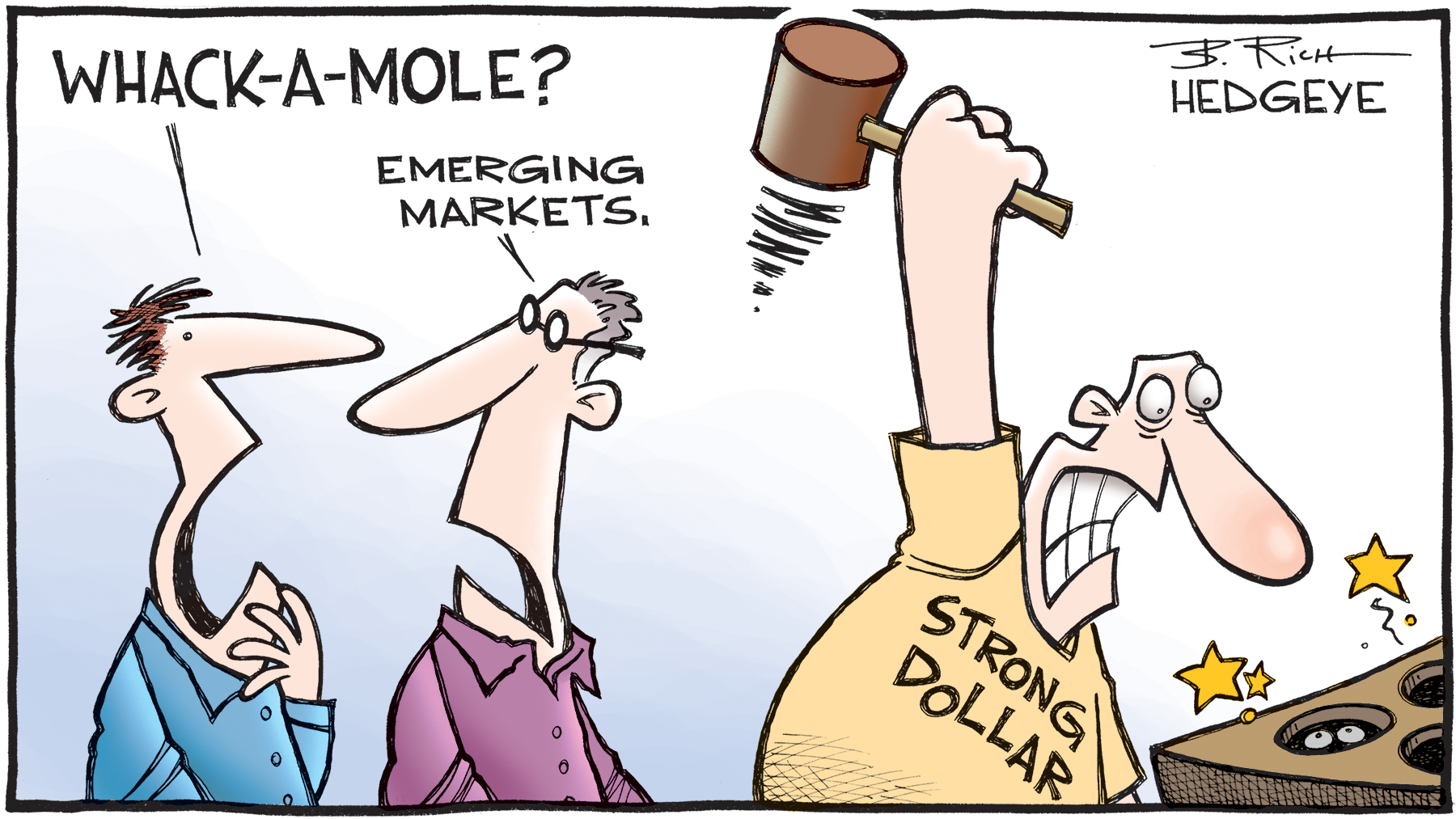

Emerging Market Stocks A Year Of Growth Despite Us Slump

Apr 24, 2025

Emerging Market Stocks A Year Of Growth Despite Us Slump

Apr 24, 2025 -

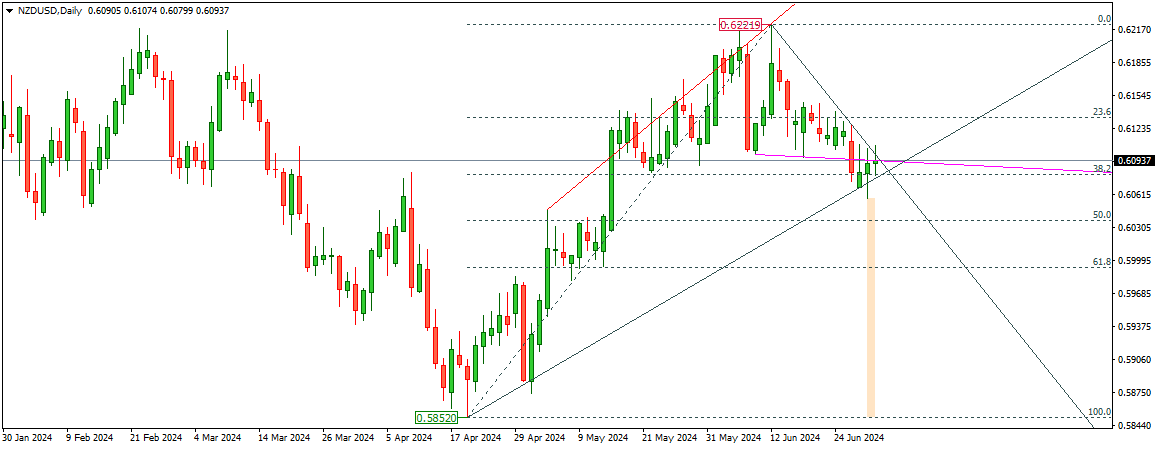

Canadian Dollars Unexpected Dip Strength Against Usd Weakness Elsewhere

Apr 24, 2025

Canadian Dollars Unexpected Dip Strength Against Usd Weakness Elsewhere

Apr 24, 2025 -

Why Is The Canadian Dollar Falling Against Major Currencies

Apr 24, 2025

Why Is The Canadian Dollar Falling Against Major Currencies

Apr 24, 2025