Your Guide To Private Credit Jobs: 5 Do's And Don'ts To Get Hired

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do #1: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit industry. It's not just about who you know, but about building meaningful relationships that can lead to opportunities.

- Attend industry events: Conferences, workshops, and even smaller networking events offer invaluable opportunities to meet professionals in private credit, private debt, and private equity. Engage in conversations, exchange business cards, and follow up afterward.

- Leverage LinkedIn: Optimize your LinkedIn profile to highlight your skills and experience relevant to private credit roles. Actively connect with professionals in the field, participate in relevant groups, and engage in discussions.

- Conduct informational interviews: Reach out to people working in private credit for informational interviews. These conversations provide insights into the industry, different career paths, and can potentially open doors to unadvertised opportunities.

- Join professional organizations: Membership in organizations like the American Finance Association or industry-specific groups provides networking opportunities and access to valuable resources.

Do #2: Craft a Targeted Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression. They need to be tailored to each specific private credit job application to showcase your relevant skills and experience.

- Quantify your accomplishments: Instead of simply listing your responsibilities, highlight your achievements with quantifiable results. For example, instead of saying "Managed client portfolios," say "Managed a portfolio of $50 million, achieving a 15% return on investment."

- Tailor to each job description: Carefully review each job description and incorporate relevant keywords from the posting into your resume and cover letter. This improves your chances of getting past Applicant Tracking Systems (ATS).

- Showcase your understanding of private credit concepts: Demonstrate your knowledge of leveraged buyouts, distressed debt, mezzanine financing, and other relevant concepts.

- Use strong action verbs: Use active and impactful verbs to describe your responsibilities and accomplishments.

Do #3: Master the Art of the Private Credit Interview

The private credit interview process is rigorous. Thorough preparation is key to showcasing your skills and securing the job.

- Master the STAR method: Practice answering behavioral questions using the STAR method (Situation, Task, Action, Result) to provide structured and compelling answers.

- Demonstrate financial modeling proficiency: Be prepared to discuss your experience with financial modeling software (e.g., Excel, Argus, Bloomberg Terminal) and demonstrate your ability to build and interpret financial models.

- Stay current on market trends: Stay informed about current market trends and events in the private credit industry. This demonstrates your passion and commitment.

- Prepare for technical questions: Expect questions on credit analysis, risk assessment, valuation, and other technical aspects of private credit. Practice your responses thoroughly.

- Ask insightful questions: Asking thoughtful questions demonstrates your genuine interest in the role and the company.

Do #4: Showcase Your Financial Modeling and Analytical Skills

Private credit roles demand strong analytical and financial modeling skills. Demonstrate your proficiency through your resume, cover letter, and during interviews.

- Develop proficiency in relevant software: Master Excel, Argus, and other financial modeling software.

- Create a portfolio of projects: Include projects or case studies in your portfolio that showcase your analytical abilities and experience with private debt analysis and financial modeling in private credit.

- Highlight your experience: Emphasize your experience with credit analysis, valuation, due diligence, and risk management.

Do #5: Follow Up After Each Interview

Following up professionally demonstrates your interest and reinforces your candidacy.

- Send a thank-you note: Send a personalized thank-you note within 24 hours of each interview, expressing your gratitude and reiterating your interest in the position.

- Follow up after a week: If you haven't heard back within a week, it's appropriate to send a polite follow-up email inquiring about the next steps in the hiring process.

5 Don'ts When Pursuing Private Credit Jobs

Don't #1: Submit a Generic Resume and Cover Letter

Submitting generic application materials demonstrates a lack of effort and significantly reduces your chances of getting noticed. Tailoring your application to each specific role is crucial.

Don't #2: Underestimate the Importance of Networking

Networking is not optional; it's essential. Failing to network effectively limits your exposure to potential opportunities.

Don't #3: Lack Preparation for Technical Interview Questions

Unpreparedness for technical questions is a major red flag. Thorough preparation is critical to demonstrating your competency.

Don't #4: Neglect to Showcase Your Technical Skills

Private credit firms seek candidates with strong financial modeling and analytical skills. Failing to showcase these skills will hinder your chances.

Don't #5: Fail to Follow Up After Interviews

Following up professionally demonstrates your commitment and keeps your application top-of-mind.

Conclusion

Securing a private credit job requires a strategic and comprehensive approach. By following these five do's and don'ts, you can significantly improve your chances of landing your dream role in this exciting and lucrative field. Remember to network diligently, craft targeted applications, master the interview process, showcase your technical skills, and follow up professionally. Start building your career in private credit today by actively applying these strategies! Don't delay – your perfect private debt or private equity role awaits.

Featured Posts

-

5 Dos And Don Ts For Landing A Job In The Private Credit Boom

Apr 24, 2025

5 Dos And Don Ts For Landing A Job In The Private Credit Boom

Apr 24, 2025 -

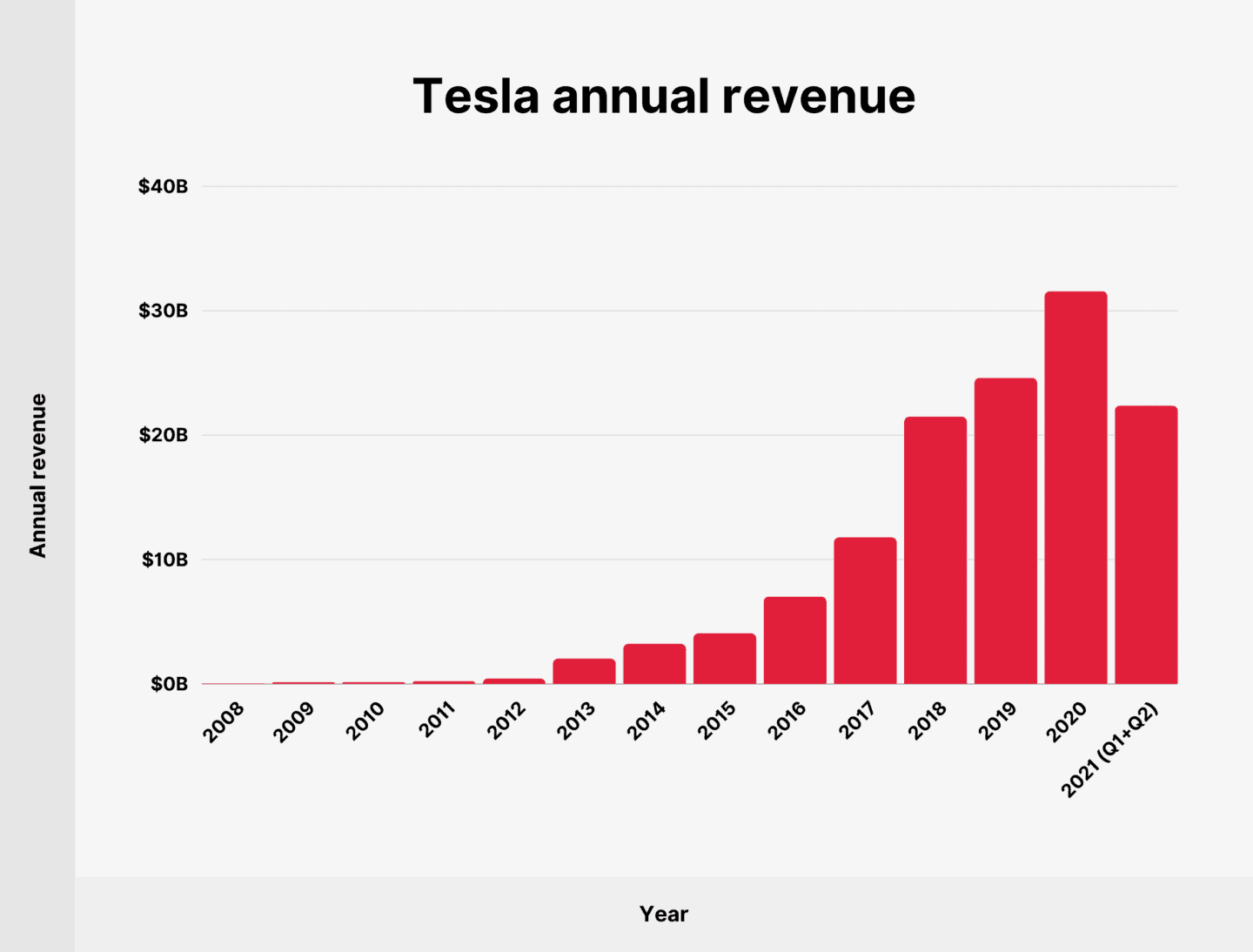

Tesla Earnings Decline 71 Net Income Drop In First Quarter

Apr 24, 2025

Tesla Earnings Decline 71 Net Income Drop In First Quarter

Apr 24, 2025 -

Navigate The Private Credit Boom 5 Essential Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts For Job Seekers

Apr 24, 2025 -

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025 -

Covid 19 Pandemic Lab Owners Guilty Plea For Fake Test Results

Apr 24, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For Fake Test Results

Apr 24, 2025